Income Statement Shows The Earnings

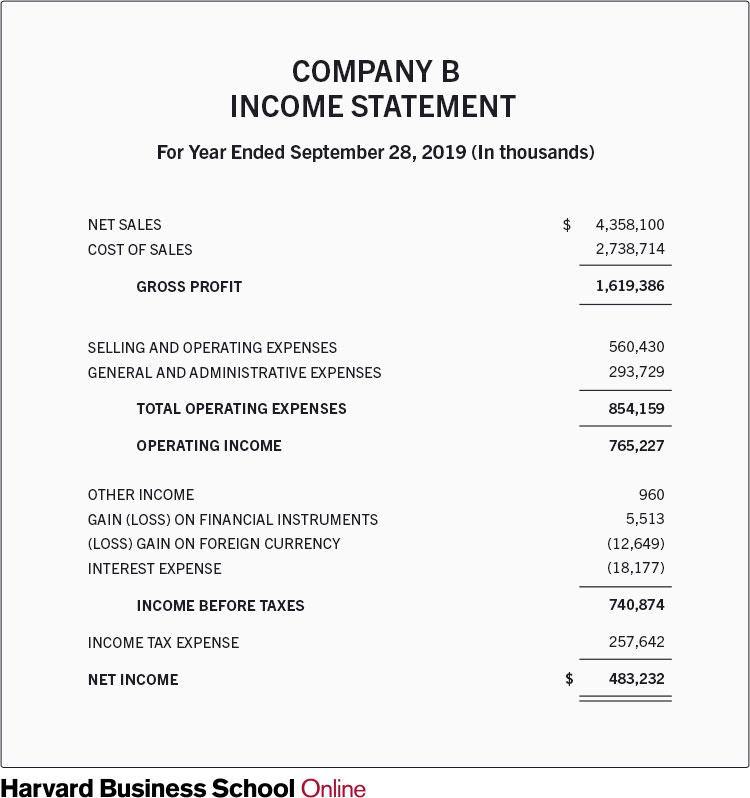

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting.

Income statement shows the earnings. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. Stocks are generally valued on earnings. The earnings figure is listed as net income on the income statement. When investors refer to a company s earnings they re typically referring to net income or the profit for the period.

Eps shows how much money shareholders would receive if all of the net earnings for the period were distributed. Income expenses and retained earnings question q. The income statement shows the revenue expenses and net income for a company over a period of time. The earnings are reported on the income statement the first financial statement most investment professionals look at.

They re usually reinvested income statements are set up stepwise. Often the first place an investor or analyst will look is the income statement. In accounting the. A month or a year.

The income statement shows the performance of the business throughout each period displaying sales revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. The statement of retained earnings also called statement of owners equity shows the change in retained earnings between the beginning and end of a period e g. The income statement also called the profit and loss statement is a report that shows the income expenses and resulting profits or losses of a company during a specific time period. A highly unlikely occurrence.

Net income before taxes is also referred to as earnings or profit. The next section titled income from continuing operations adds net other income or expenses like one time earnings interest linked expenses and applicable taxes to arrive at the net. Andersen s nursery has sales of 318 400 cost of 199 400 depreciation expense of 28 600 interest expense of 1 000 and a tax rate of 34. The income statement can be run at any time during the fiscal year to show a company s profitability.

The income statement totals the debits and credits to determine net income before taxes. The income statement s primary purpose is to show the financial performance of a business. Income and expense accounts are yearly or temporary accounts. The income statement can either be prepared in report format or account format.

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)