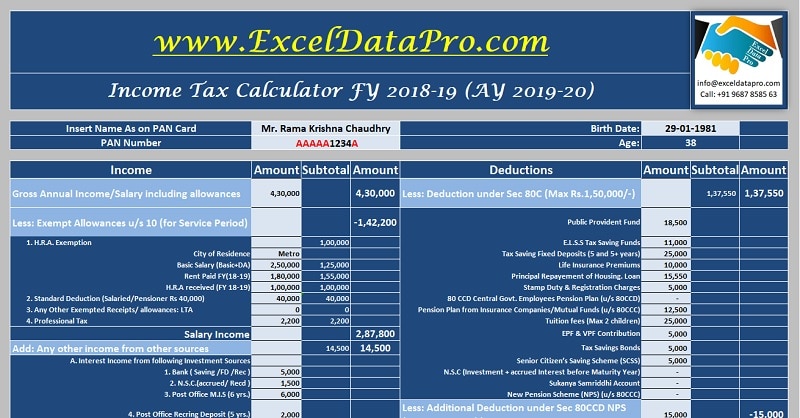

Income Tax Withholding Rates For Tax Year 2018 19

Each allowance you claim reduces the amount withheld.

Income tax withholding rates for tax year 2018 19. How many withholding allowances you claim. Tax scale changes for 2018 19 the recent budget 2018 provided for changes to. For example the income of an individual is taxed at a slab rate whereas the income of the company is taxed at a fixed rate. Who is 80 years or more at any time during the previous year net income range.

Income tax rates for financial year 2018 19 for individual below the age of sixty years hindu undivided family association of persons body of individuals artificial juridical person are as under. The taxpayer needs to pay taxes and file itr every year. Payment on account of purchase through local l c under section 52u tds rate was applicable at a single rate 3. Rates of income tax for financial year 2018 19 or assessment year 2019 20.

These tables are for use by employers to calculate the amount of tax to be withheld from payments to individual taxpayers. Rate of income tax assessment year 2021 22 assessment year 2020 21 up to rs. Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in angola. Savings income 2018 19 and 2017 18 starting rate for savings 0 starting rate limit for savings 5 000 1 000 of savings income for basic rate taxpayers 500 for higher rate may be tax free.

If you withhold at the single rate or at the lower married rate. 10 00 000 30 30 surcharge. Dividend income 2018 19 and 2017 18 dividend ordinary rate 7 5 dividend upper rate 32 5 dividend additional rate 38 1. Below are the tax rates applicable for income earned during the fy 2017 18 ay 2018 19.

But this year the tds rates will be 3 and 1 if purchase of goods for the purpose of trading or reselling after process or conversion and payment against. Rate of income tax. 10 00 000 20 20 above rs. So no tax at source shall be applicable from this financial year 2018 19.

Argentina last reviewed 18 june 2020. Tax instalment tables linked below are for the 2018 19 financial year commencing on 1 july 2018. Surcharge is levied on the amount of income tax at following rates if total income of an assessee exceeds specified limits. Hindu undivided family including aop boi and artificial juridical person net income range.

Income is taxed based on the category of taxpayers. If you withhold an additional amount. Three types of information you give to your employer on form w 4 employee s withholding allowance certificate. 2 50 000 rs.