Income Tax Rates Europe Vs Us

Components of taxation personal income tax.

Income tax rates europe vs us. The tax policy center looked into the matter in 2018 and found that u s. Most jurisdictions have lower rate of taxes for low levels of income. The countries with the highest top income tax rates are slovenia 61 1 percent portugal 61 0 percent and belgium 60 2 percent. The median cost of health care in the us is 8 of gross income which brings the total equivalent.

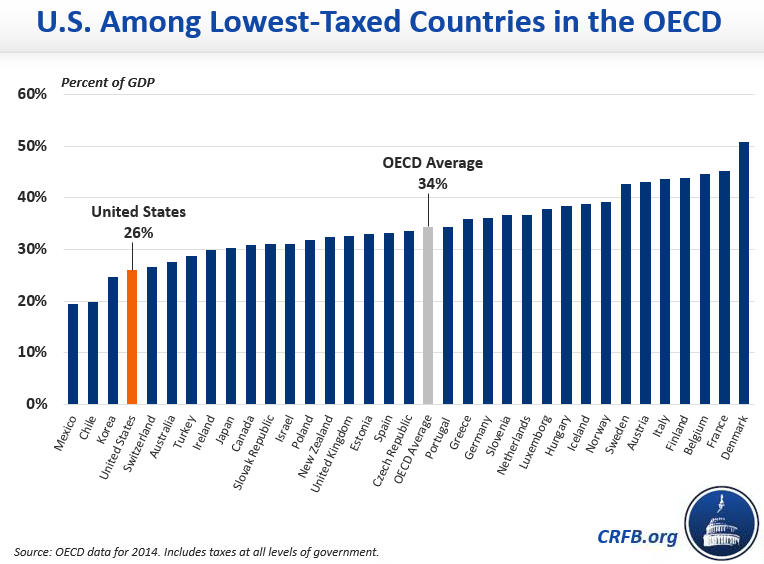

The tax foundation performed an analysis of income tax rates in october 2019 and found that the u s. In 1980 the top rates of most european countries were above 60. In 2018 taxes at all levels of us government represented 24 percent of gross domestic product gdp compared with an average of 34 percent for the other 35 member countries of the organisation for economic co operation and development oecd. Some countries also have lower rates of corporation tax for smaller companies.

Estonia 21 3 percent latvia 21 4 percent and the czech republic 31 1 percent have the lowest top income tax rates of all european countries covered. Personal income tax as a percentage of total tax collected by the country data is for 2002. Us taxes are low relative to those in other high income countries figure 1. Follow on social media.

Gdp constant lcu gdp is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products. Some other taxes for instance property tax substantial in many countries such as the united states and payroll tax are not shown here. Corporate tax individual income tax and sales tax including vat and gst but does not list capital gains tax. The quoted income tax rate is except where noted the top rate of tax.

The median tax rate in the us is 26 not including health care. Is near the very bottom well below the overall average of 34. This includes cost of health care. Tax rate starts at 16 for incomes up to 8 021 going up to 50 for incomes over 70 907.

Today most european countries have rates below 50. The oecd median for europe is a tax rate of 34. A research paper published this week by the federal reserve bank of chicago includes the above chart highlighting the tax burdens of all 35 oecd countries as of 2014. Tax rate starts at 19 for incomes up to 12 450 going up to 45 for incomes over 60 000.

Gdp constant lcu. The list focuses on the main indicative types of taxes. There are two tax rates at 20 and 25 depending on income. Ranked 32 on a list of 41 countries.

According to a kpmg report on income tax and social security rates on 100 000 usd of income in germany the percentage paid by individuals was 28 3 plus 9 8 in pension insurance for a total of 38 1 this does not include the mandatory 15 5 for health insurance that we in the united states pay separately.

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)