A Contribution Margin Income Statement Shows

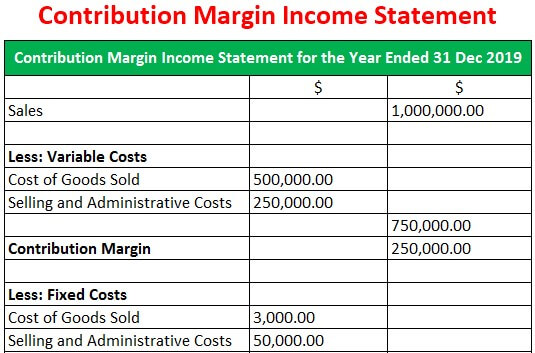

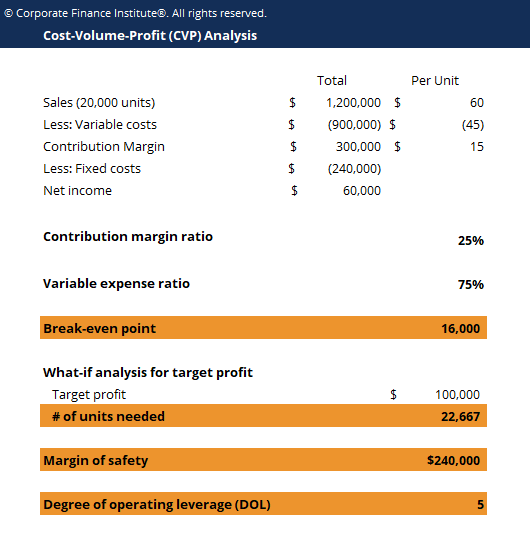

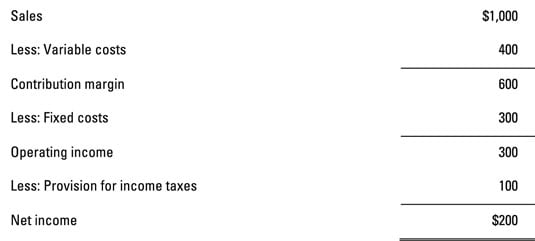

This income statement format is a superior form of presentation because the contribution margin clearly shows the amount available to cover fixed costs and generate a profit or loss.

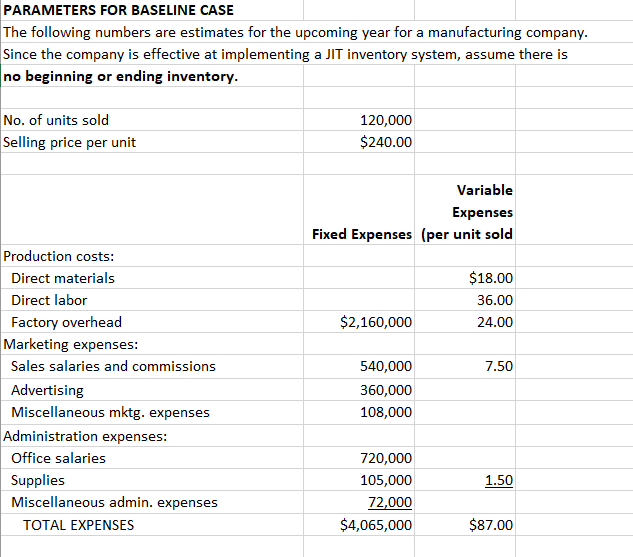

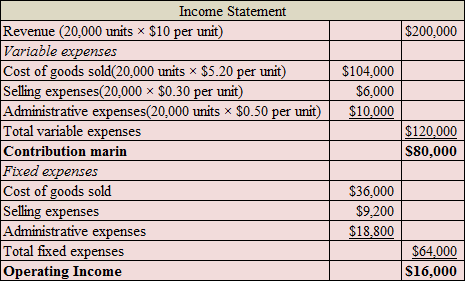

A contribution margin income statement shows. Note that operating profit is the same in both statements. Prepare a forecasted contribution margin income statement for 2018 that shows the expected results with the machine installed. This type of statement appears in panel b of figure 5 7 traditional and contribution margin income statements for bikes unlimited. Contribution margin income statements refer to the statement which shows the amount of contribution arrived after deducting all the expenses that are variable in nature from the total revenue amount and further fixed expenses are deducted from the contribution to get the net profit loss of the business entity.

The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses. For vaughn manufacturing at a sales level of 4000 units sales is 71000 variable expenses total 60000 and fixed expenses are 21000. A contribution margin income statement is an income statement in which all variable expenses are deducted from sales to arrive at a contribution margin from which all fixed expenses are then subtracted to arrive at the net profit or loss for the period. What is the contribution margin income statement.

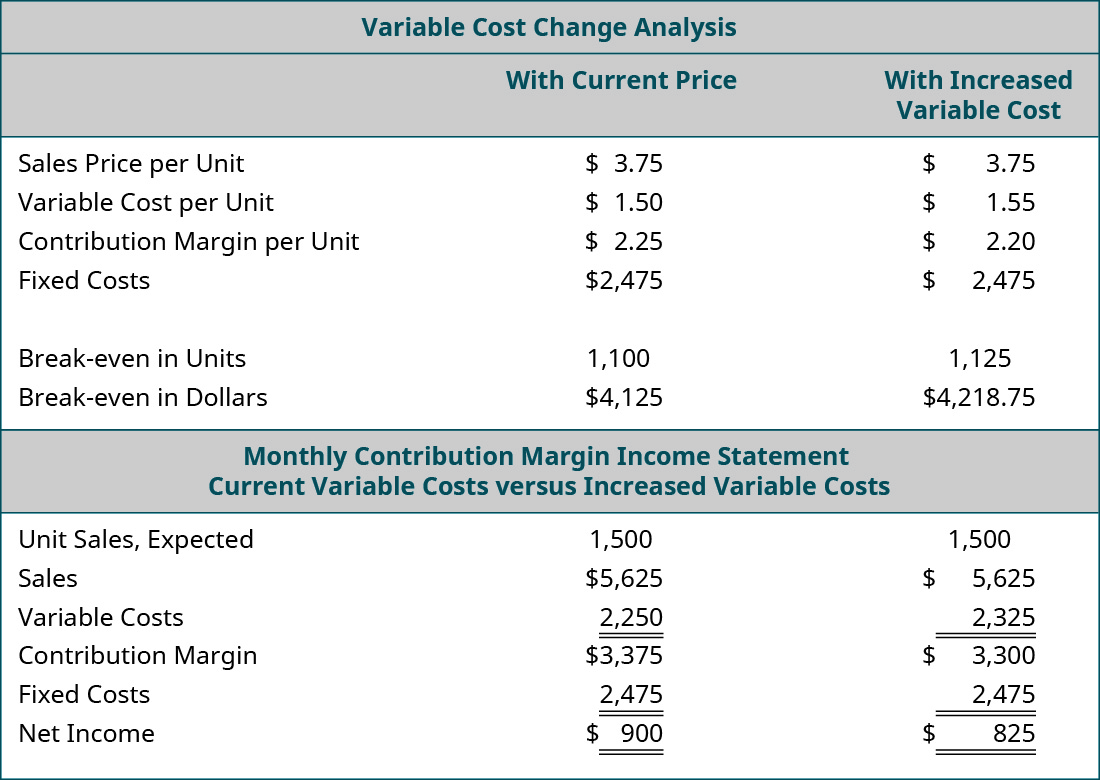

Assume that the unit selling price and the number of units sold will not change and no income taxes will be due. The resulting value is sometimes referred to as operating income or net income. Another income statement format called the contribution margin income statement shows the fixed and variable components of cost information. Contribution margin shows you the aggregate amount of revenue available after variable costs to cover fixed expenses and provide profit to the company knight says.

In essence if there are no sales a contribution margin income statement will have a zero contribution margin with fixed costs clustered beneath the. In this article we shall discuss two main differences of two income statements the difference of format and the difference of usage. This statement tells you whether your efforts for the period have been profitable or not. This difference of treatment of two types of costs affects the format and uses of two statements.