Income Tax Rates Geneva

I wealth tax.

Income tax rates geneva. 2 tax 2019 geneva ernst young ltd table of contents tax 2019 individuals 4 1 income 5 1 1 rates 5 1 2 coeffi cients 7 1 3 privileged portion for the commune 8 1 4 deductions 9 1 5 sample calculations 11 1 6 source tax 13 2 wealth 15 3 interest rates on debts and tax liabilities 17 4 social security and occupational pension provision 18. During the duration of the plan no wealth tax is due and income is excluded from tax. The federal tax rate of 8 5 is levied on net income since income and capital taxes are deductible in determining taxable income the effective tax rate etr is 7 8. Foreign employees residing in switzerland whose gross salary exceeds chf 120 000 per year chf 500 000 in the republic and canton of geneva are obliged to file a tax return for their worldwide income and assets.

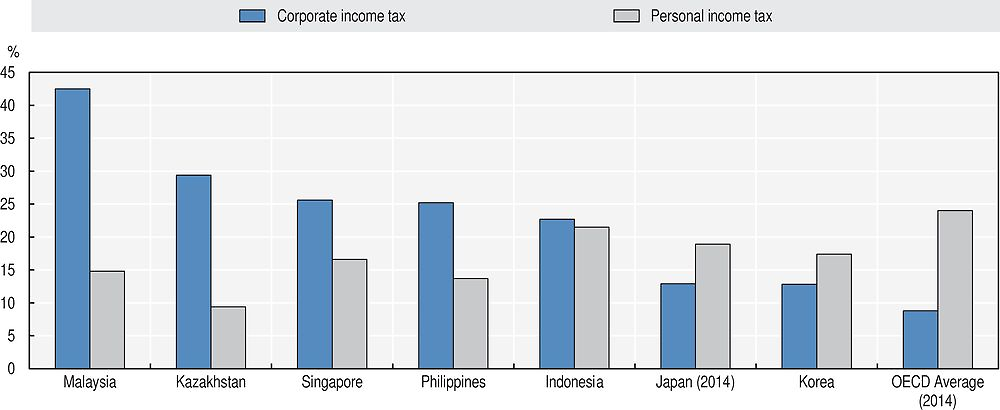

The personal income tax rate in switzerland stands at 40 percent. Rate tax is imposed at the federal and cantonal communal levels. This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 13 7 and your marginal tax rate is 22 9.

High income earners tax assessment. The tax rate applicable to single widowed divorced or separated individuals living with a dependant child or adult is the rate applicable to 50 of the income. Taking into account both the federal and the cantonal communal income tax the. The tax rate applicable to a married couple or individuals in a swiss registered partnership is the rate applicable to 50 of their combined income so called splitting.

You will find other information on the tax forum in french speaking switzerland very useful for tax questions in geneva and also on the hôtel des finances website. For church tax the basic tax above is multiplied by the church tax factor which is between 0 06 and 0 15. Switzerland has one of the lowest income taxes in the world charging a maximum income tax of 13 20. The tax withheld from salary is credited interest free against the assessed tax.

The cantons are free to decide on their own tax rates. Personal income tax rate in switzerland averaged 40 09 percent from 2004 until 2020 reaching an all time high of 40 40 percent in 2005 and a record low of 40 percent in 2008. For instance an increase of chf 100 in your salary will be taxed chf 22 88 hence your net pay will only increase by chf 77 12. This page provides switzerland personal income tax rate actual values historical data forecast chart statistics economic calendar and news.

For the additional municipal taxes the above rate has to be multiplied by the respective municipal tax factor which varies between 0 76 and 1 34 city of zurich. This means that the tax laws and tax rates vary widely from canton to canton.