Income Tax Brackets 2020 New York

New york s income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016.

Income tax brackets 2020 new york. We revised the 2020 new york state personal income tax rate schedules to reflect certain income tax rate reductions enacted under the tax law. 2020 tax year new york income tax forms. Fourteen states including new york allow local governments to collect an income tax. The new york city school tax credit is available to new york city residents or part year residents who can t be claimed as dependents on another taxpayer s federal income tax return.

31 2020 can be e filed in conjunction with a irs income tax return. 2020 new york tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Each marginal rate only applies to earnings within the applicable marginal tax bracket. The exemption for the 2019 tax year is 5 74 million which means that any bequeathed estate valued below that amount is not taxable.

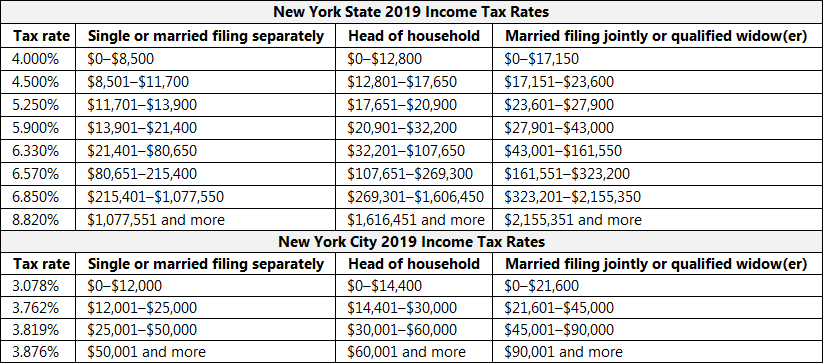

New york has eight marginal tax brackets ranging from 4 the lowest new york tax bracket to 8 82 the highest new york tax bracket. New york state income tax rate table for the 2019 2020 filing season has eight income tax brackets with ny tax rates of 4 4 5 5 25 5 9 6 21 6 49 6 85 and 8 82. A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. The ny tax forms are below.

Withholding tax rate changes nys and yonkers withholding tax changes effective january 1 2020. We also updated the new york state and yonkers resident withholding tax tables and methods for 2020. What is a local income tax. New york s estate tax is based on a graduated rate scale with tax rates increasing from 5 to 16 as the value of the estate grows.

Detailed new york state income tax rates and brackets are available on this page. For 2020 the exemption will rise to 5 85 million. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. New york state income tax forms for tax year 2020 jan.

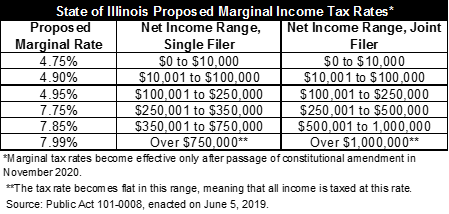

While the federal income tax and the new york income tax are progressive income taxes with multiple tax brackets all local income taxes are flat rate. New york estate tax. W2 1099 1095 software. Details on how to only prepare and print a new york 2020 tax return.

Product download purchase support deals online cart. You can take a refundable credit of 125 if you re married file a joint return and have income of 250 000 or less.