Income Tax Us Wiki

An income tax is a tax imposed on individuals or entities that varies with respective income or profits.

Income tax us wiki. Thus if your income is usd 25 000 per annum and the rate of income tax is 10 flat you shall have to. Under a flat system income tax is charged at a flat rate of the income. Income taxes are based on what a person earns in one calendar year between january 1 and december 31. The top 3 65 with incomes over 200 000 earned 17 5.

Income tax is a type of tax levied and collected on the income of an individual companies and other entities like trusts and associations. In other words the income tax rate is the part or portion of a person s income that the government takes. One half 49 98 of all income in the us was earned by households with an income over 100 000 the top twenty percent. By 1918 the top rate of the income tax was increased to 77 on income over 1 000 000 equivalent of 16 717 815 in 2018 dollars to finance world war i.

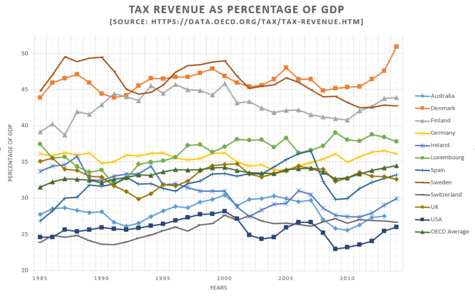

Tax policy is the mechanism through which market results are redistributed affecting after tax inequality. Income tax system imposes a tax based on income on individuals corporations estates and trusts. Income tax is self assessed and individual and corporate taxpayers in all states imposing an income tax must file tax returns in each year their income exceeds certain amounts determined by each state. Individual income is often taxed at progressive rates where the tax rate applied.

The provisions of the united states internal revenue code regarding income taxes and estate taxes have undergone significant changes under both republican and democratic administrations and congresses since 1964. The tax rate may increase as taxable income increases. Since the johnson administration the top marginal income tax rates have. The income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductions.

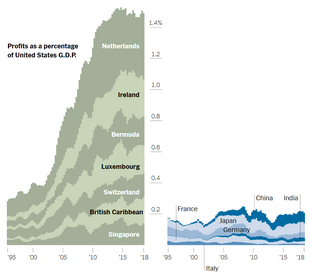

This tax may be reduced by credits some of which may be refunded if they exceed the tax calculated. In 2010 corporate tax revenue constituted about 9 of all federal revenues or 1 3 of gdp. The tax imposed on companies is usually known as corporate tax and is levied at a flat rate. Income taxes in the united states are imposed by the federal most states and many local governments.

Over one quarter 28 5 of all income was earned by the top 8 those households earning more than 150 000 a year. Taxation rates may vary by type or characteristics of the taxpayer. Congress enacted an income tax in october 1913 as part of the revenue act of 1913 levying a 1 tax on net personal incomes above 3 000 with a 6 surtax on incomes above 500 000. The present rate of tax on corporate income was adopted in the tax reform act of 1986.

The corporate income tax raised 230 2 billion in fiscal 2019 which accounted for 6 6 percent of total federal revenue and had seen a change from 9 percent in 2017. Income tax generally is computed as the product of a tax rate times taxable income. When it takes income taxes the government takes a percentage of a person s income. Returns are also required by partnerships doing business in the state.