Ohio Income Tax Joint Filing Credit 2019

Ohio i file joint filing credit.

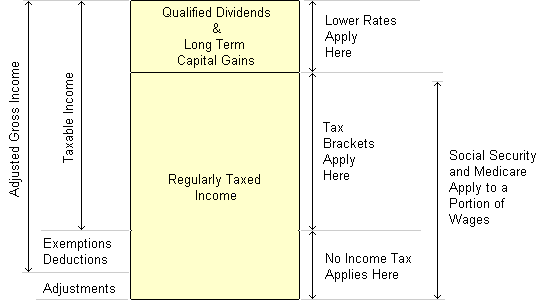

Ohio income tax joint filing credit 2019. Less will pay no ohio income tax. And enter ohio employer withholding account number employer s state id number box 15 note. If you have additional income that qualifies for the joint filing credit please proceed to the joint filing credit page and select yes to enter your income source. Qualifying income does not include income from interest dividends distributions royalties rents capital gains and state or municipal income tax.

The joint filing credit also requires qualifying income so if the spouse does not work or have retirement income other than social security the couple does not usually even get the credit. Those taxpayers claiming the business income deduction bid will be required to add back the bid when calculating. Each spouse must have at least 500 of qualifying income to get the credit.

/ScreenShot2020-04-03at11.52.59AM-9d0f626d45704b75a451679182d740ef.png)