When An Income Statement Shows Data For Segments Of The Organization

When an income statement shows data for segments of the organization and data for each segment are added together to get totals for the whole organization.

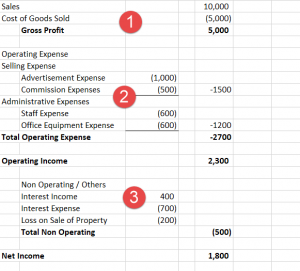

When an income statement shows data for segments of the organization. All expenses should be allocated to the segments. When an income statement shows data for segments of the organization and data for each segment are added together to get totals for the whole organization. Only direct revenues and direct expenses should be assigned to segments. An income statement is one of the three major financial statements that reports a company s financial performance over a specific accounting period.

Each segment are added together to get totals for the whole organization. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. When an income statement shows data for segments of the organization and data for each segment are added together to get totals for the whole organization. 1 when an income statement shows data for segments of the organization and data for.

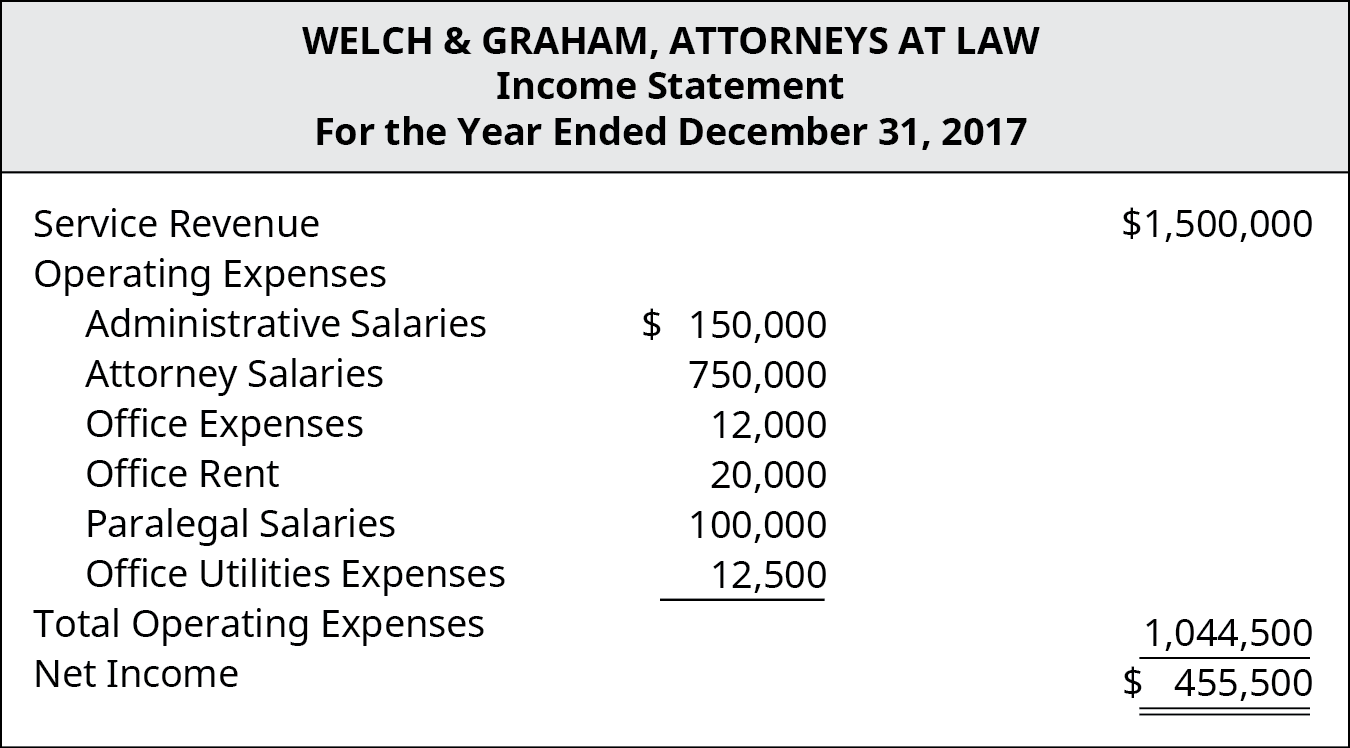

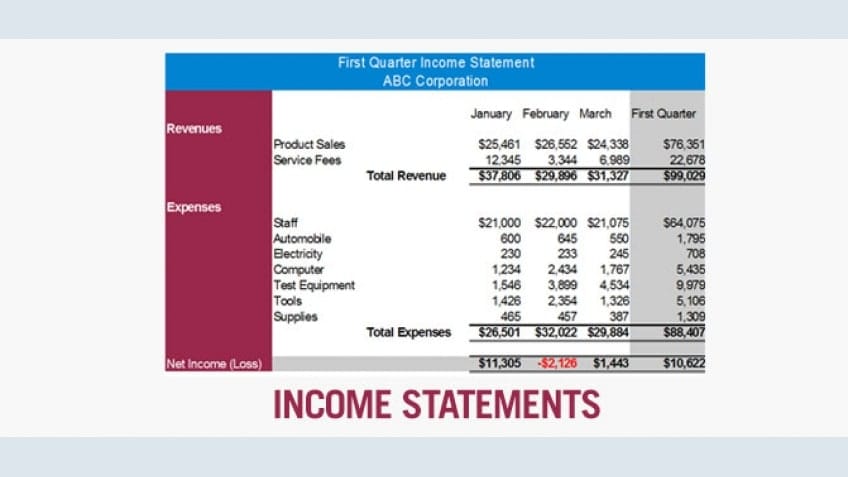

The income statement format above is a basic one what is known as a single step income statement meaning just one category of income and one category of expenses and prepared specifically for a service business. When an income statement shows data for segments of the organization and data for each segment are added together to get totals for the whole organization. Common fixed expenses should be allocated to the segments. Common fixed expenses should be allocated to the segments.

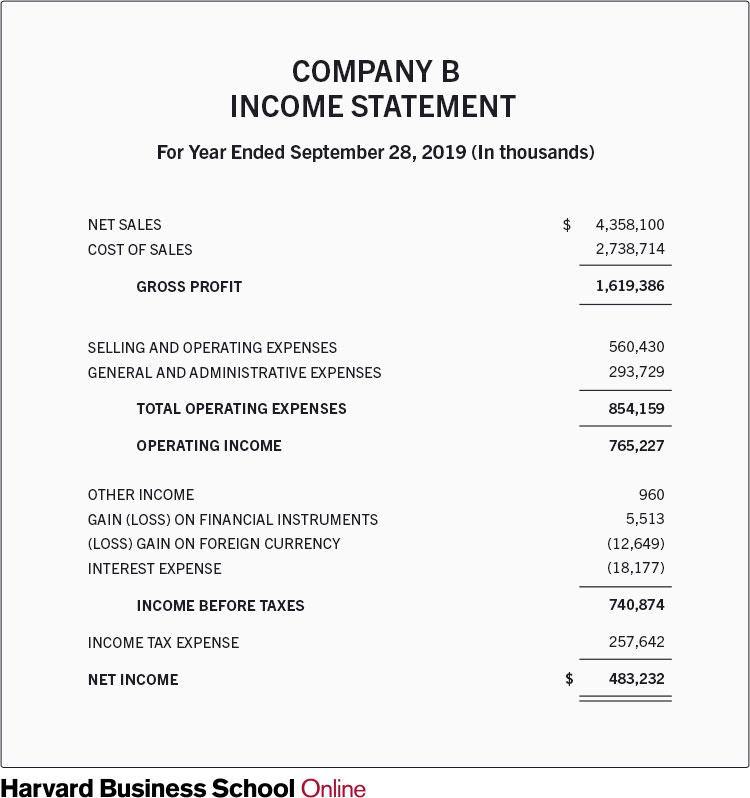

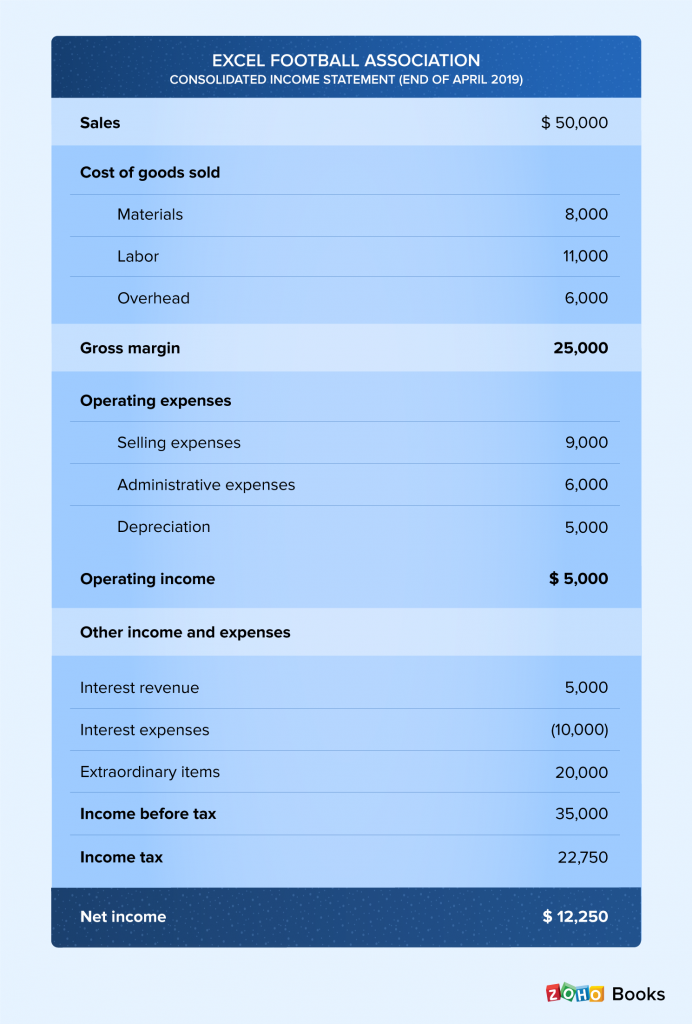

All expenses should be allocated to the segments. All expenses should be allocated to the segments. This income statement shows that the company brought in a total of 4 358 billion through sales and it cost approximately 2 738 billion to achieve those sales for a gross profit of 1 619 billion. Only direct revenues and direct expenses should be assigned to segments.

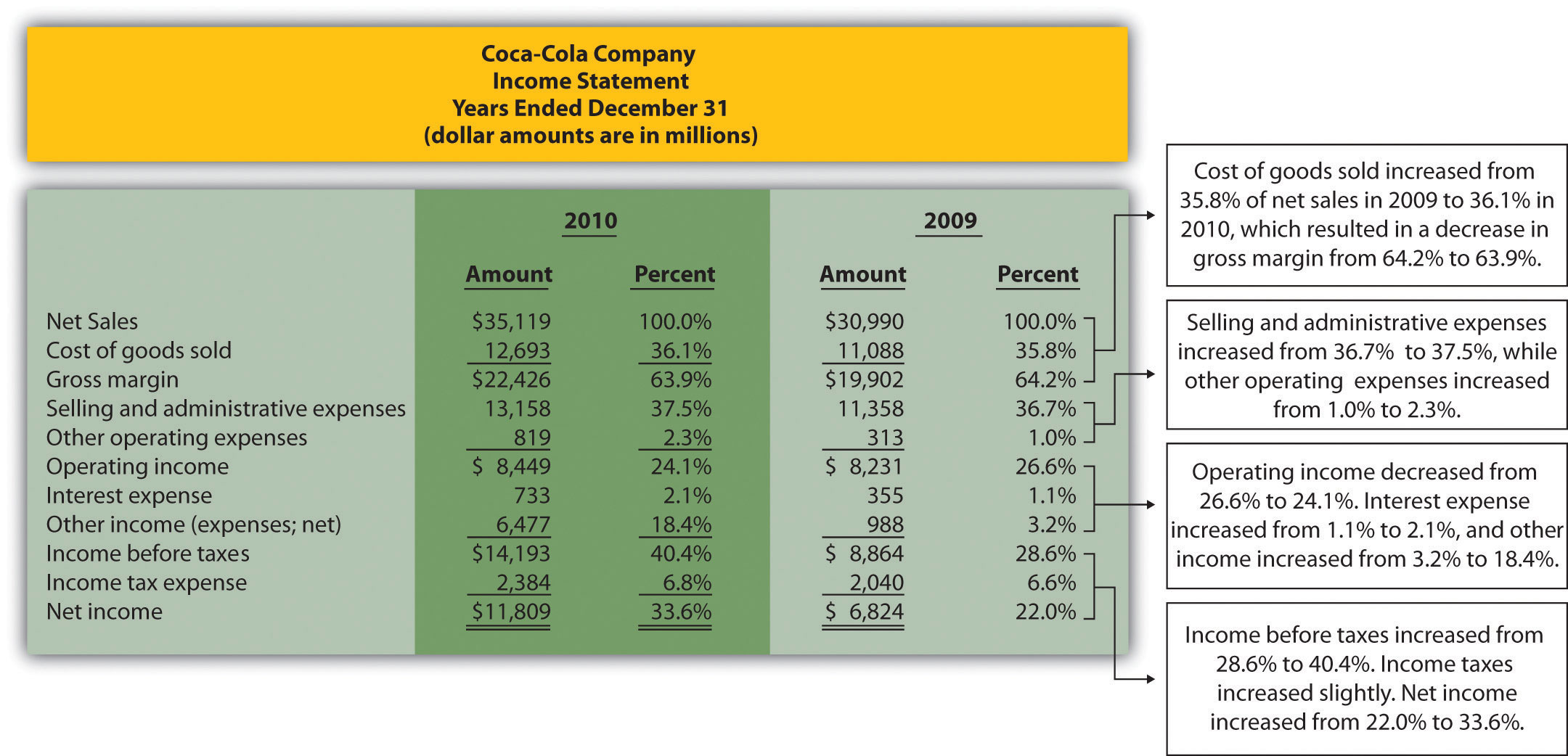

Examples of service businesses are medical accounting or legal practices or a business that provides services such as plumbing cleaning consulting design etc. The income statement contains several subtotals that can assist in. Only direct revenues and direct expenses should be assigned to. The purpose of the income statement is to show the reader how much profit or loss an organization generated during a reporting period this information is more valuable when income statements from several consecutive periods are grouped together so that trends in the different revenue and expense line items can be viewed.

Common fixed expenses should be allocated to the segments. Common fixed expenses should be allocated to the segments. Only direct revenues and direct expenses should be assigned to segments. A total of 560 million in selling and operating expenses and 293 million in general and administrative expenses were subtracted from that.

Direct fixed expenses should be subtracted as one amount in the total column.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)