Income Tax Rate 2020 Ghana

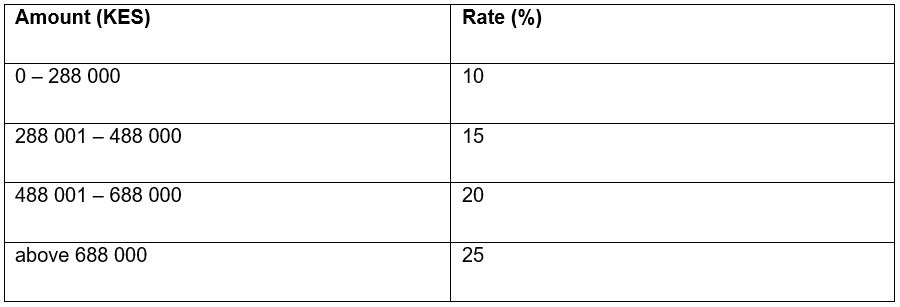

Personal income tax rates.

Income tax rate 2020 ghana. The annual maximum tax rate applicable on chargeable income exceeding ghs 240 000 remains at 30. The user interface is neatly design and easy to use. Tax proposals in 2020 budget the 2020 budget presented 13 november 2019 does not propose any new taxes but would extend the national fiscal stabilization levy nfsl at a rate of 5 and the special import levy sil at a rate of 2 for five years through 2024. 2 act 2018 act 979.

It is built using the latest tax rates from ghana revenue authority gra. Recent changes to ghana s personal income tax regime amend the tax bands for resident individuals and increase their personal relief deductions in arriving at taxable income. For resident individuals the rates and brackets are as follows based on annual income. The ghana revenue authority has announced the passage of the income tax amendment act 2019 act 1007 which includes amendments to the individual income tax brackets and rates for 2020.

Following tax proposals made by the government of ghana in the 2019 budget and economic policy statement tax amendments have been passed to give legal backing to the implementation of the proposals. Important changes which were made in the new income tax rates in ghana included the following. Up to ghs 3 828 0. New income tax law in ghana.

In the long term the ghana personal income tax rate is projected to trend around 25 00 percent in 2021 according to our econometric models. New tax rates effective 1 st january 2020. Amendments to the income tax act 2015 act 896 the commissioner general of the ghana revenue authority gra wishes to inform the general public that the following amendments have been made to the income tax act 2015 act 896 by the income tax amendment act 2019 act 1007. The 2015 income tax act ghana law act 896 was amended in 19 february 2016.

That is income tax amendment no. Tax proposals in 2020 budget ghana. The act provided new regulations on how income tax was to be imposed to ghanaians citizen. Notably the personal income tax rates applicable to resident individuals have been revised to take effect from 1 january 2019.

New tax rates effective 1 st january 2020. Amendments to the income tax act 2015 act 896 the commissioner general of the ghana revenue authority gra wishes to inform the general public that the following amendments have been made to the income tax act 2015 act 896 by the income tax amendment act 2019 act 1007. This part is useful for everybody. Residents are subject to tax at rates ranging between 0 and 30 on the following annual graduated scale of income.

Ghana paye calculator calculates your income tax based on your salary and ssnit contribution 5 5 and gives you an accurate representation of what you are to pay. Non residents are liable to ghanaian income tax on any income derived in ghana from any trade business profession or vocation or which is derived from an employment exercised in ghana.