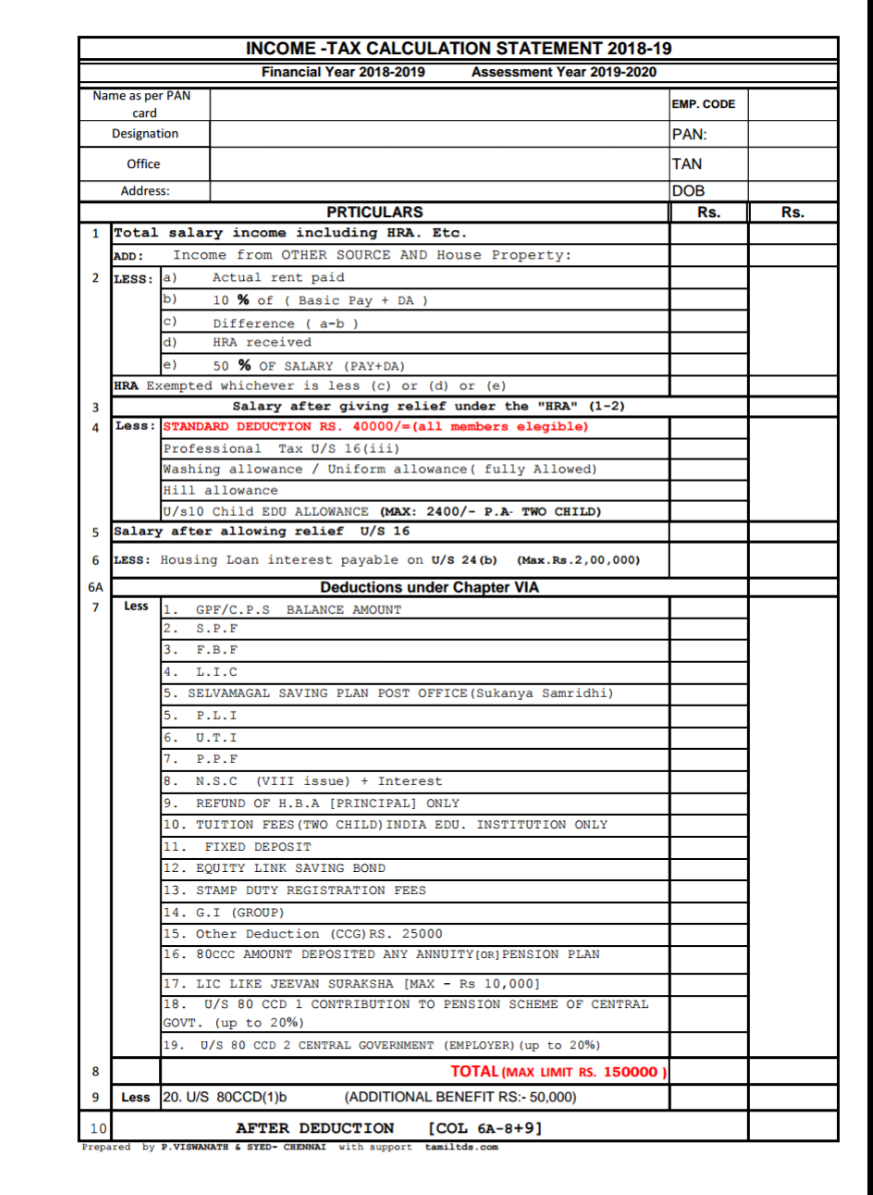

Income Tax Calculation Statement Form Assessment Year 2019 20

Senior citizens are eligible for standard deduction of 40 000 under section 16 i of the income tax act 1961.

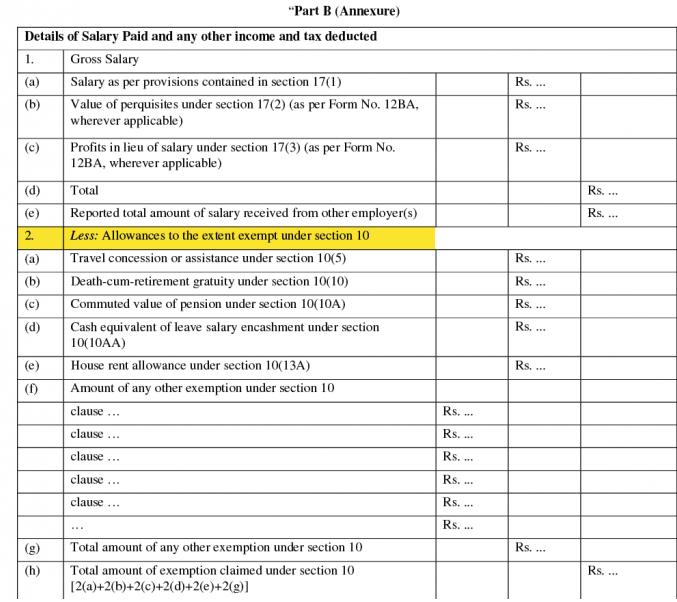

Income tax calculation statement form assessment year 2019 20. P an particulars of salary etc. To be furnished by the employees officers whose income exceeds rs. Salary for march 2019 to february 2020 give full details in a enclosed statement 2. Both of these tools are meant for income tax calculation for the year 2019 20 ay 2020 21 taking in to account all the changes made in income tax for salaried class in the budget 2019 20.

Central university of haryana income tax calculation form for financial year 2019 20 emp no. Tuition fee reimbursement other supplementary income including. Individual email id 1. The surcharge on income tax is increased in the present finance bill.

Gconnect income tax calculator 2019 20 ay 2020 21 with save option gconnect income tax calculator 2019 20 ay 2020 21 instant version. Income tax statement for the financial year 2019 20 assessment year 2020 2021 name of employee. Male female date of birth. 2020 21 name designation permanent account no.

2 50 000 1 a gross salary income includes salary da hra cca interim relief ot allowance deputation allowance medical allowance etc march 2019. Know about how to use the calculator by clicking the link of youtube video. Income tax calculation sheet for the financial year 2019 20 ay 2020 21 automated salary tax calculator along 15 other features april 4 2019 january 4 2020 payrollexperts 80c deductions 80ddb excel vba dashboard gratuity house rent allowance hra human resource hr income tax tds payroll provident fund pf. Surcharge on income tax.

Download tds calculator in excel format for salary for assessment year 2019 20 ay 2019 20 or financial year 2018 19 fy 2018 2019 also useful for computing income tax simple excel calculator. Assessment year.