Income Tax Rates Australia 2021

22 775 plus 37c for each 1 over 90 000.

Income tax rates australia 2021. 5 550 plus 32 5c for each 1 over 37 000. Income tax rates in 2021. Icalculators australia tax calculator provides a good example of income tax calculations for 2021 it includes historical tax information for 2021 and has the latest australia tax tables included. The income tax brackets and rates for australian residents for this financial year are listed below.

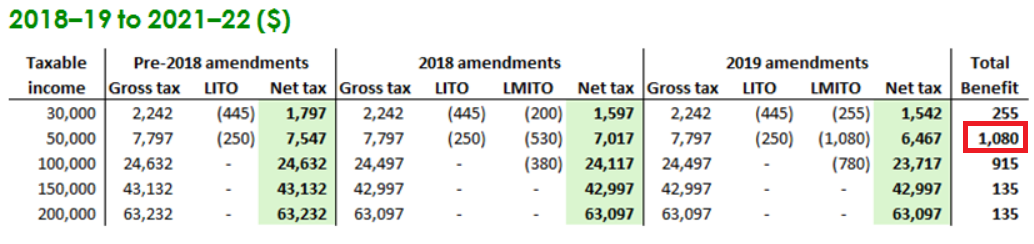

In australia financial years run from 1 july to 30 june of the following year so we are currently in the 2020 21 financial year 1 july 2020 to 30 june 2021. The above tables do not include medicare levy or the effect of low income tax offset lito or lmito under changes outlined in budget 2020 the low income tax offset up to 700 is to apply from 1 july 2020 previously 2022 and the low and middle income tax offset up to 1 080 is retained. Working holiday maker tax rates 2019 20. 56 075 plus 45c for each 1 over 180 000.

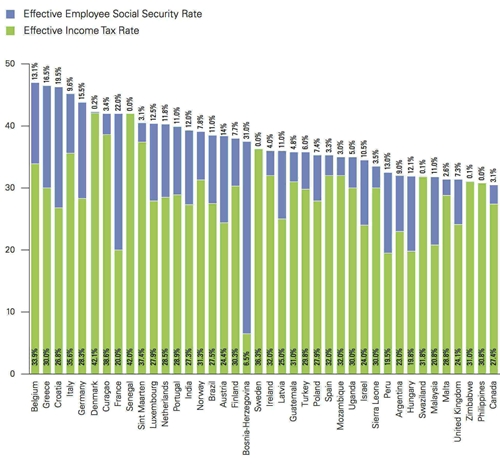

15c for each 1. Australia has a progressive tax system which means that the higher your income the more tax you pay. Australia 2021 tax tables.