Balmain Co Estimated Income Statement For The Year Ended December 31 20y7

For the fiscal year ended may 31 2019.

Balmain co estimated income statement for the year ended december 31 20y7. Office supplies 30 000 prepaid insurance 24 000 total current assets. Prepare an estimated income statement for 2010. Expects to maintain the same inventories at the end of 20y7 as at the beginning of the year. Statement of profit or loss and other comprehensive income group the amounts reported for the year ended december 31 2018 have been computed in accordance with sri lanka accounting standard slfrs 9 on financial instruments whereas amounts for 2017 have not been restated.

Net income for the year 943 400. Withdrawals 100 000 increase in owner s equity843 400. Prepare an estimated income statement for 20y7. Direct materials direct labor factory overhead cost of goods sold gross profit expenses.

The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. The multiple step form of income statement contains various sections for. Revenues and expenses with. In this tutorial we will prepare an income statement of a sole proprietorship service type business using information from previous lessons.

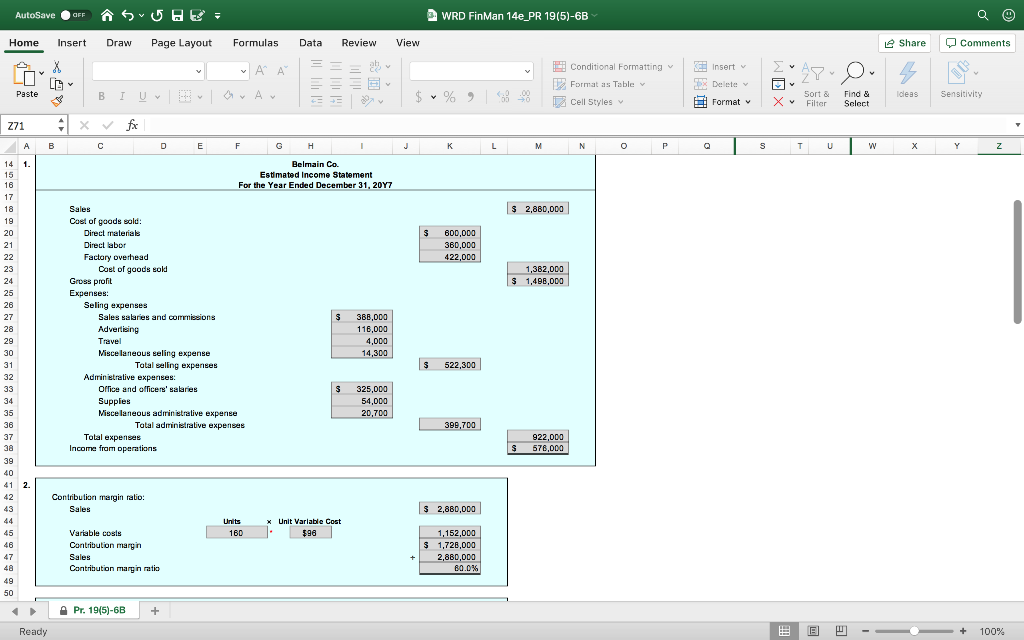

Sales salaries and commissions advertising travel miscellaneous selling expense. Belmain co estimated in come statement for the year ended december 31 2016 sales cost of goods sold direct materials direct labor factory overhead 600 000 360 000 422 000 cost of goods sold 1 382 000 gross profit expenses. Adjusted trial balance if you want you may take a look at how an income statement looks like here before we proceed. With this in mind the various department heads were asked to submit estimates of the costs for their departments during the year.

Estimated income statement for the year ended december 31 20y7 sales cost of goods sold. Accounts payable 67 000. Expects to maintain the same inventories at the end of 20y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold.

We will be using the adjusted trial balance from this lesson. Selling expenses sales salaries and commissions advertising travel miscellaneous selling expense 388 000 116 000 4 000 14 300 total selling expenses administrative expenses. Estimated income statement for the year ended december 31 20y7 sales cost of goods sold. Accounting accounting contribution margin break even sales cost volume profit chart margin of safety and operating leverage belmain co.

When you re ready let s begin. Direct materials direct labor factory overhead cost of goods sold gross profit expenses. Direct materials 450 000 direct labor 300 000 factory overhead 345 000 cost of goods sold 1 095 000 gross profit 705 000 expenses. Office equipment 230 400 less accumulated depreciation 99 000 131 400 store equipment 1 023 000 less accumulated depreciation 373 400 649 600 total property plant and equipment 781 000 total assets 2 062 000 liabilities current liabilities.

1 281 000 property plant and equipment. With this in mind the various department heads were.