Us Korea Income Tax Treaty

However the treaty allows us expats to avoid double taxation on their income taxed in korea.

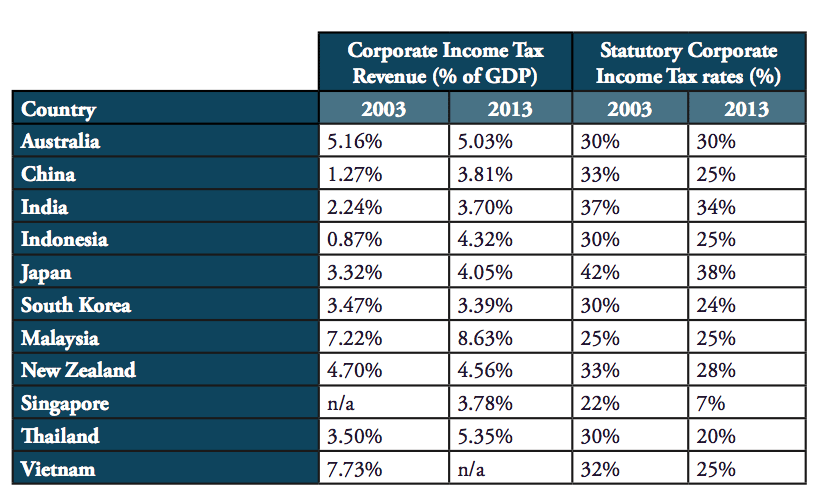

Us korea income tax treaty. However according to the tax treaty signed with some countries i e. The united states korea tax treaty covers double taxation with regards to income tax corporation tax and capital gains tax however a clause called savings clause in article 4 paragraph 4 states that the us can still tax its citizens living in korea as if the rest of the treaty didn t exist. Income taxes on certain income profit or gain from sources within the united states. The united states has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from u s.

If you have problems opening the pdf document or viewing pages download the latest version of adobe acrobat reader for further information on tax treaties refer also to the treasury department s tax treaty documents page. A in the case of the united states the federal income taxes imposed by the internal revenue code the united states tax and b in the case of korea the income tax and the corporation tax the korean tax. 2 the reduced tax rates for most tax treaties also include 10 of local income tax. Thus the treatment of income received by a partnership will be determined by the residence and taxation of its partners for united states tax purposes with respect to that income.

1 local income tax is included. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or. Copyright 2020 direktorat jenderal pajak. 62 21 525 0208.

Where a resident of indonesia derives income from korea and that income may be taxed in korea in accordance with the provisions of this agreement the amount of korean tax payable in respect of the income shall be allowed as a credit against the indonesian tax imposed on that resident. In case of residents salaries received outside of korea as well as those received within korea will be taxed in korea. Jalan gatot subroto kav. 2 this convention shall also apply to taxes substantially similar to those covered by paragraph 1.

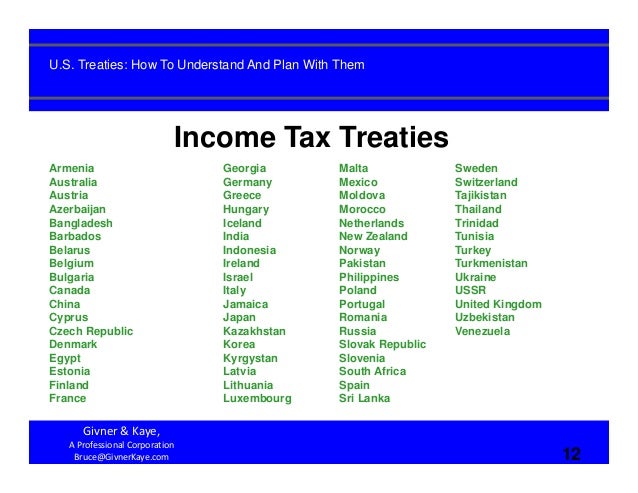

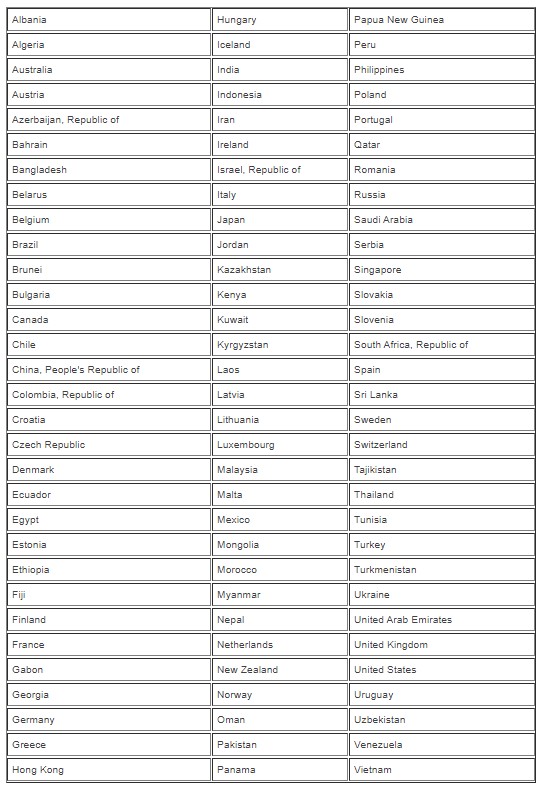

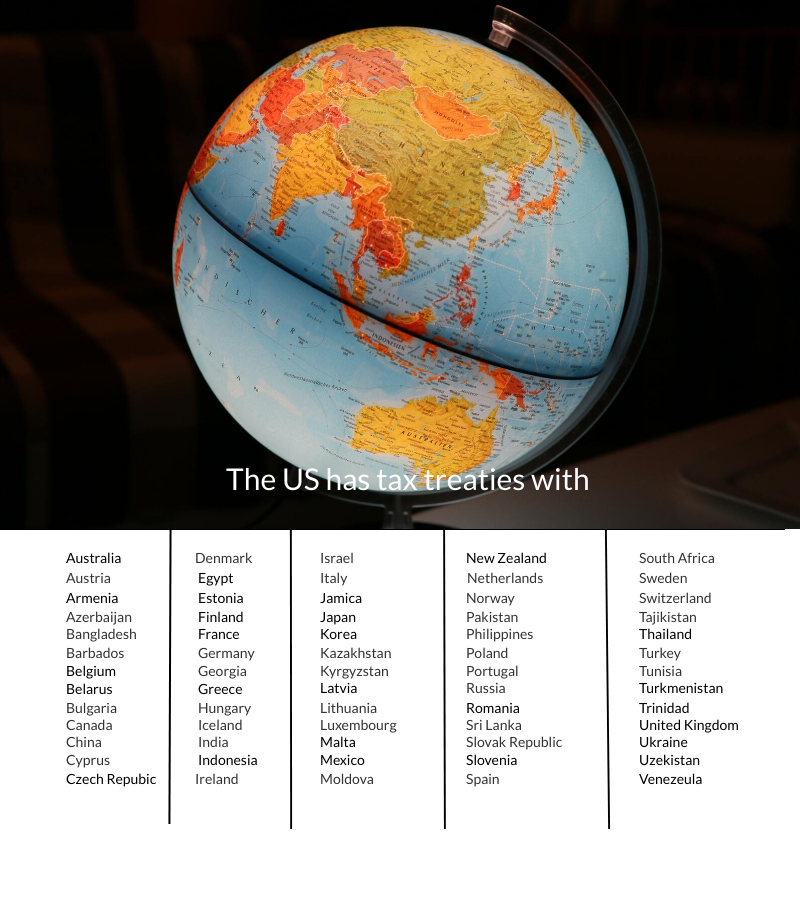

Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from u s. These reduced rates and exemptions vary among countries and specific items of income. The complete texts of the following tax treaty documents are available in adobe pdf format. The united states has tax treaties with a number of foreign countries.

Taxes on certain items of income they receive from sources within the united states. United states of america local income tax is not the subject of the tax treaty.