United States United Kingdom Income Tax Treaty

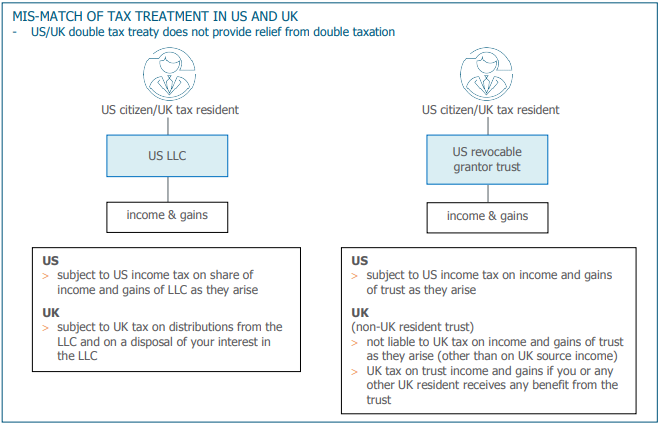

The united states uk tax treaty covers double taxation with regards to income tax and capital gains tax.

United states united kingdom income tax treaty. The focus of this article is how the u s irs applies treaty principles. If you have problems opening the pdf document or viewing pages download the latest version of adobe acrobat reader for further information on tax treaties refer also to the treasury department s tax treaty documents page. United kingdom tax treaty with the united states impacts the taxation of real estate retirement pension business income for residents non residents. Important us uk tax issues.

The treaty also clarifies the manner in which the united kingdom may tax the united states source income of united states citizens residing in the united kingdom and united kingdom branches of united states corporations. The treaty generally allows the united kingdom to tax such income but in so doing the united kingdom must first allow a credit against its tax for any united states tax paid with respect to the same income. For most types of income the solution set out in the treaty for us expats to avoid double taxation of their income arising in the uk is to claim us tax credits to the same value as british taxes that they ve already paid on their income.