Deferred Income Tax Financial Statement Presentation

This article will start by considering aspects of deferred tax that are relevant to paper f7 before moving on to the more complicated situations that may be tested in paper p2.

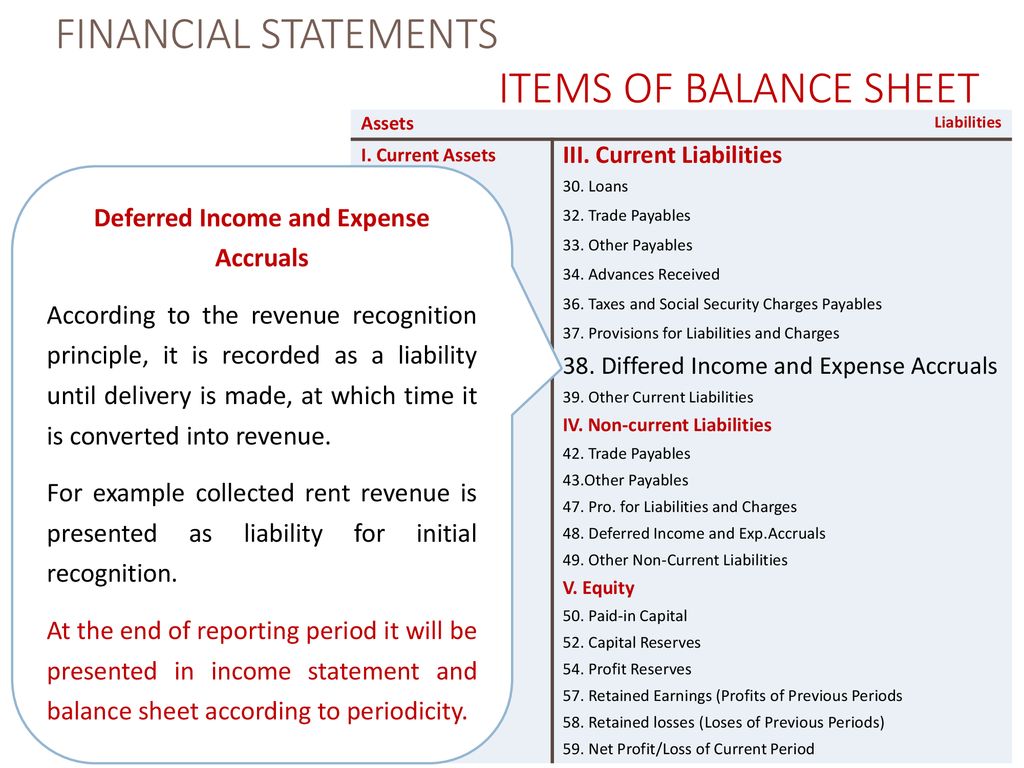

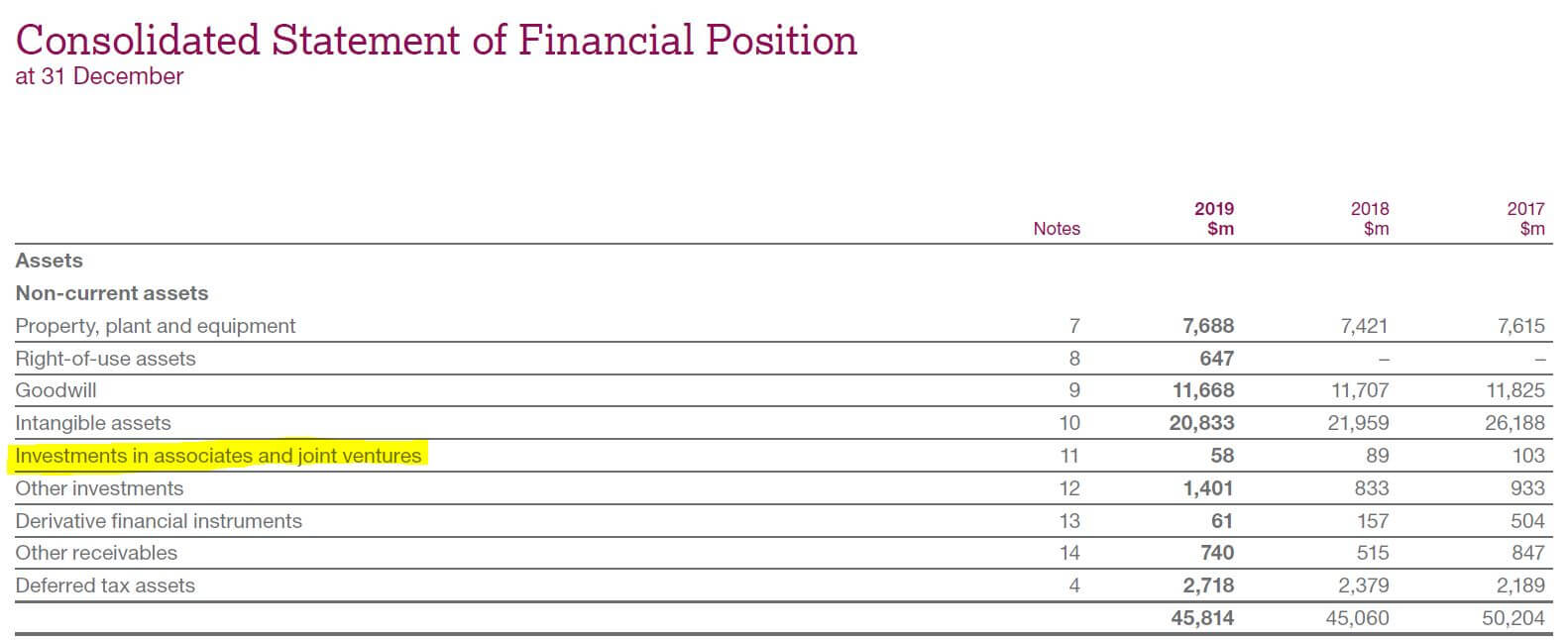

Deferred income tax financial statement presentation. Deferred income tax shows up as a liability on the. Deferred tax is a topic that is consistently tested in paper f7 financial reporting and is often tested in further detail in paper p2 corporate reporting. Our financial reporting guide financial statement presentation details the financial statement presentation and disclosure requirements for common balance sheet and income statement accounts it also discusses the appropriate classification of transactions in the statement of cash flows and addresses the requirements related to the statements of stockholders equity and other comprehensive. The amount of the deferred tax assets and liabilities recognised in the statement of financial position for each period presented.

A statement of cash flow is part of the annual financial statements that are presented by an entity along with the statement of financial position statement of comprehensive income and statement of changes in equity. It represents the net cash flow cash generated less cash spent of an entity during a specific period i e. Deferred tax assets may be presented as current assets if a temporary difference between accounting income and taxable income is reconciled the following year. A month a quarter or year which is arrived at by.

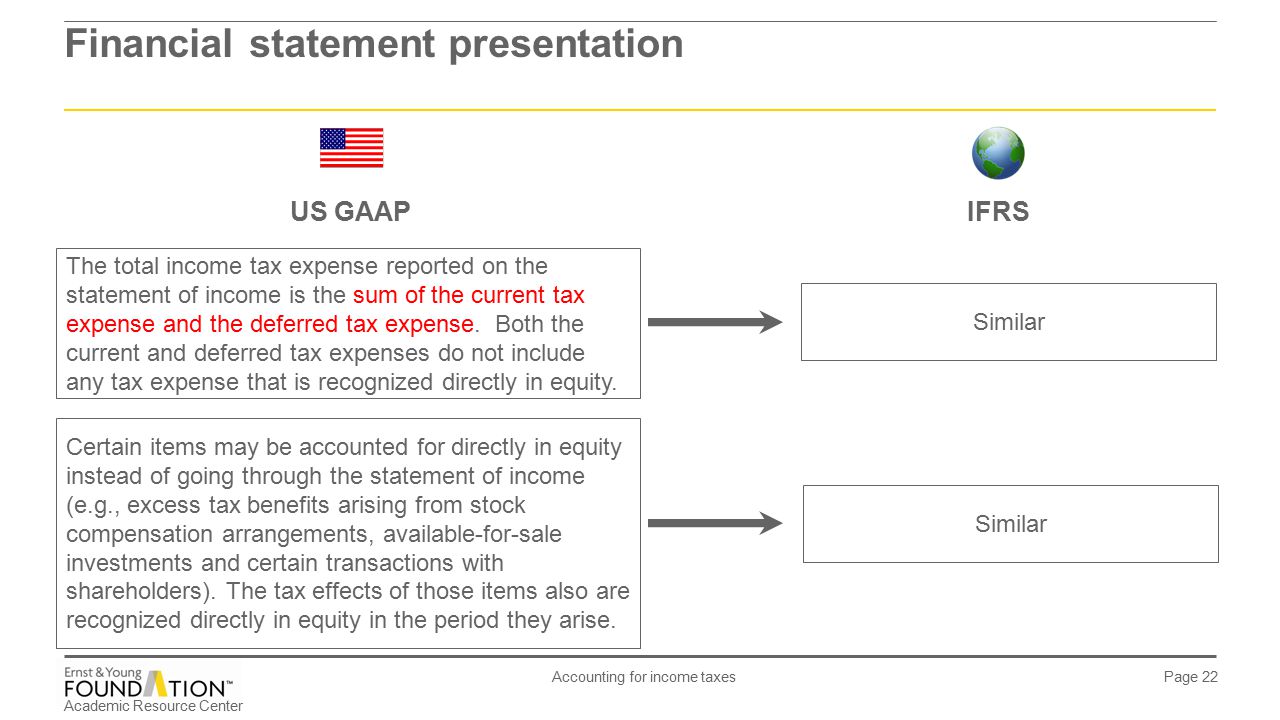

The larger income tax payable on tax returns creates a deferred tax asset which companies can use to pay for deferred income tax expense in the future. Question 1 describe the presentation of deferred tax in the financial statements in accordance with mfrs 112 income taxes. Presentation disclosure chapter summary revised june 2015 asc 740 not only provides guidance on the calculation of income tax expense but also includes requirements for the presentation in the financial statements of the tax provision uncertain tax positions and deferred tax assets and liabilities. The standard applies to all organizations that present a classified balance sheet.

Deferred income tax is a result of the difference in income recognition between tax laws i e the irs and accounting methods i e gaap. The amount of the deferred tax income or expense recognised in profit or loss if this is not apparent from the changes in the amounts recognised in the statement of financial position. Mfrs 112 income tax requires entities to compute deferred taxes based on financial position generally referred to as the liability method or balance sheet liability method. A discussion on how to present deferred tax amounts on the balance shee and the income statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)