Yield Or Income Valuation Method

Fair earnings yield is 15 20x4 20x5 20x6 20x7 earnings 450 000 480 000 550 000 630 000 company b.

Yield or income valuation method. Capital value 2 5 million. For example in properties with unstable income flows the yield capitalization method is most appropriate. The illegal practice of underwriters marking up the prices on bonds for the purpose of reducing the yield on the bond. For businesses that are still at the development stage projected revenue or earnings are used as the basis of.

Fair earnings yield is 13. Property and income tax obligations. Covenant strength its effect on property yield. Direct capitalization has nothing to do with anticipated resale value income in the future inflation or anything else that takes place outside the scope of the first year.

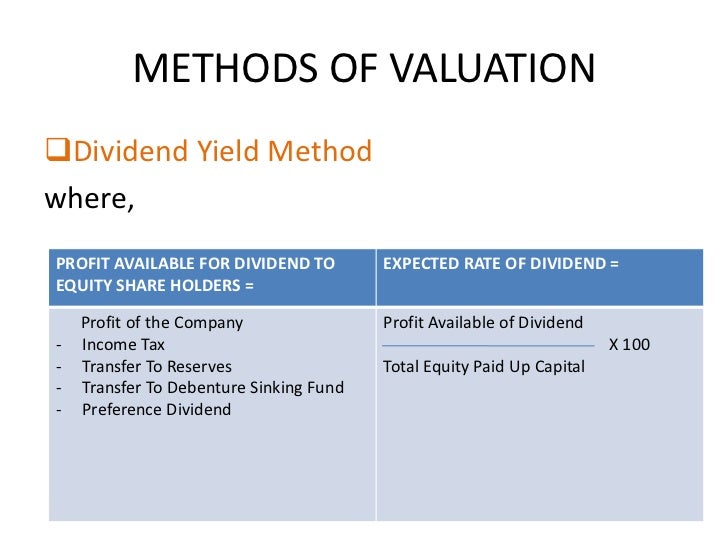

2 yield or earning capacity valuation or income method. This practice referred to as burning the yield is done. It s calculated by dividing the net operating income by the capitalization. Direct and yield capitalization methods are the two most popular methods used in real estate valuation.

This number is then multiplied by a financial metric to yield enterprise value. Otherwise market value of share is less than the paid up value. Business valuation asset based methods. To reiterate consider that the method of direct capitalization gives you the relation between a single year s income year 1 and the value sales price of the property.

Many future factors can affect. Annual rental income 150 000. The logic follows that if company x trades at a 10 times p e ratio and company y has earnings of 2 50 per. In this method the valuation of share is done by comparing expected rate of return with normal rate of return.

Comps are the most widely used approach as they are easy to calculate and always current. However the two methods are used in different instances depending on the situation. This equity valuation method is used for a target business with an identifiable stream of revenue or earnings which can be maintained by the business. Capital value annual rental income yield x 100.

The comps valuation method provides an observable value for the business based on what other comparable companies are currently worth. Environmental compliance costs. Yield capitalization is used in the valuation of income producing real property to assess the future value of a property taking into account future circumstances. The income approach is a real estate valuation method that uses the income the property generates to estimate fair value.

Calculating the property capital value.

:max_bytes(150000):strip_icc()/market-value-69e5d658792841c3baabe0d0d23c2dcc.jpg)