Income Versus Withholding Tax

Please be aware that we re not tax professionals and this is not tax advice just a general guideline.

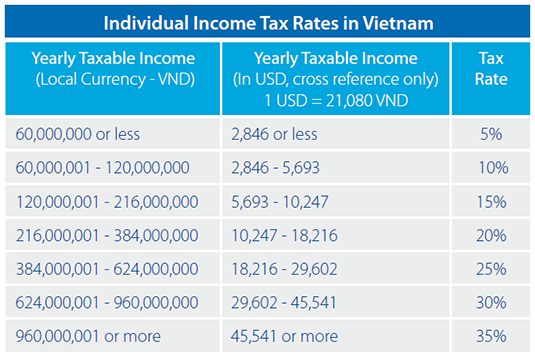

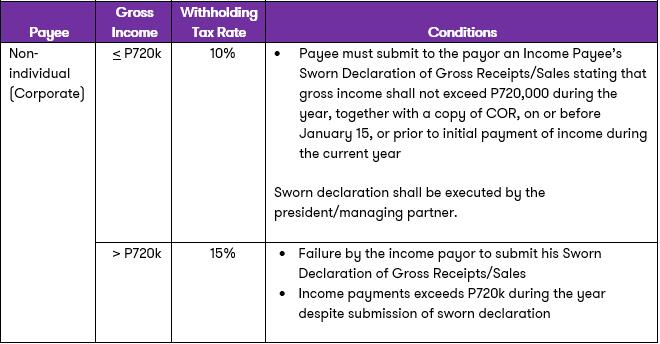

Income versus withholding tax. In most jurisdictions withholding tax applies to employment income. The money taken is a credit against the employee s annual income tax. The federal income tax is a pay as you go tax meaning you pay taxes as you earn or receive income throughout the year. Depending on your financial situation you may pay these taxes through withholding earnings or making estimated quarterly tax payments.

The tax is thus withheld or deducted from the income due to the recipient. Many jurisdictions also require withholding tax on payments of interest or dividends. Knowing the difference between fica vs. The income tax is what is paid by withholding of tax from someones payment pay.

Other taxes or charges like insurance worker comp etc may be apd by withholding the amount from payment payroll. A withholding tax takes a set amount of money out of an employee s paycheck and pays it to the government.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)