Income Tax Notice Us 142 1

Penalty for non compliance of section 142 1 tax notice.

Income tax notice us 142 1. But 4 days back i received 142 1 notice for these two assessment years 2015 16 and 2016 17. Notice to produce accounts documents etc. I even got my 143 1 intimation from cpc a long time back. However following points are worthy to note.

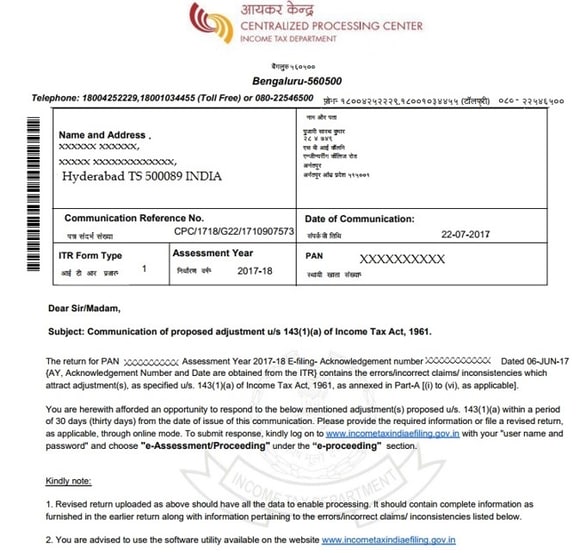

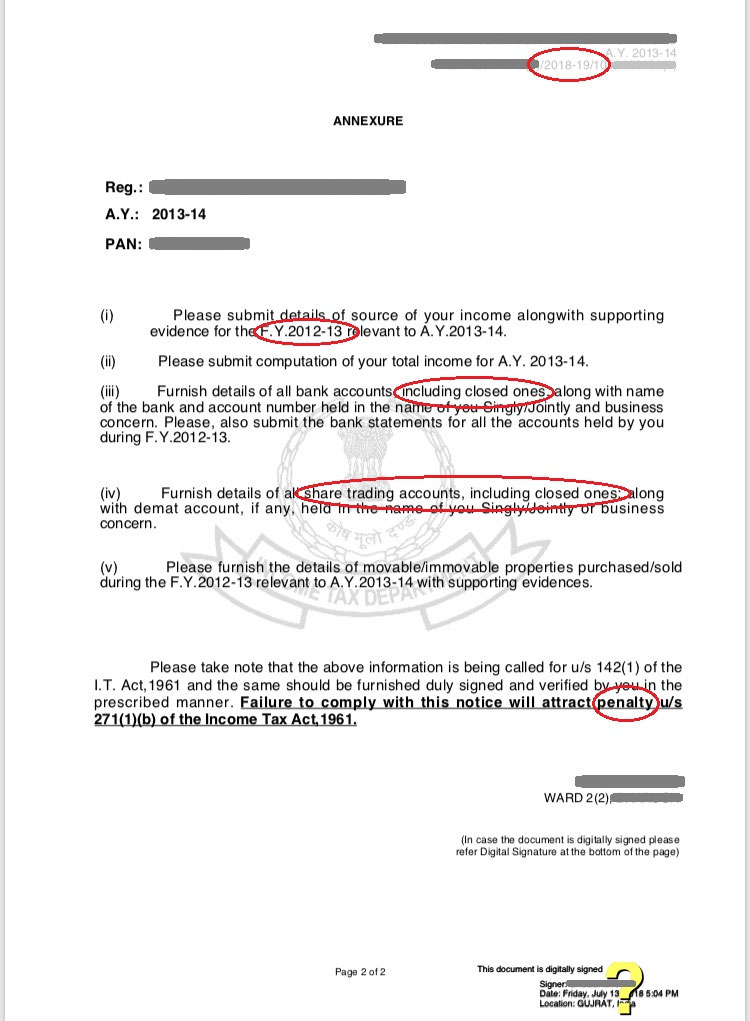

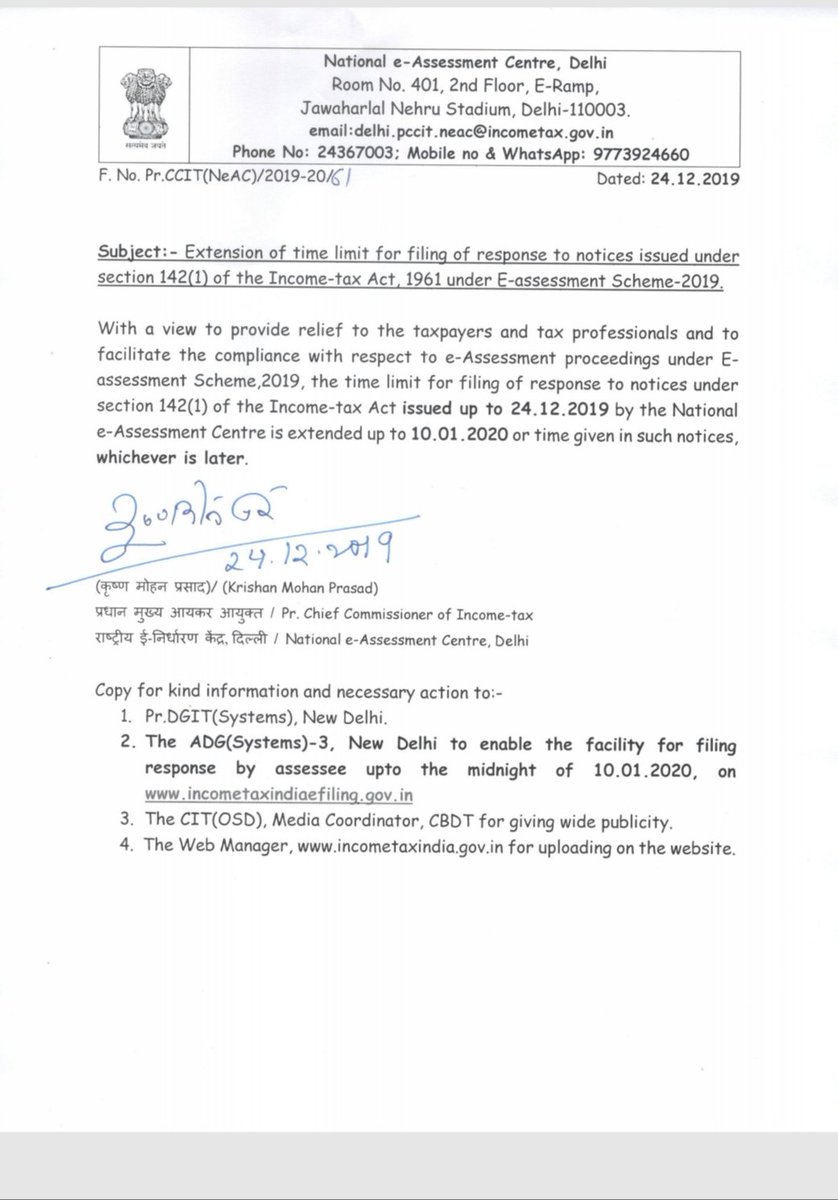

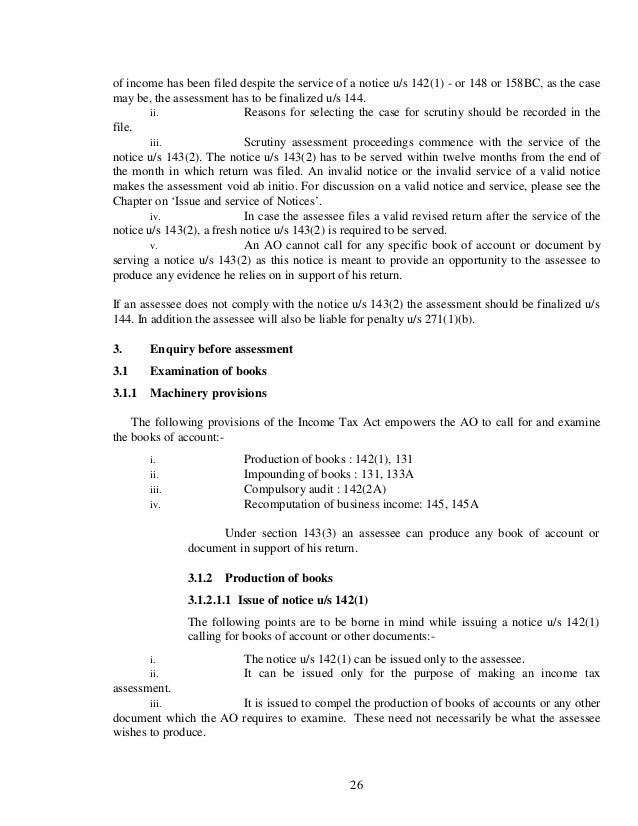

Further there is no maximum time limits of issue of notice us 142 1 i of the act. Filing of income tax return. A notice under section 142 1 of income tax act is generally served to taxpayers in order to call upon certain documents and details or to particularly assess a case. If notice us 142 1 i is issued after the due date then roi filed will be deemed roi us 142 1 i.

Follow up to the notice u s 142 1 if the ao is not satisfied with the response of the assessee or assessee fail to provide the documents against income tax notice u s 142 1 as explained in the earlier point then you will receive notice u s 143 2. When an individual receives such a notice it is most commonly the first step in the preliminary investigation into any discrepancies found by an assessing officer who would require the taxpayer to furnish further proofs or details. Failure in compliance with the section 142 1 tax notice may result in best judgment assessment u s. Section 142 1 in the income tax act 1995 1.

Producing specific accounts and documents. If the assessee has not submitted a return of income within the time allowed u s 139 1 the assessing officer may require him to submit a return in the prescribed form on or before the date specified in the notice. How to deal with notice u s 154. In the case of non filing of the return the income tax return needs to be filed within the time given in the notice and a proof of the same be submitted along with the required documents.

Notice to submit a return sec. Hi my tax returns for the assessment years 2015 16 and 2016 17 were filed and processed. If you ve not filed your return within the specified period of time or before the end of the relevant assessment year then you might receive notice u s 142 1 asking you to file your return. It means if during the relevant assessment year assessee filed roi under any of the section then by issuing this notice ao can t call for return of income us 142 1 1.

In income tax act 1961 return of income can be filed within only under four sections. In this scenario the case is called for detailed scrutiny. The italicised words were substituted for or upon whom a notice has been served by the. Notice us 142 1 i can be issued even after the end of the relevant assessment year.

Substituted for or to whom a notice has been issued under sub section 2 of section 139 whether a return has been made or not by the direct tax laws amendment act 1987 w.