Income Statements And Balance Sheets Are Normally Based On What Method Of Accounting

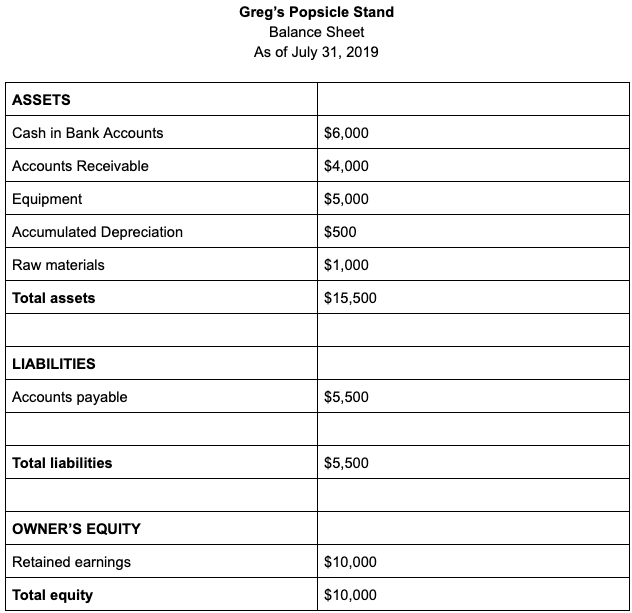

A balance sheet lists assets and liabilities of the organization as of a specific moment in time i e.

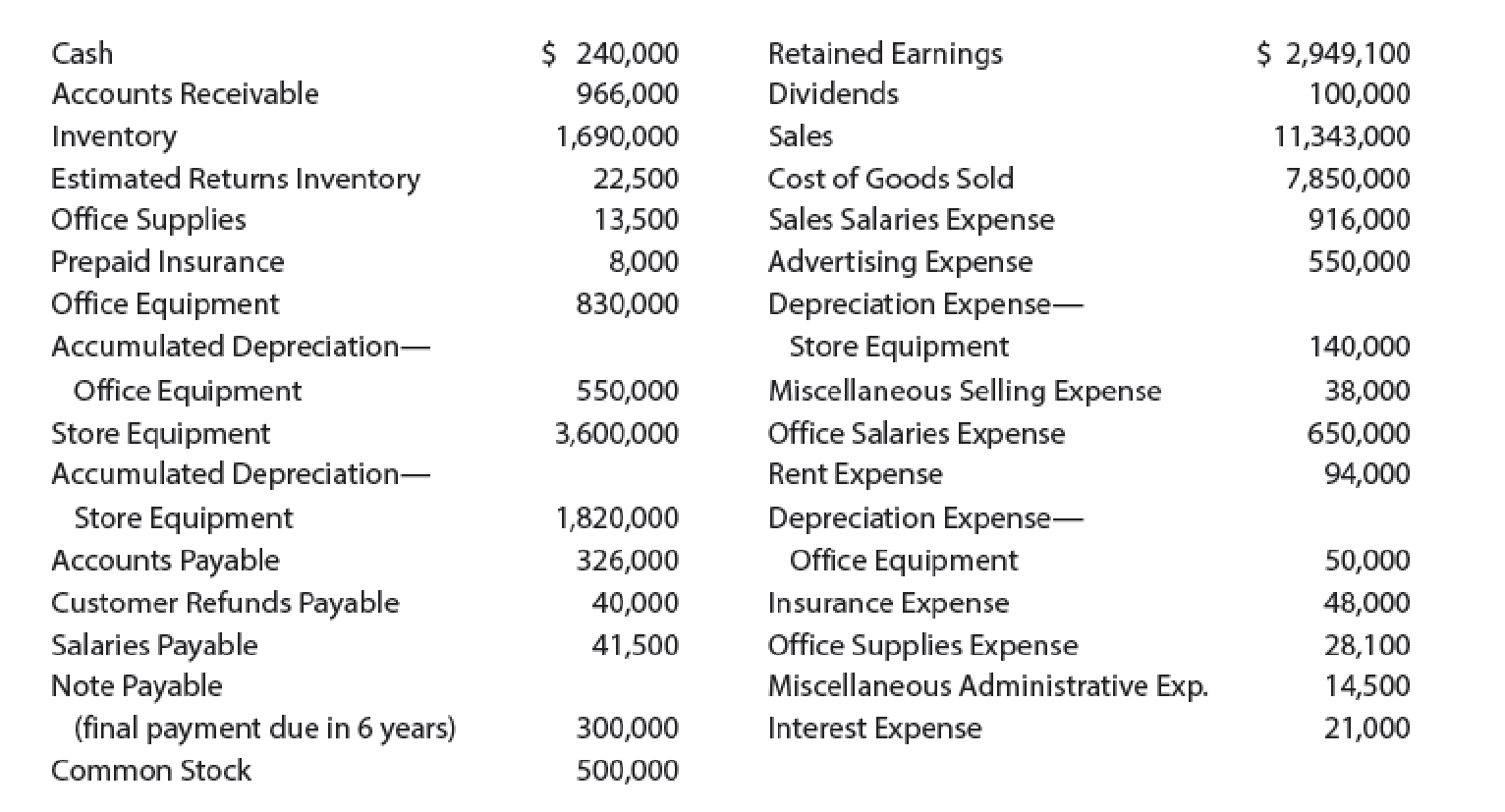

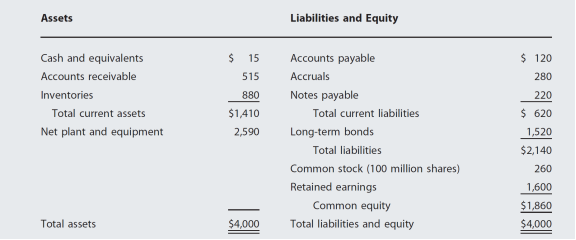

Income statements and balance sheets are normally based on what method of accounting. A sale increases an asset or decreases a liability and an expense decreases an asset or increases a liability. In financial accounting the balance sheet and income statement are the two most important types of financial statements others being cash flow statement and the statement of retained earnings. The income statement totals the debits and credits to determine net income before taxes the income statement can be run at any time during the fiscal year to show a company s profitability. Profit loss on sale of property plant and equipment intangible assets financial assets.

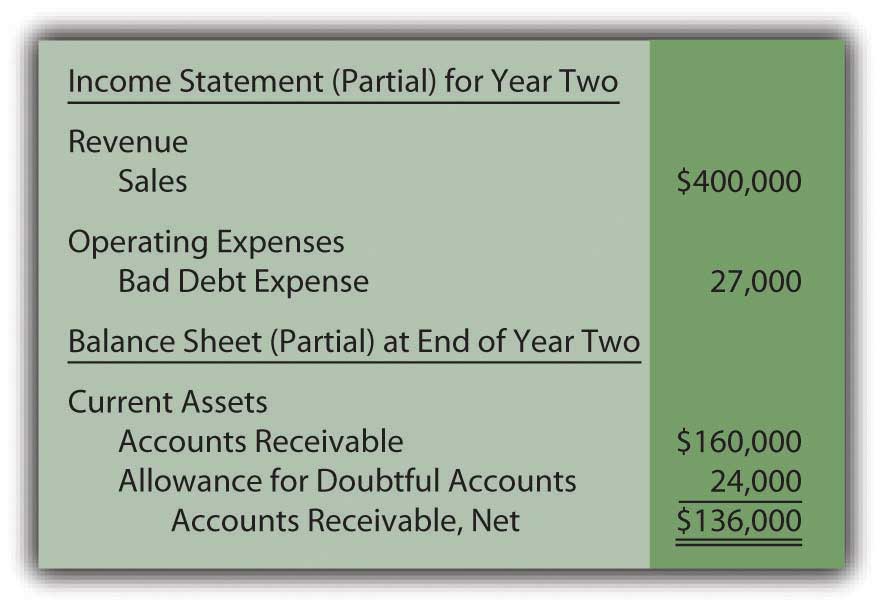

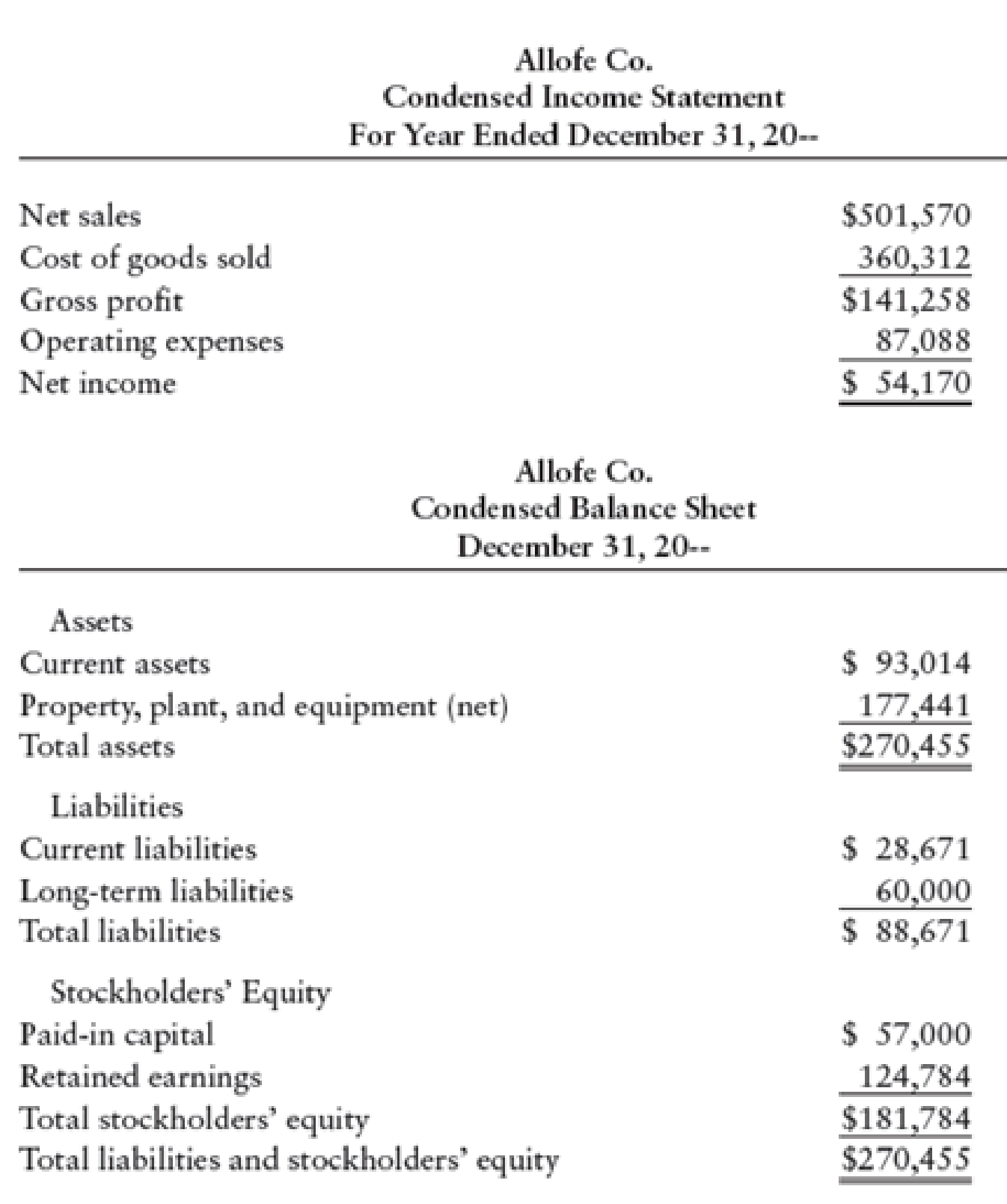

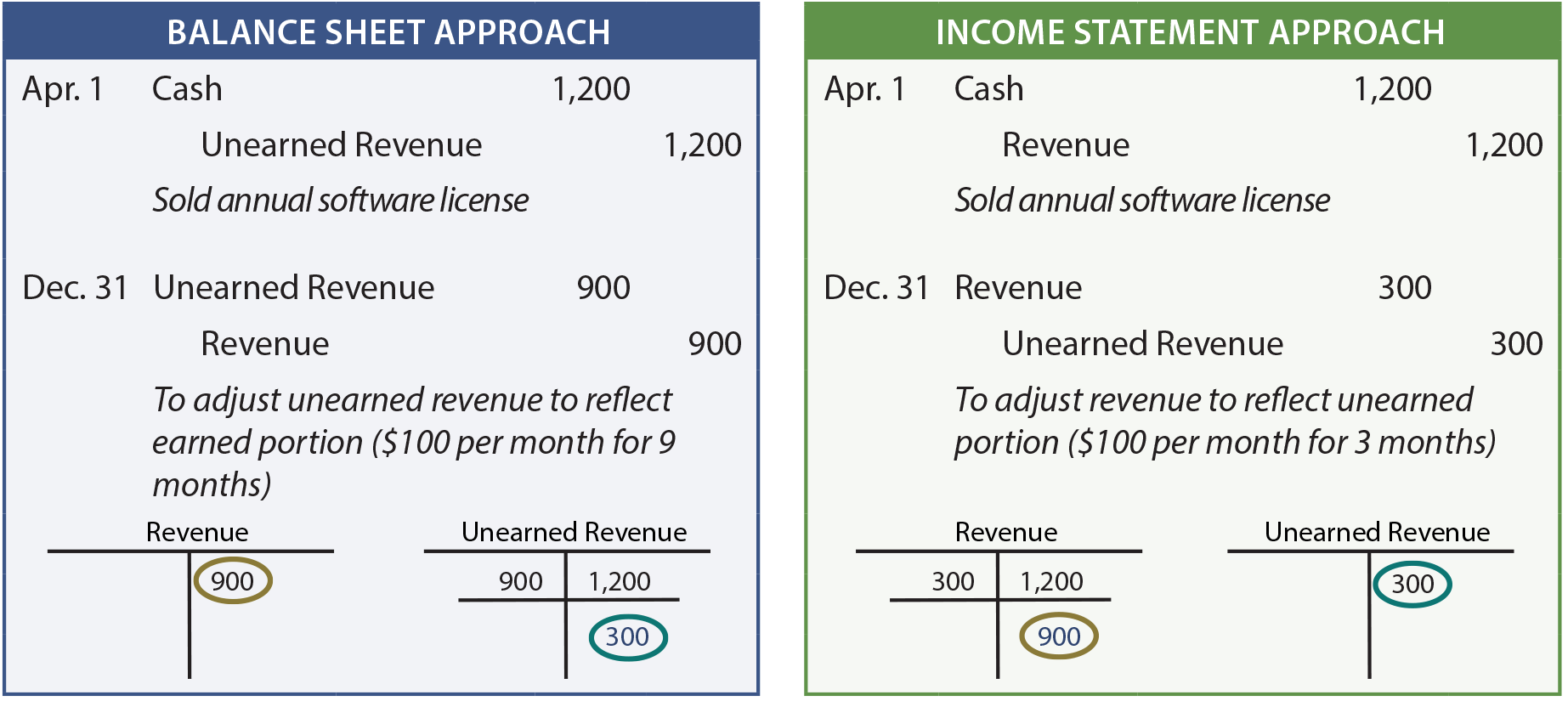

Income statements show how much profit a business generated during a specific reporting period and the amount of expenses incurred while earning revenue. The balance sheet method estimates bad debt based on a percentage of outstanding accounts receivable. Therefore one side of every sales and expense entry is in. Here is an example of how to prepare an income statement from paul s adjusted trial balance in our earlier accounting cycle examples.

As of a certain date. The balance sheet displays the company s total assets and how these assets are financed through either debt or equity. When an accountant records a sale or expense entry using double entry accounting he or she sees the interconnections between the income statement and balance sheet. When an entity prepares consolidated financial statements under equity method accounting of associates its share of profit is accounted for as income.

Bad debt expense increases debit and allowance for doubtful accounts increases credit for the amount estimated as uncollectible. As you can see this example income statement is a single step statement because it only lists expenses in one main category. An income statement also called a profit and loss account or p l. The income statement method estimates bad debt based on a percentage of credit sales.

Single step income statement. The balance sheet discusses leverage assets funding and other aspects of the organization s existing infrastructure. Compared to the balance sheet and the cash flow statement the income statement is primarily focused on the actual operational efficiency of the organization. The cash flow statement is primarily a description of liquidity.

The income statement also called a profit and loss statement is one of the major financial statements issued by businesses along with the balance sheet and cash flow statement. The income statement or profit and loss report is the easiest to understand it lists only the income and expense accounts and their balances. Income statement and balance sheet overview. An income statement is one of the three along with balance sheet and statement of cash flows major financial statements that reports a company s financial performance over a specific accounting.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)