Ohio Retirement Income Tax Calculator

This breakdown will include how much income tax you are paying state taxes federal taxes.

Ohio retirement income tax calculator. Alone that would place ohio at the lower end of states with an income tax but many ohio municipalities also charge income taxes some as high as 3. Your annual savings expected rate of return and your current age all have an impact on your retirement s monthly income. Any income from pensions or retirement accounts like a 401 k or an ira is taxed as regular income but there are credits available. Similarly ohio s statewide sales tax rate is 5 75 but when combined with county sales tax rates ranging from 0 75 up to 2 25 the total average rate is 7 17.

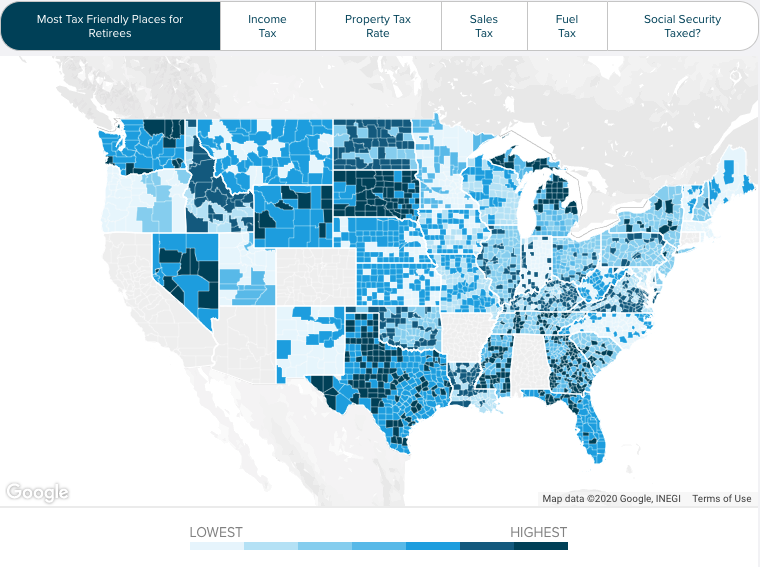

View the full report to see a year by year break down of your retirement savings. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. Ohio state tax calculator tax calculator the ohio tax calculator is updated for the 2021 22 tax year. Methodology to find the most tax friendly places for retirees our study analyzed how the tax policies of each city would impact a theoretical retiree with an annual income of 50 000.

Retirement income calculator use this calculator to determine how much monthly income your retirement savings may provide you in your retirement. The provided information does not constitute financial tax or legal advice. Overview of ohio retirement tax friendliness. Social security retirement benefits are fully exempt from state income taxes in ohio.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Overview of ohio taxes. Our analysis assumes a retiree receiving 15 000 from social security benefits 10 000 from a private pension 10 000 in wages and 15 000 from a retirement savings account like a 401 k or ira. Using our ohio salary tax calculator.

This includes retirement income from all pensions from your employer annuities from either your employer or private insurance arrangements and any retirement account such as a 401k plan ira 403b plan or any other private or employer based retirement scheme. Ohio taxes all of your private retirement income. To use our ohio salary tax calculator all you have to do is enter the necessary details and click on the calculate button. Ohio has a progressive income tax system with eight tax brackets.

We strive to make the calculator perfectly accurate. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The ohio income tax calculator is designed to provide a salary example with. The oh tax calculator calculates federal taxes where applicable medicare pensions plans fica etc allow for single joint and head of household filing in ohs.

For all filers the lowest bracket applies to income up to 21 750 and the highest bracket only applies to income above 217 400. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax.