Current Us Income Tax Rates

20 797 plus 37c for each 1 over 90 000.

Current us income tax rates. The 2020 federal income tax brackets on ordinary income. Which federal income tax bracket are you in. Instead 37 is your top marginal tax rate. 10 tax rate up to 9 875 for singles up to 19 750 for joint filers 12 tax rate up to 40 125.

If you re one of the lucky few to earn enough to fall into the 37 bracket that doesn t mean that the entirety of your taxable income will be subject to a 37 tax. Your tax free personal allowance the standard personal allowance is 12 500 which is the amount of income you do not have to pay tax on. For tax year 2020 the 28 tax rate applies to taxpayers with taxable incomes above usd 197 900 usd 98 950 for married individuals filing separately. Tax on this income.

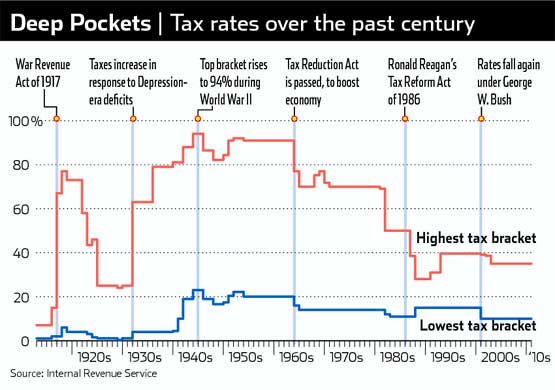

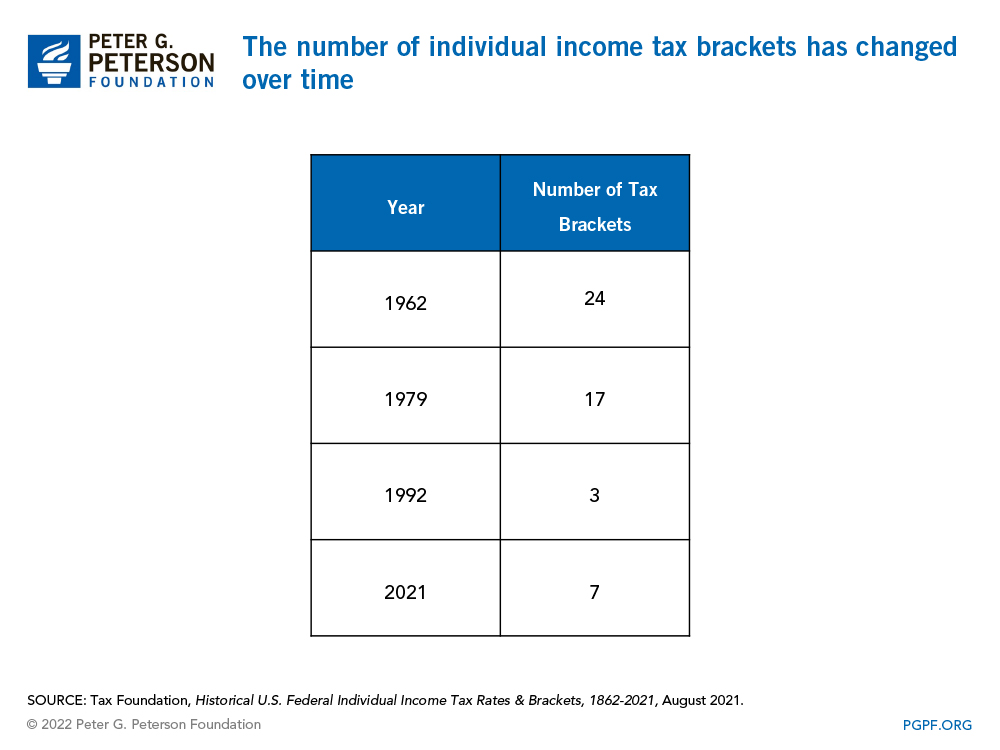

Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. 54 097 plus 45c for each 1 over 180 000. See how tax brackets work how to cut your tax.

19c for each 1 over 18 200. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510 300 and higher for single filers and 612 350 and higher for married couples filing jointly. Resident tax rates 2019 20. The current tax year is from 6 april 2020 to 5 april 2021.

There are seven income tax brackets ranging from 10 to 37. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. For tax year 2019 the 28 tax rate applies to taxpayers with taxable incomes above usd 194 800 usd 97 400 for married individuals filing separately. There are seven tax brackets for most ordinary income.

The bracket you land in depends on a variety of factors ranging from your total income your total adjusted income filing jointly or as an individual dependents deductions credits and so on.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

/TaxPolicy.Paul.4.2.1_-_figure_1-512c20575f6b4bc6bf23ef34dee0f9c4.png)