Multi Step Income Statement Practice Problems

Start studying multi step income statement practice.

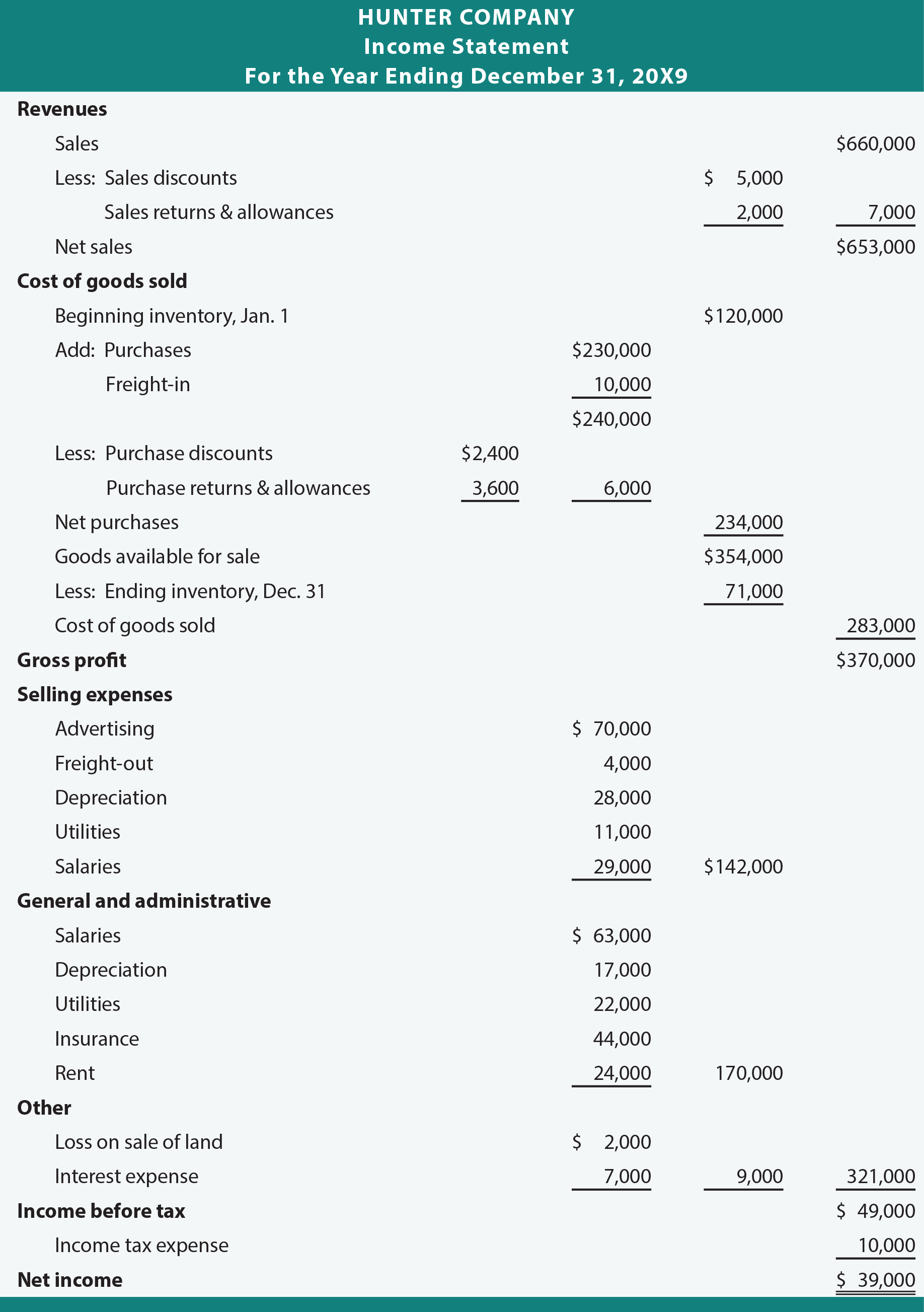

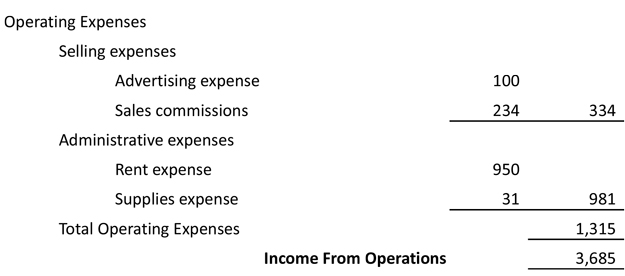

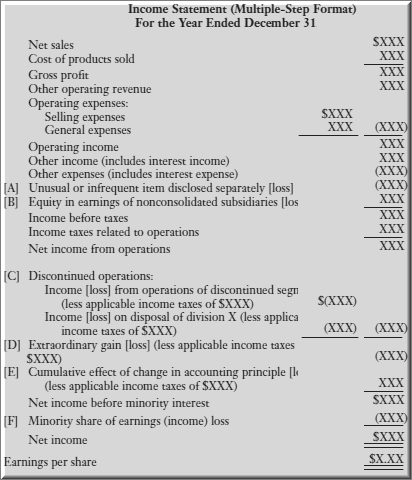

Multi step income statement practice problems. Compute net income income from. Multi step income statement is the income statement of the company which segregates the total operating revenue of the company from non operating revenue and total operating expenses of the company from non operating expenses thereby separating the total revenue and expense of a particular period into two different sub categories i e operating and the non operating. Preparing a multi step income statement and a classified balance sheet 30 40 min link back to chapter 4 classified balance sheet. The accounts of taylor electronics company are listed along with their balances before closing for the month ended march 31 2012.

A multi step income statement showed net sales of 870 000 cost of goods sold of 376 000 and total operating expenses of 330 000 for the fiscal year ended december 31 2016. The adjusted trial balance of mccoy company included the following selected accounts. Practice problems practice problem 1 b company provided an adjusted trial balance as of december 31. Problem solving use what you ve learned to.

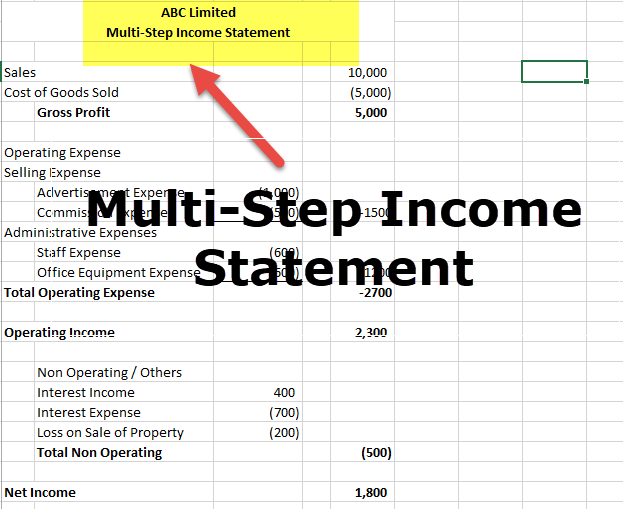

Compute gross profit total sales cost of goods sold step 2. A multi step income statement contains four measures of profitability and a single step income statement contains one measure of profitability. Let s take a look at a multi step income statement example. The multiple step profit and loss statement segregates the operating revenues and operating expenses from the nonoperating revenues nonoperating expenses gains and losses.

Learn vocabulary terms and more with flashcards games and other study tools. Compute income from operations gross profit operating expenses step 3. Multi step income statement sample problem. An alternative to the single step income statement is the multiple step income statement because it uses multiple subtractions in computing the net income shown on the bottom line.