The Income Statement Approach To Calculating Bad Debt Expense Should Not Be Used

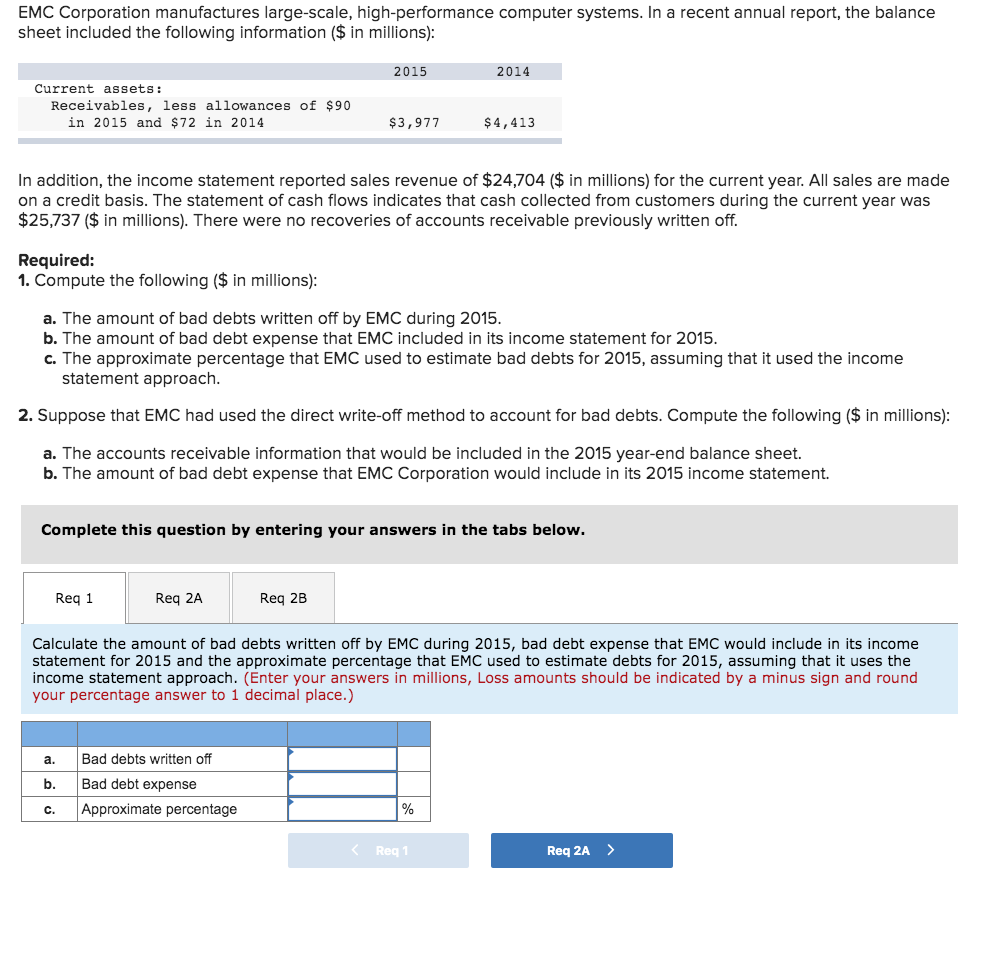

Sometimes at the end of the fiscal period when a company goes to prepare its financial statements it needs to determine what portion of its receivables is collectible.

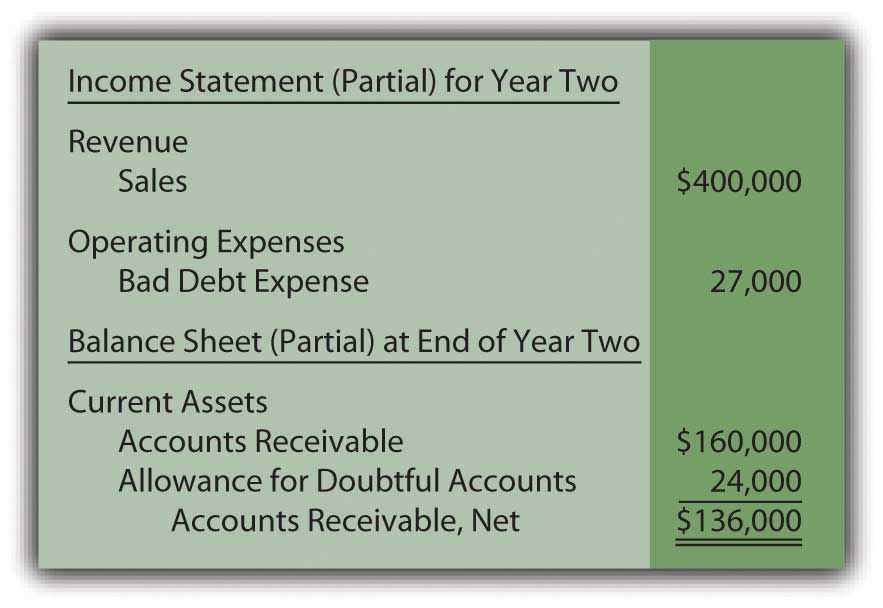

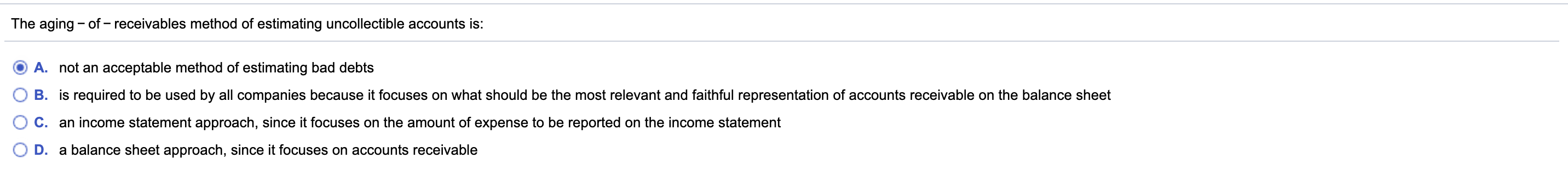

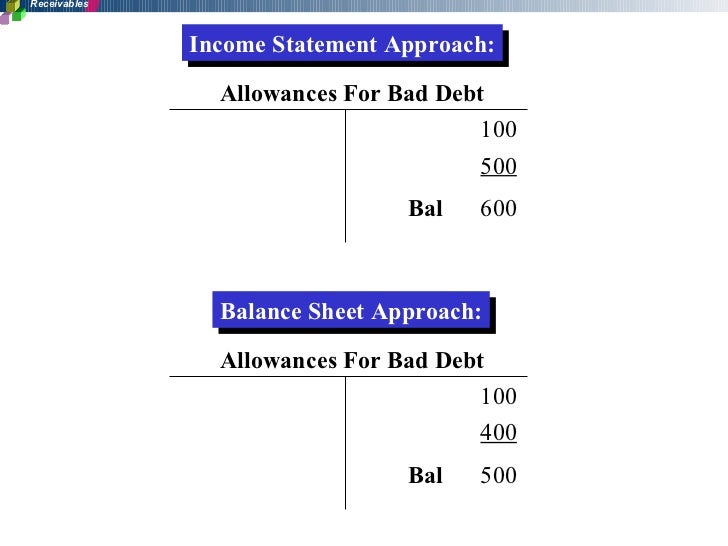

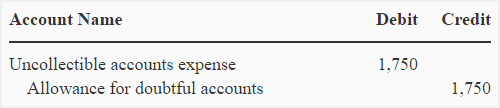

The income statement approach to calculating bad debt expense should not be used. The difference between. The balance sheet approach to bad debts expresses uncollectible accounts as a percentage of accounts receivable. It s an inevitable reality that not all customers will pay down their account balances. Accordingly they enter a bad debt expense of 3 000 on the company s monthly financial statement and add the same amount to the allowance for doubtful accounts on the balance sheet.

Accounts receivable aging method. Income statement approach assume that based on past year experience management estimates that uncollectible debt is 3 percent of total sales. On the income statement bad debt expense would still be 1 of total net sales or 5 000. Bad debt expense equation helps in obtaining a true and fair view of financial statements as net profit and debtors are correctly estimated by identifying bad and doubtful debts.

The portion that a company believes is uncollectible is what is called bad debt expense the. This method is based on an evaluation of the collectibility of accounts receivable. The income statement approach to calculating bad debt expense should not be used if it results in a carrying value of accounts receivable that is materially different from what would be obtained under a balance sheet approach. In applying the percentage of sales method companies annually review the percentage of uncollectible accounts that resulted from the previous year s sales.

To calculate bad debt expense use the direct write off method or the allowance method. Will record its bad loss. To account for this lost income businesses record bad debt expense on a periodic basis. Bad debt expense recognized through the allowance method helps the organization to keep some funds aside for meeting future expenses.

The income statement approach for estimating bad debts uses a percentage of net credit sales sales to customers in which the customers pay within 30 to 60 days are referred to as credit sales or sales on account. Units should consider using an allowance for doubtful accounts when they are regularly providing goods or services on credit and have experience with the collectability of those accounts. In addition this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses.