Ohio Nonresident Income Tax Form

Beginning with tax year.

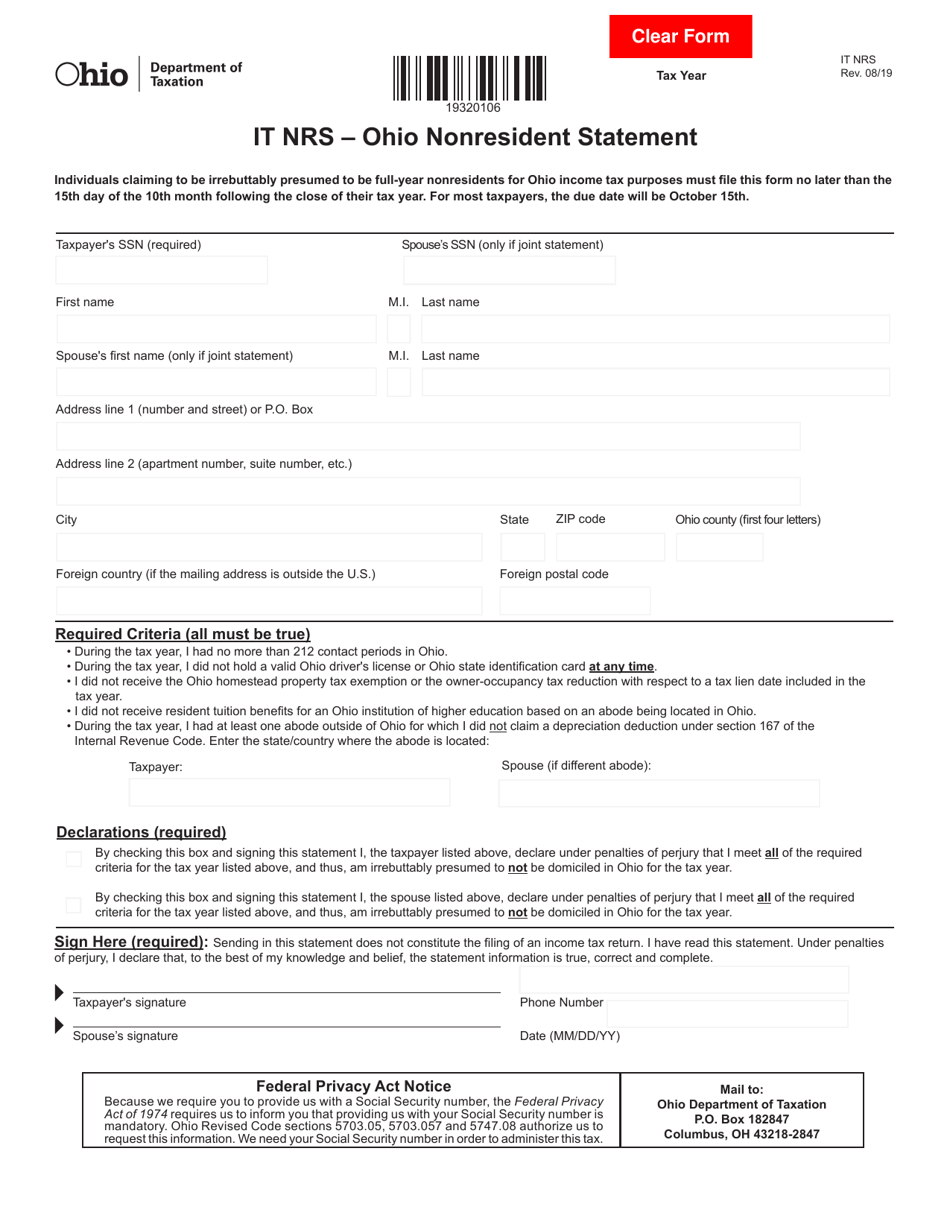

Ohio nonresident income tax form. Individuals claiming to be irrebuttably presumed to be full year nonresidents for ohio income tax purposes must file this form no later than the. Ohio has a nonresident credit allocation form. For instance if you earned 45 000 in earnings and 5 000 at the casino ohio will figure out how much tax you would pay on your total income and then determine your tax liability proportionate to the amount of income received from ohio sources. Pdf pdf fill in it 40p.

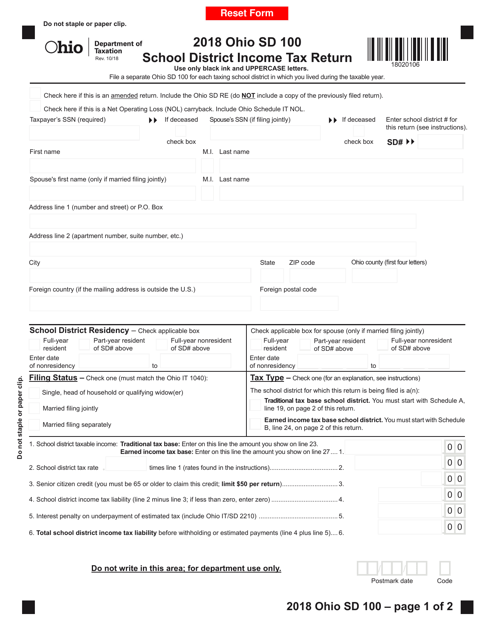

City state zip code ohio county first four letters it nrs ohio nonresident statement. 15th day of the 10th month following the close of their tax year. Ohio it nrc income allocation and apportionment nonresident credit and part year resident credit include this three page form with the ohio it 1040 individuals. Nonresidents of ohio only pay ohio individual income tax on income earned or received in ohio.

The total of your senior citizen credit lump sum distribution credit and joint filing credit ohio schedule of credits lines 4 5 and 12 is equal to or exceeds your income tax liability ohio. Addit ionally all ohio income tax rates have been reduced by 4. 2019 ohio it 1040 individual income tax return this file includes the ohio it 1040 schedule a it bus schedule of credits schedule j it 40p it 40xp and it re. You do not have to file an ohio income tax return if.

It nrs ohio nonresident statement. Income allocation and apportionment nonresident credit and part year resident credit pit it2023 tax year it 2023 rev. Thus an ohio resident pays ohio individual income tax on all of his or her compensation distributive share of income from pass through entities interest dividends capital gains rents royalties etc. Ohio imposes its individual income tax on every taxpayer residing in or earning or receiving income in ohio.

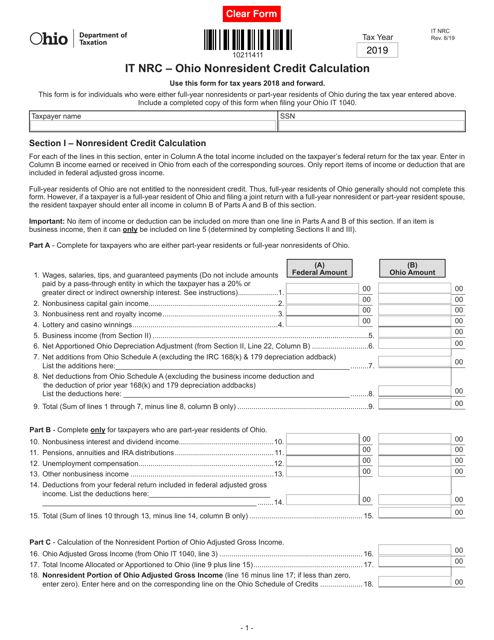

Beginning with tax year 2019 ohio s individual income tax brackets have been modified so that individuals with ohio taxable nonbusiness income of 21 750 or less are not subject to income tax. This form is for taxpayers claiming the nonresident credit on the ohio it 1040 for tax years 2016 and forward. Make sure that your non ohio wages show tx other state postal abbreviation in box 15 of your w 2 screen with the tx amount in box 16. In reality ohio will not tax all of your income but it does factor it in in determining how much tax you must pay.

Ohio governor mike dewine recently signed two bills house bills 62 and 155 that enact several significant ohio income tax changes for the upcoming tax filing season. 2019 income tax changes. Your ohio adjusted gross income line 3 is less than or equal to 0. Ohio income tax tables.

This system allows ohio to apply their highest tax rate based on your total income while only taxing your ohio income.