An Income Statement Shows A Firm S Quizlet

Chapter 10 understanding a firm s financial statements true false 1.

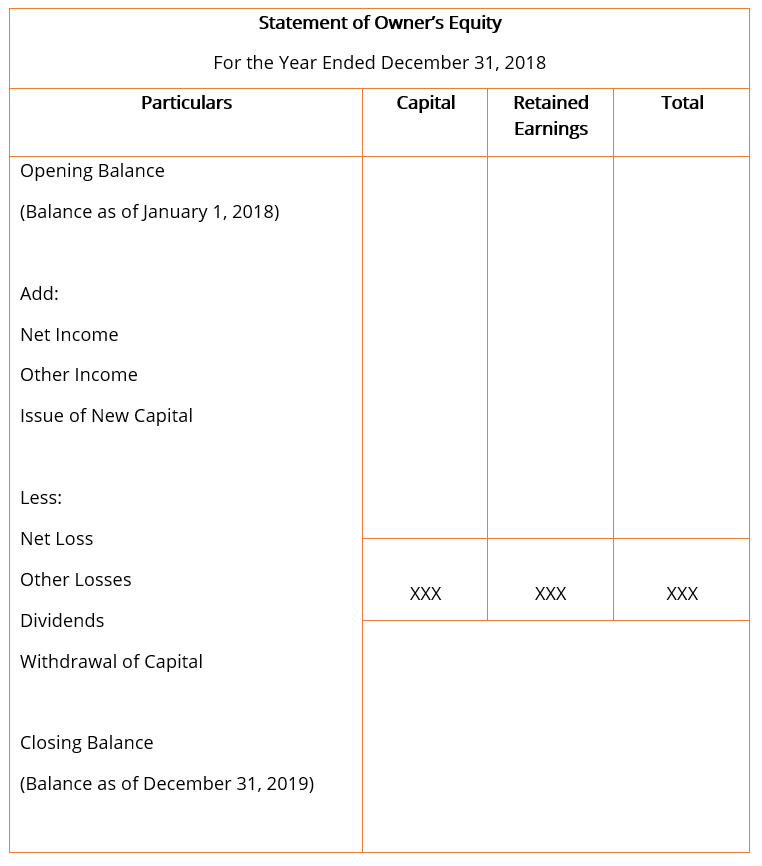

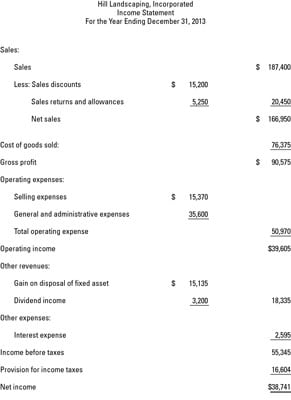

An income statement shows a firm s quizlet. Financial statements balance sheet income statement. How much tax would a company pay on a taxable income of 60 000. The income statement shows a firm s financial position on a specific date. Statement of earnings presents a firm s revenues expenses net income and earnings per share for an accounting period generally lasting a year or a quarter annual reports include three years of income statements.

Given the tax rates of 15 on income from 0 to 50 000 25 on income from 50 001 to 75 000 and 34 on income 75 001 to 100 000 approx. Net income or net loss. A the income statement shows the earnings and expenses at a given point in time. 469 expenses a firm incurs for insurance office salaries and rent are.

F the income statement indicates the amount of profit or loss generated by a firm over a given period of time often one year. Which of the following statements regarding the income statement is incorrect. Start studying unit 6. These records provide information that shows the ability of a company to generate profit by increasing revenue and reducing costs.

17 4 level of learning 1. However not all reported income comes in the form or cash and reported costs likewise may not correctly reflect cash outlays. Recording classifying summarizing and interpreting financial events in an organization is called. Learn vocabulary terms and more with flashcards games and other study tools.

The income statement shows the difference between a firm s income and its costs i e its profits during a specified period of time. Which financial statement shows the firm s profit after costs expenses and taxes. Learn vocabulary terms and more with flashcards games and other study tools. The last line on the income statement.

Knowledge of key terms nickels chapter 17 309 topic. Analytic finance 2. B the income statement shows the flow of earnings and expenses generated by the firm between two dates. Net income or loss 310.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)