Foreign Income Worksheet Ato

Gross foreign source income.

Foreign income worksheet ato. It is always best to contact a top rated tax agent for advice on what needs to go on your return. Foreign income worksheet for cmn ato iitr 730359. You will need to report your worldwide income. If you ve paid foreign tax on employment income or capital gains in another country you may be entitled to an australian foreign income tax offset.

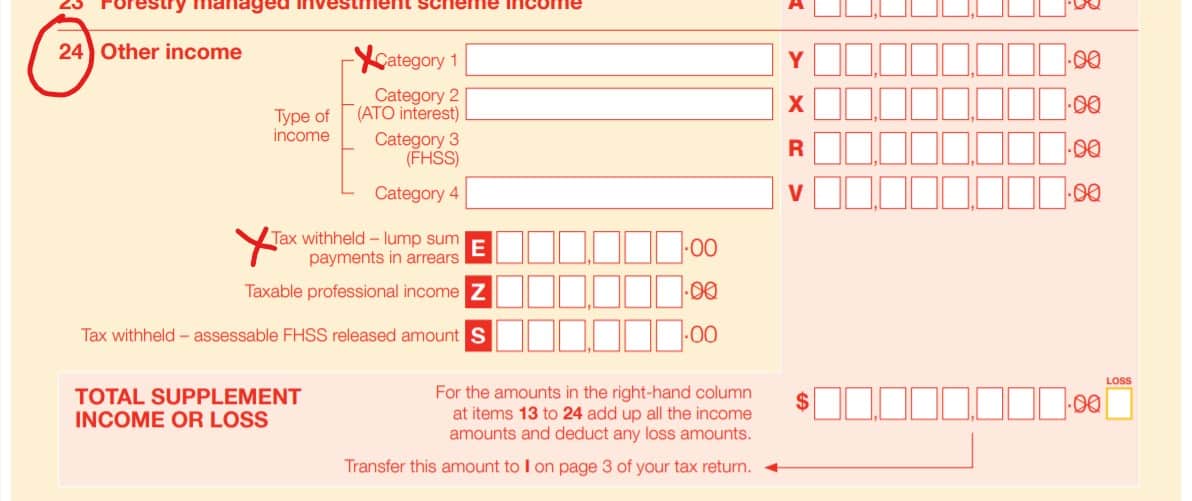

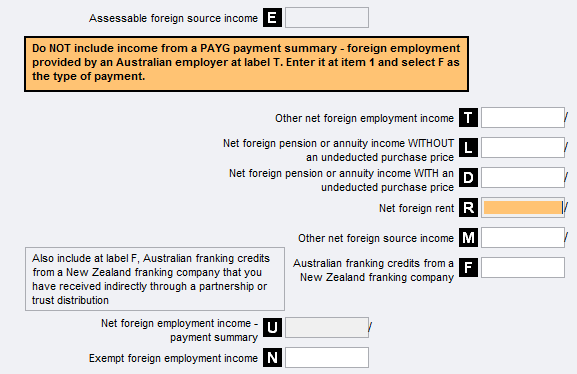

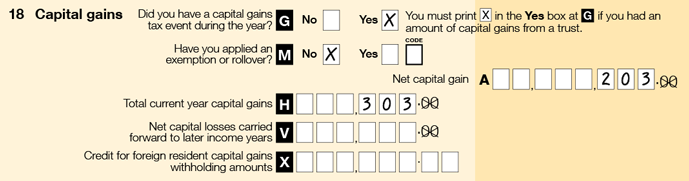

Overseas pensions annuities and salary income worksheet ove to complete labels t l d and n foreign rental property worksheet ref to complete label r foreign income worksheet for to complete labels m and f these three worksheets collect all the income and foreign tax paid and store it the summary. Guide to foreign income tax offset rules. Even if you have paid tax on the overseas income it must be reported to the ato. This can be completed through ato online services or through an australian registered tax agent.

23 other assessable foreign source income. See item 20 foreign source income on the ato website for further information. Did you have overseas branch operations or a direct or indirect interest in a foreign trust foreign company controlled foreign entity or transferor trust. The income was not exempt income.

Lachlan received a 11 250 for his foreign employment after he paid a 3 750 in foreign tax. Convert foreign income to australian dollars. However you may be able to claim a foreign income tax offset to account for any foreign tax paid. Whether it is rental income from your old family home an untouched bank account earning interest or salary from working offshore it must be reported.

You must have actually paid an amount of foreign income tax. 22 attributed foreign income. To be entitled to an offset. Small business income tax offset.

Lachlan was employed overseas from 15 october 2019 until 23 april 2020. You must convert all foreign income deductions and tax offsets to australian dollars in your tax return. Claiming a foreign income tax offset. Interest income int cmn ato iitr 730377 when the individual is an australian resident for the full year the country of residence when the interest was paid or credited in the attached income details schedule must not be provided.

Similar to above income tax will only be payable on your australia sourced income however the help tsl repayments will be calculated on income from australian and foreign sourced income. If you are claiming more than 1 000 you will first need to work out your foreign income tax offset limit to determine your entitlement.