Complete The Partial Income Statement If The Company

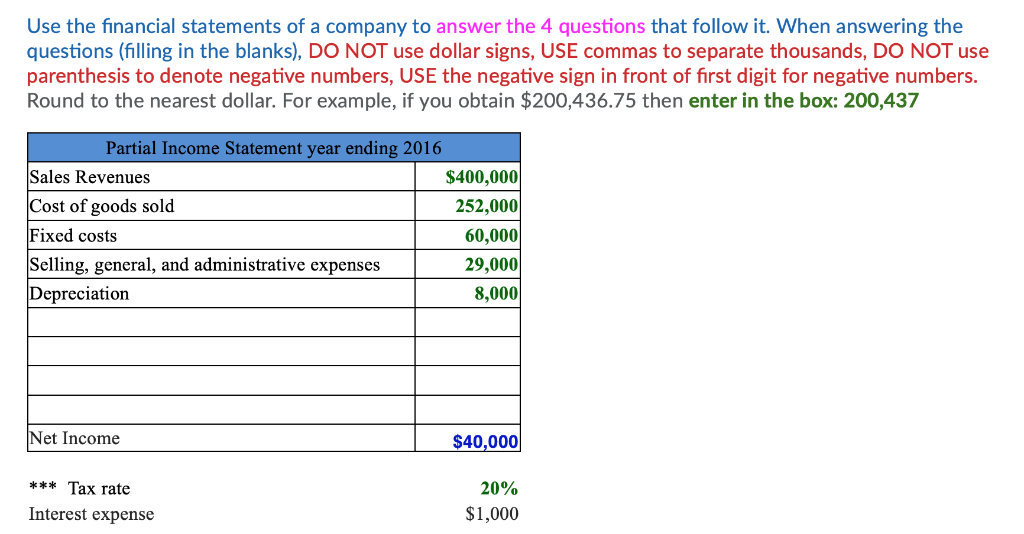

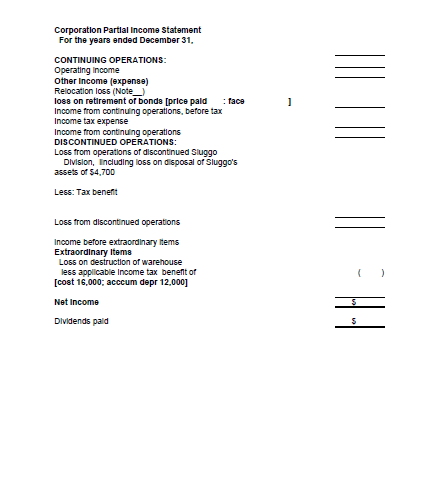

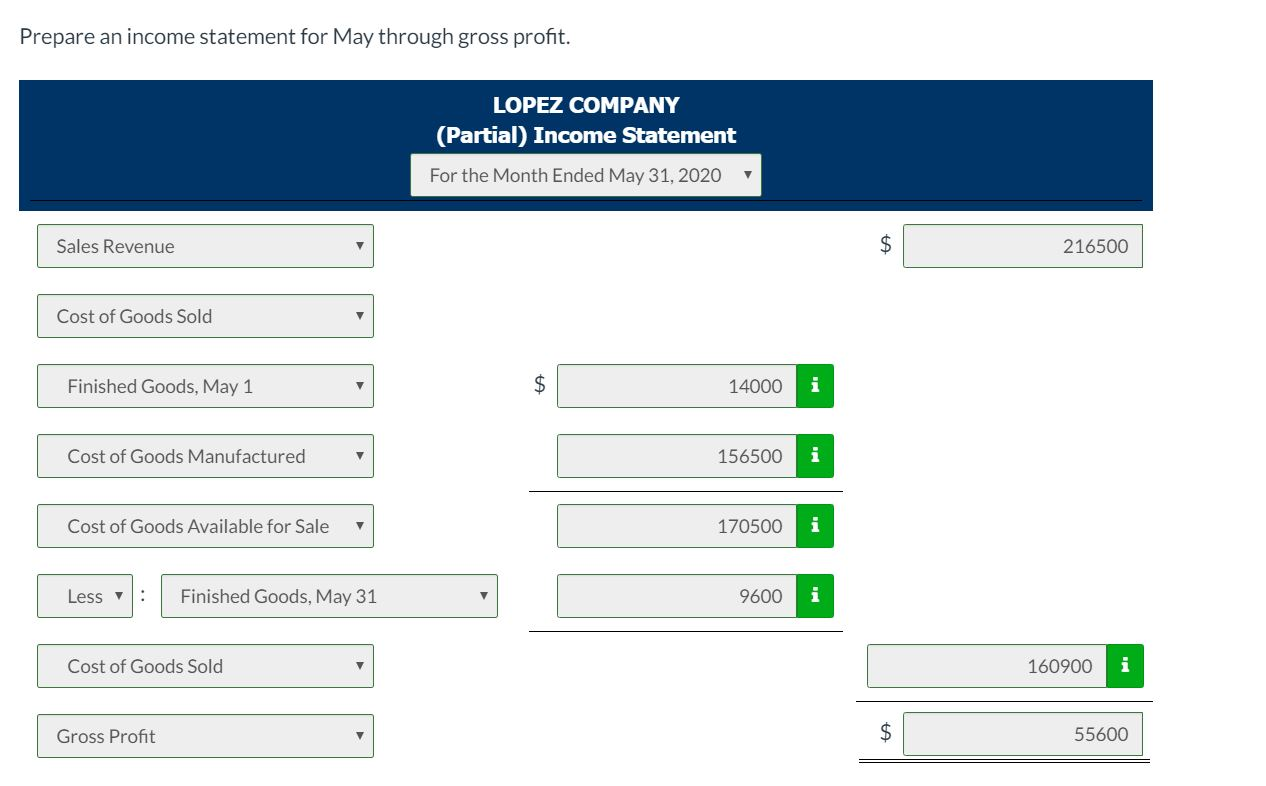

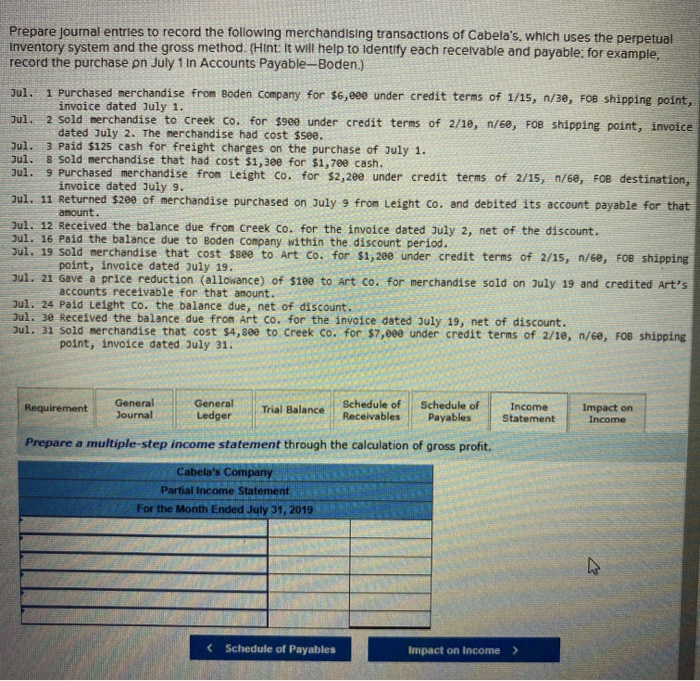

Complete the partial income statement if the company paid income statement.

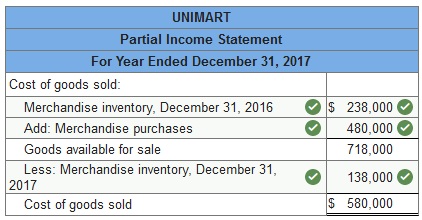

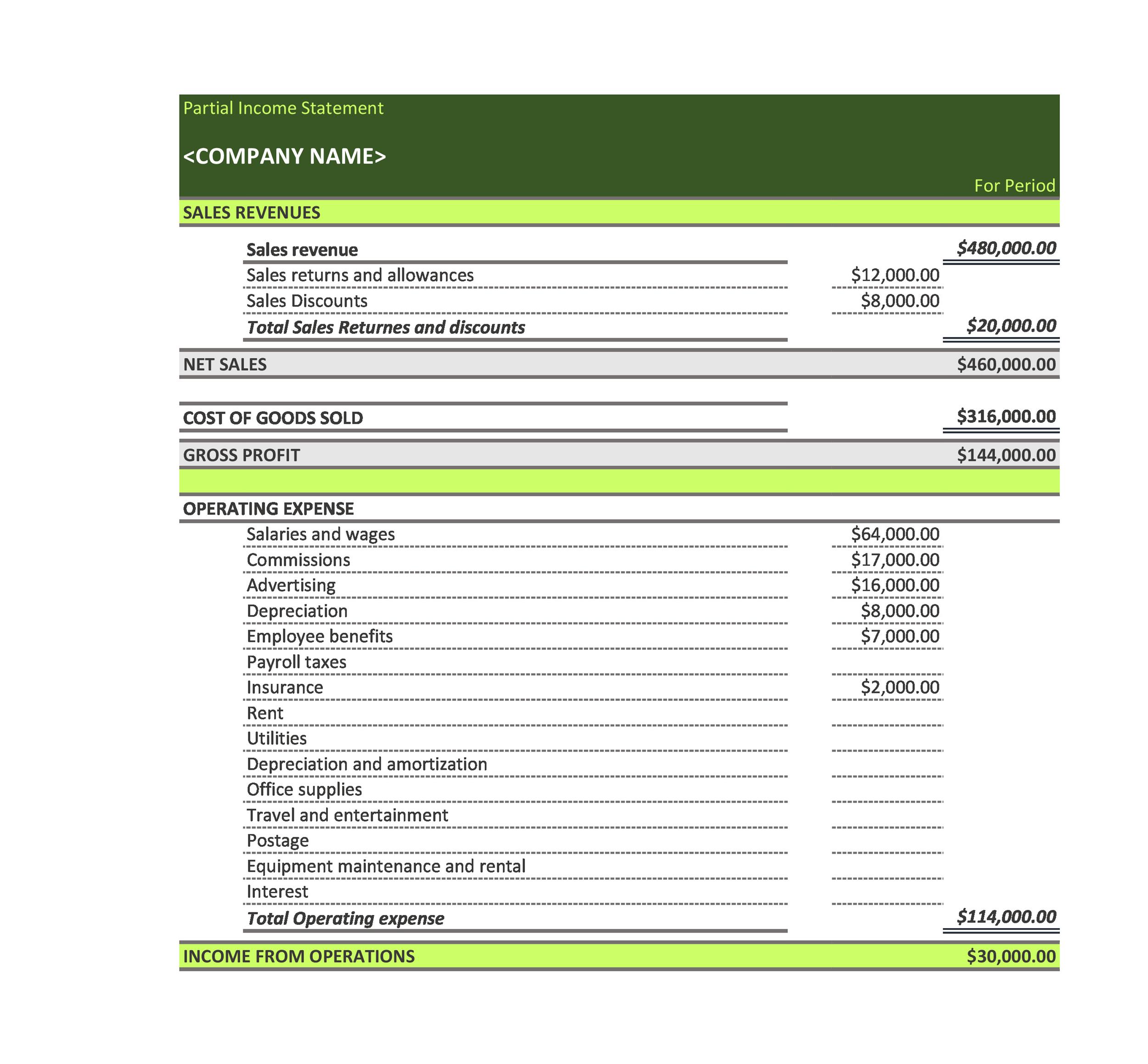

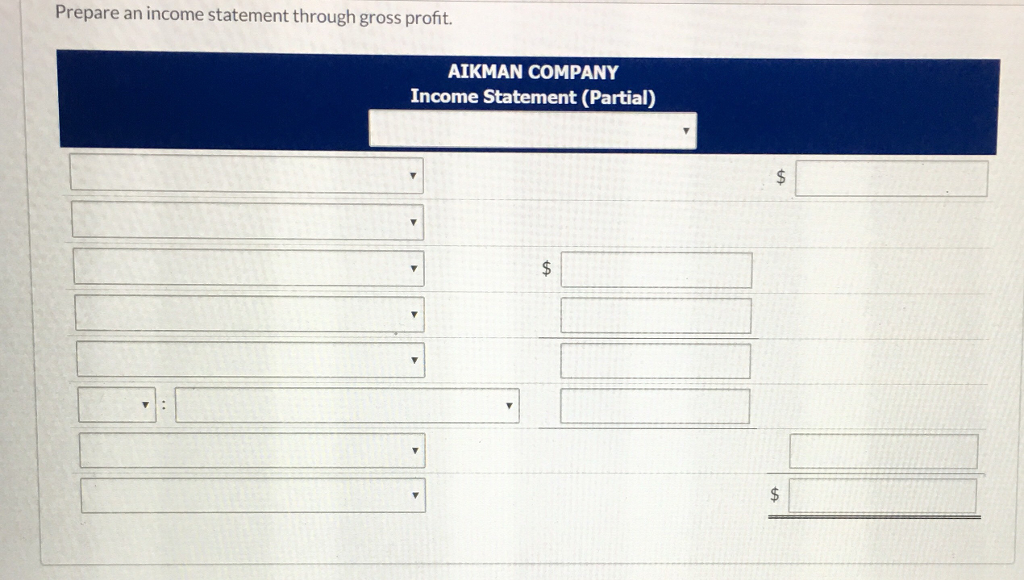

Complete the partial income statement if the company. Round to the nearest dollar income statement year ending 2017 data table sales revenue cost of goods sold fixed costs selling general and administrative expenses depreciation 359 000 135 000. Complete the income statement below. Round to the nearest dollar. Round to the nearest dollar.

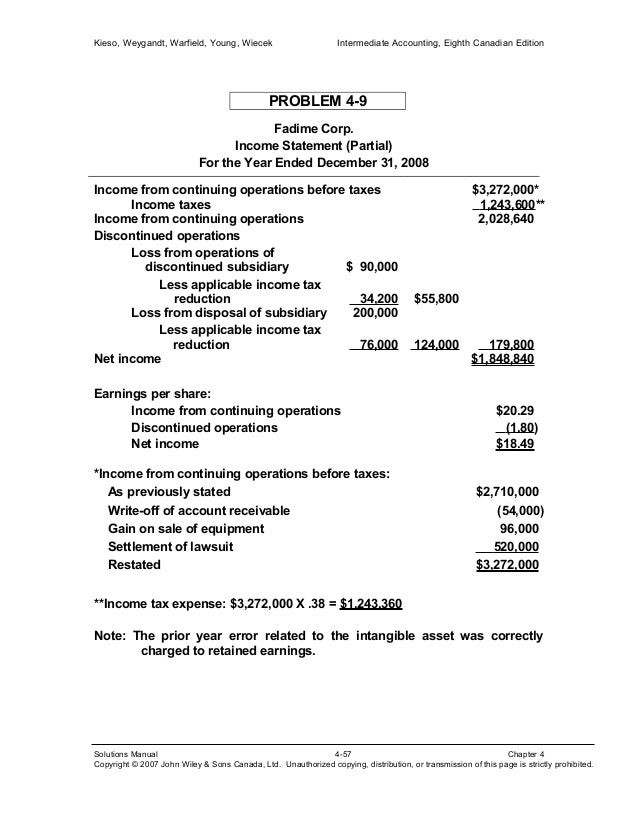

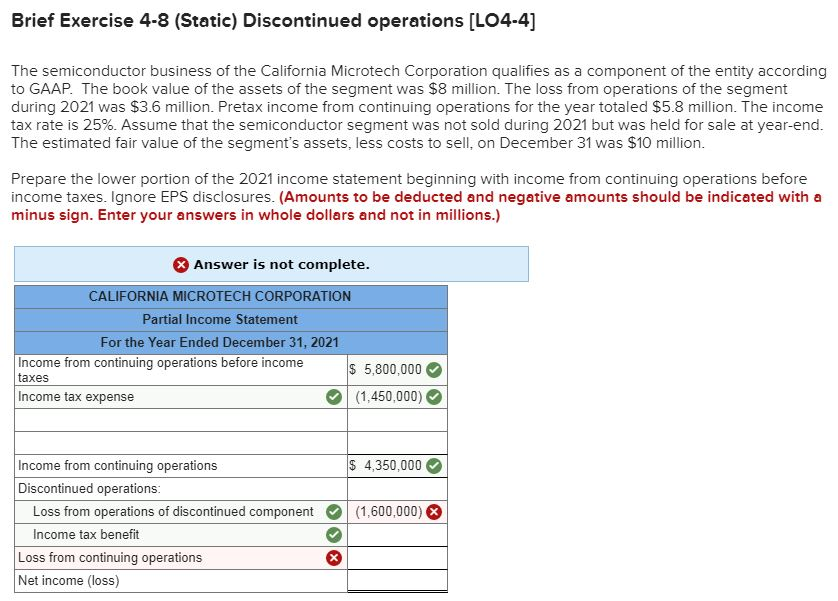

Answer income statement for the year ending 12 31 2014 sales revenue 350 000 cogs 140 000 fixed costs 43 000 sg a expenses 28 000 depreciation 46 000 ebit 93 000 interest expense. Complete the partial income statement if the company paid interest expense of 17 800 for 2017 and had an overall tax rate of 40 for 2017. Answer income statement for the year ending 12 31 2011 sales revenue 350 000 cogs 140 000 fixed costs 43 000 sg a expenses 28 000 depreciation 46 000 ebit 93 000 interest expense 18 000 taxable. For example a company may have acquired another business in the middle of a month and so only needs the financial results of the acquiree for the remaining days of the accounting period for consolidation purposes.

Complete the income statement below. Complete the income statement below. Complete the partial income statement if the company paid interest expense of 18 000 for 2011 and had an overall tax rate of 40 for 2011. Complete the partial income statement if the company paid interest expense of 18 000 for 2014 and had an overall tax rate of 40 for 2014.

Complete the partial income statement if the company paid interest expense of 18 000 for 2011 and had an overall tax rate of 40 for 2011. Complete the partial income statement if the company paid interest expense of 18 300 for 2017 and had an overall tax rate of 40 for 2017. Use the data from the following financial statement in the popup window b. Solution set for sept 10 problem set problems 7 14 chapter 2 7.

Complete the income statement below. A partial income statement reports information for only part of a normal accounting period this tends to be a special purpose document that is only used once. Round to the nearest dollar. Income statement year ending 2011 sales revenue 350 000 00 cogs.

Complete the partial income statement if the company paid interest expense of 17 800 for 2017 and had an overall tax rate of 40 for 2017. Complete the partial income statement if the company paid interest expense of 18 900 for 2017 and had an overall tax rate of 40 for 2017. Use the data from the following financial statement in the popup window interest expense of 18 800 for 2017 and had an overall tax rate of 40 for 2017.