Income Tax Rate 2020 Lhdn

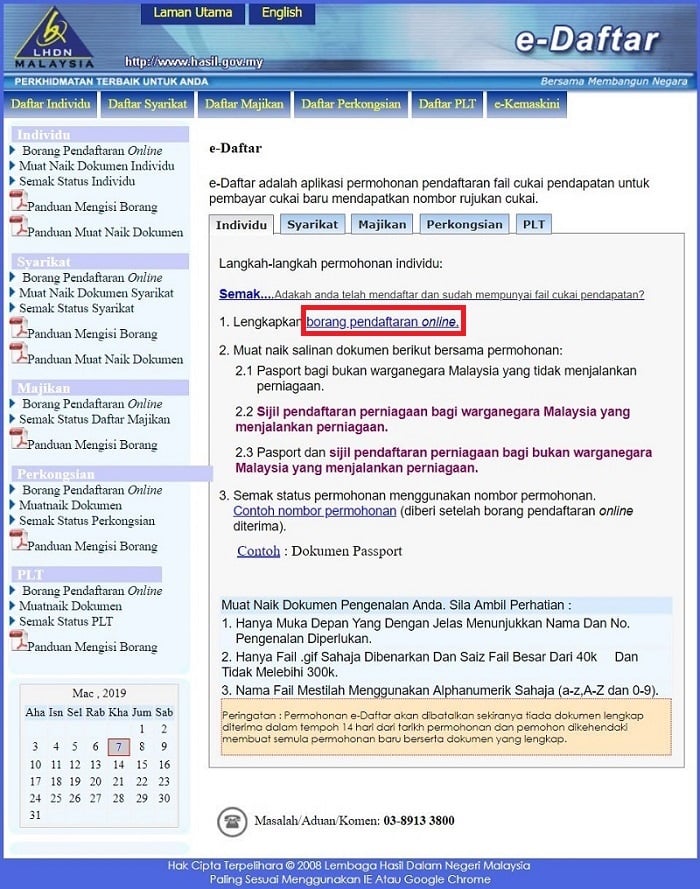

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

Income tax rate 2020 lhdn. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. A corporate tax rate of 17 to 24 is imposed upon resident and non resident companies on taxable income that is sourced from or obtained in malaysia. This relief is applicable for year assessment 2013 and 2015 only. Medical expenses for parents.

Below is the list of tax relief items for resident individual for the assessment year 2019. 150 tarikh kemaskini. These proposals will not become law until their enactment and may be amended in the course of their passage through. I 5 000 limited year of assessment.

5 000 limited 3. 31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income. On the first 2 500. First of all don t confuse tax rebate with tax relief.

Tax relief is the amount deducted from your taxable income whereas tax rebate is the amount deducted from your income tax. Income tax rates 2021 malaysia. Basic supporting equipment. Make sure you keep all the receipts for the payments.

Below are the individual personal income tax rates for the year of assessment 2020 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. For the assessment year 2020 there is an additional range of taxable income that is for taxable income in excess of rm2 million. A ringgit tax rebate will worth more to you than a ringgit of tax relief. 10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia.

Corporate income tax or corporate tax is a direct tax that is paid to the government via irbm lhdn it is governed under the income tax act 1967. Calculations rm rate tax rm 0 5 000. On the first 5 000 next 15 000. This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices.

The relief amount you file will be deducted from your income thus reducing your taxable income. Special relief of rm2 000 will be given to tax payers earning on income of up to rm8 000 per month aggregate income of up to rm96 000 annually. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.