Income Tax Definition Apush

The companies relented the president appointed an independent commission from which the.

Income tax definition apush. Instead of using the standard deduction you can take individual deductions. Taxes in the u s. Ap us history ch 29 31. The amendment states that the congress shall have power to lay and collect taxes on incomes from whatever source derived without apportionment among the several states and without regard to any census or enumeration.

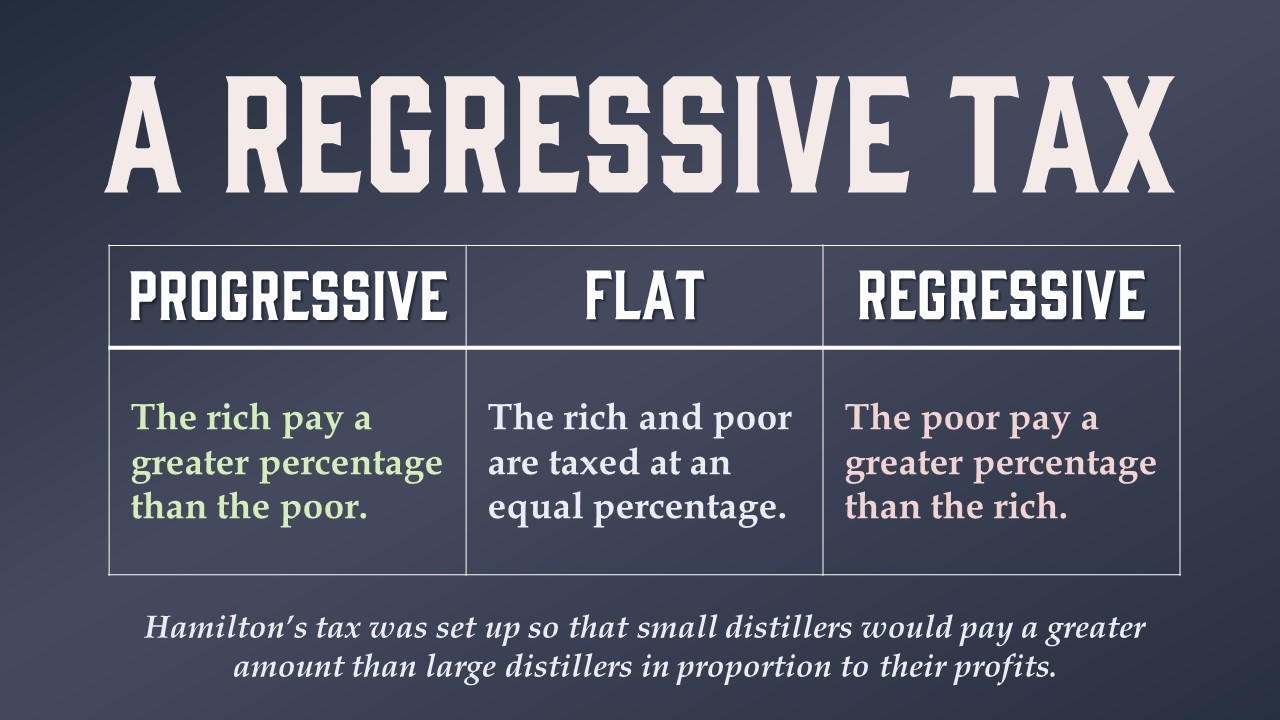

Quizlet flashcards activities and games help you improve your grades. Tax based on the net income of an individual or business and which taxes different income levels at different rates levy the act of drafting into military service a charge set in place or collected. American pageant 14th ed. Represents the half of the republicans the progressives nominated tr called bull moose because tr said he felt as strong as a bull moose which then became the unofficial progressive symbol.

It was a progressive tax that took up to 75 percent of the highest incomes over 1 million per year. Tax systems vary widely among nations and it is important for individuals and corporations to carefully study a new locale s tax laws before earning income or doing business there. 30 1935 raised federal income tax on higher income levels by introducing the wealth tax. A coal shortage in the cold winter incited roosevelt to offer a conference at the white house.

A tax based on income with. Ap government and politics. The sixteenth amendment explicitly authorized congress to levy a tax on income. Miners strike for wage increases lower hours and walk off the job when demands are not met.

Key terms chapter 14 22 terms. A tax bracket is a range of income that determines what tax rate will be applied to your taxable income. When the companies refused to submit the issues to arbitration tr threatened to send troops to seize the mines. The individual income tax and social security tax are two major sources of the federal government s revenue.

The congress separately also passed new taxes that were regressive especially the social security tax. The revenue act of 1935 49 stat.