Capital Vs Revenue Expenditure Income Tax Act

For instance the alteration of accounting entry of the capital expenditure if recorded in the revenue by mistake or intention it shrink the amount of revenue and profit while revenue expense if capitalised appreciates the profits which misrepresent the actual position of the business.

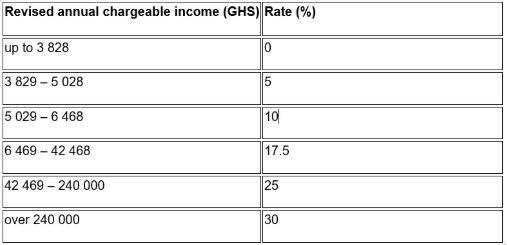

Capital vs revenue expenditure income tax act. Commissioner of income tax 1998 232 itr 771 commissioner of gift tax v. Several previous year v. Capital expenditure produces benefits for several previous years whereas revenue expenditure is consumed within a previous year. Distinguish has to be made between revenue losses and capital losses of the business because under the provisions of this act capital losses can be set off against the income from capital gain only whereas the revenue losses are business losses and as such can be set off against any other income of the assessee.

To hold that all expenditure which is revenue in nature would not fall under section 35ab of the act and would have necessarily to fall under section 37 of the act to our. It refers to the distinction of capital from revenue expenditure for tax purposes. According to mohanlal hargovind of jubbulpore vs. Acquisition of fixed assets v.

Capital v revenue expenditure is a term used throughout this toolkit. Business expenditure capital vs. Expenditure that is capital is generally. Routine expenditure capital expenditure is incurred in acquiring extending or improving a fixed asset whereas revenue expenditure is incurred in the normal course of business as a business expenditure.

Revenue expenditure is taken into account while computing taxable profits and would be eligible for a tax deduction whereas on capital expenditure only depreciation can be claimed.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)