Self Employment Income Verification Form Illinois

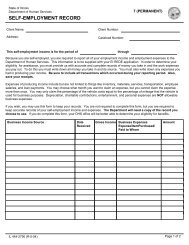

This self employment income is for the period of through.

Self employment income verification form illinois. Self employment record 7 permanent client name. Press done after you complete the blank. 7 permanent il444 2790 r 10 17 self employment record printed by authority of the state of illinois 0 copies page 1 of 2. This usually comes in form of the letter written by you or an.

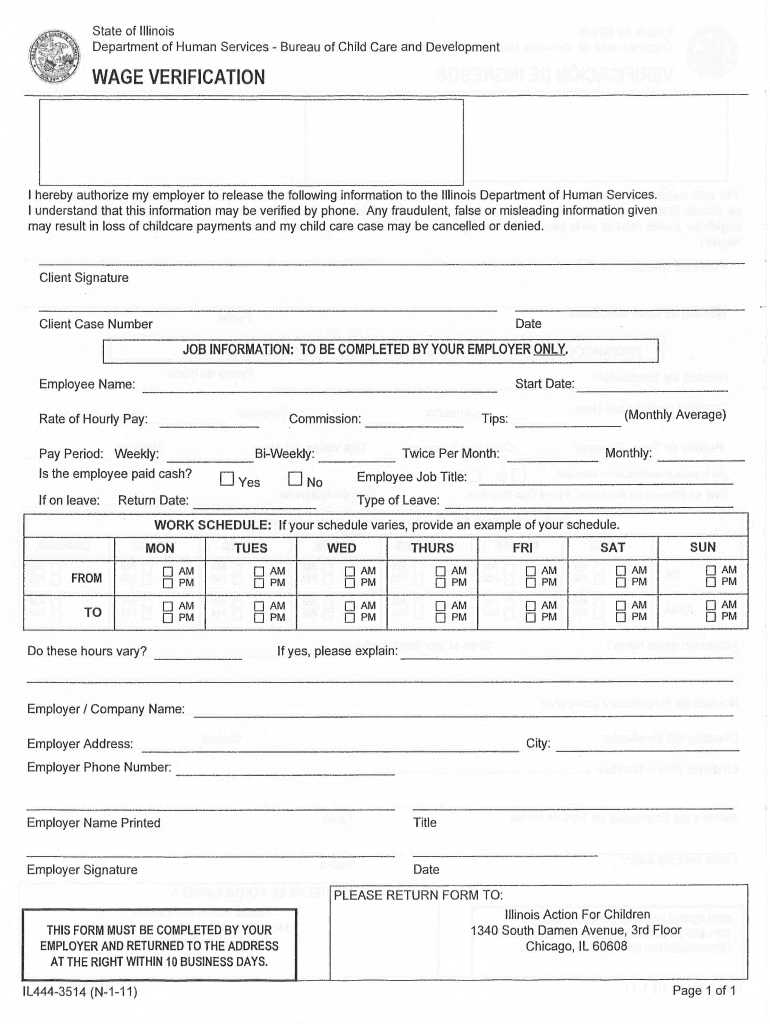

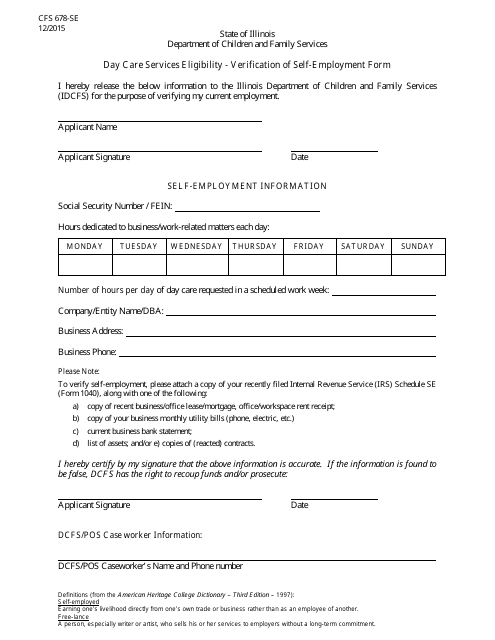

Because you are self employed you are required to report all of your employment income and employment expenses to the department of human services. Make use of the sign tool to add and create your electronic signature to certify the illinois income verification form. 400 per week x 4 3 weeks in the month 1720 month. Gross income is your income before you take out taxes.

To write income verification letter for self employed one must hire a person or human resource to write a letter for them but if you are self employed you definitely have to write it by yourself. This type of verification letter is commonly used when someone seeks housing or is applying for a mortgage. The requestor of the employment information will use the form to confirm that an individual has a secure job and an income stream capable of affording the monthly payment. Items to be verified.

State of illinois department of human services. This self employment income is for the period of through. Proof of income and expenses for the last 30 days is unavailable or. Now you ll be able to print save or share the form.

Income verification letter for self employed admin september 22 2018 the employment verification letter is a kind that verifies the salary or wage earned by way of an hired particular person. Because you are self employed you are required to report all of your employment income and employment expenses to the department of human services. State of illinois department of human services. Income and expense records for the last 30 days do not reflect anticipated annual income because the self employment income is seasonal or variable throughout the year.

Let s say you work full time at 10 hour. The client may use business records or the self employment report form dhs 3336 pdf as monthly proof of self employment income and expenses. If the client fails or refuses to provide proof of self employment income and expenses the case is ineligible. Address the support section or get in touch with our support team in case you have any questions.

Writing an income verification is very usual to be asked to verify your income when inquiring about a loan rental agreement etc. Your gross income every week is going to be 40 hours x 10 hour or 400 per week. There are more than 4 weeks in a month except february so your monthly gross income is actually.