Social Security Withholding Income Limit 2020

Only the social security tax has a wage base limit.

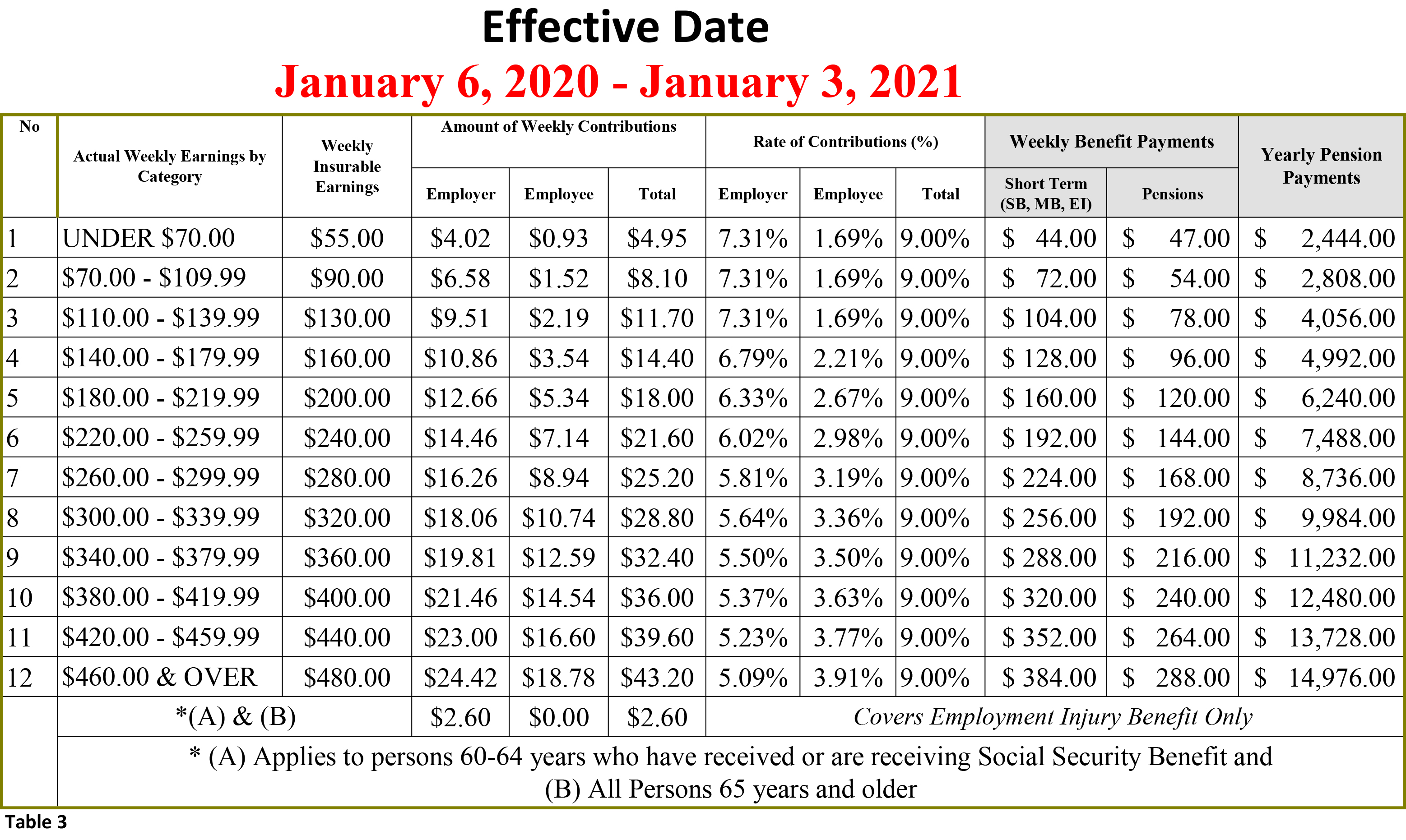

Social security withholding income limit 2020. If you need more information about tax withholding read irs publication 554 tax guide for seniors and publication 915 social security and equivalent railroad retirement benefits. 2020 social security and medicare tax withholding rates and limits. This is the maximum social security tax for 2020. There is no limit on covered self employment income that will be subject to the medicare tax.

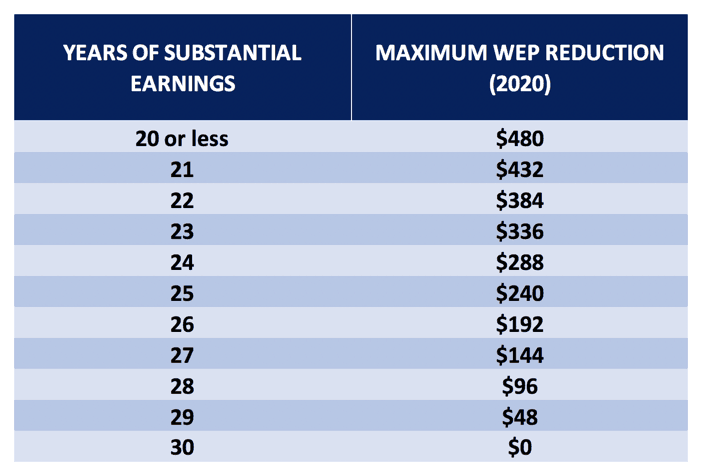

You aren t required to pay the social security tax on any income beyond the social security wage base. The self employment tax rate will be 15 3 combined social security tax rate of 12 4 and medicare tax rate of 2 9 up to the social security wage base. The social security portion oasdi is 6 20 on earnings up to the applicable taxable maximum amount see below. The social security maximum taxable income for 2020 is 137 700.

The social security tax rate remains at 6 2 percent. The resulting maximum social security tax for 2020 is 8 537 40. The wage base limit is the maximum wage that s subject to the tax for that year. The 7 65 tax rate is the combined rate for social security and medicare.

The wage base limit helps determine the maximum amount to social security tax to be withheld. That s because the employee. For people attaining nra in 2020 the. In 2021 this limit is 142 800 up from the 2020 limit of 137 700.

The social security wage base for self employed individuals in 2020 will also be 137 700. Also a s of january 2013 individuals with earned income of more than. The medicare portion hi is 1 45 on all earnings. The wage base limit is the annual limit on the wages earned for which the social security tax is paid.

For people attaining normal or full retirement age nra after 2020 the annual exempt amount in 2020 is 18 240. Social security explains it this way. Or publication 51 for agricultural employers. This maximum includes both employee wages and income from self employment.

The maximum social security tax you could owe in 2020 is 8 537 40 for employees and 17 074 80 for those who are self employed. As a result in 2021 you ll pay no more than 8 853 60 142 800 x 6 2 in social security taxes. If you have questions about your tax liability or want to request a form w 4v you can also call the irs at 1 800 829 3676. There is no maximum taxable income for medicare withholding.

This wage base limit will change every year. It is set on a yearly basis and adjusted based on the change in wage growth. The social security maximum taxable income for 2021 is 142 800.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png)