Annual Income Qualified Unit Report

79 under home regulations annual income may be determined in one of three ways.

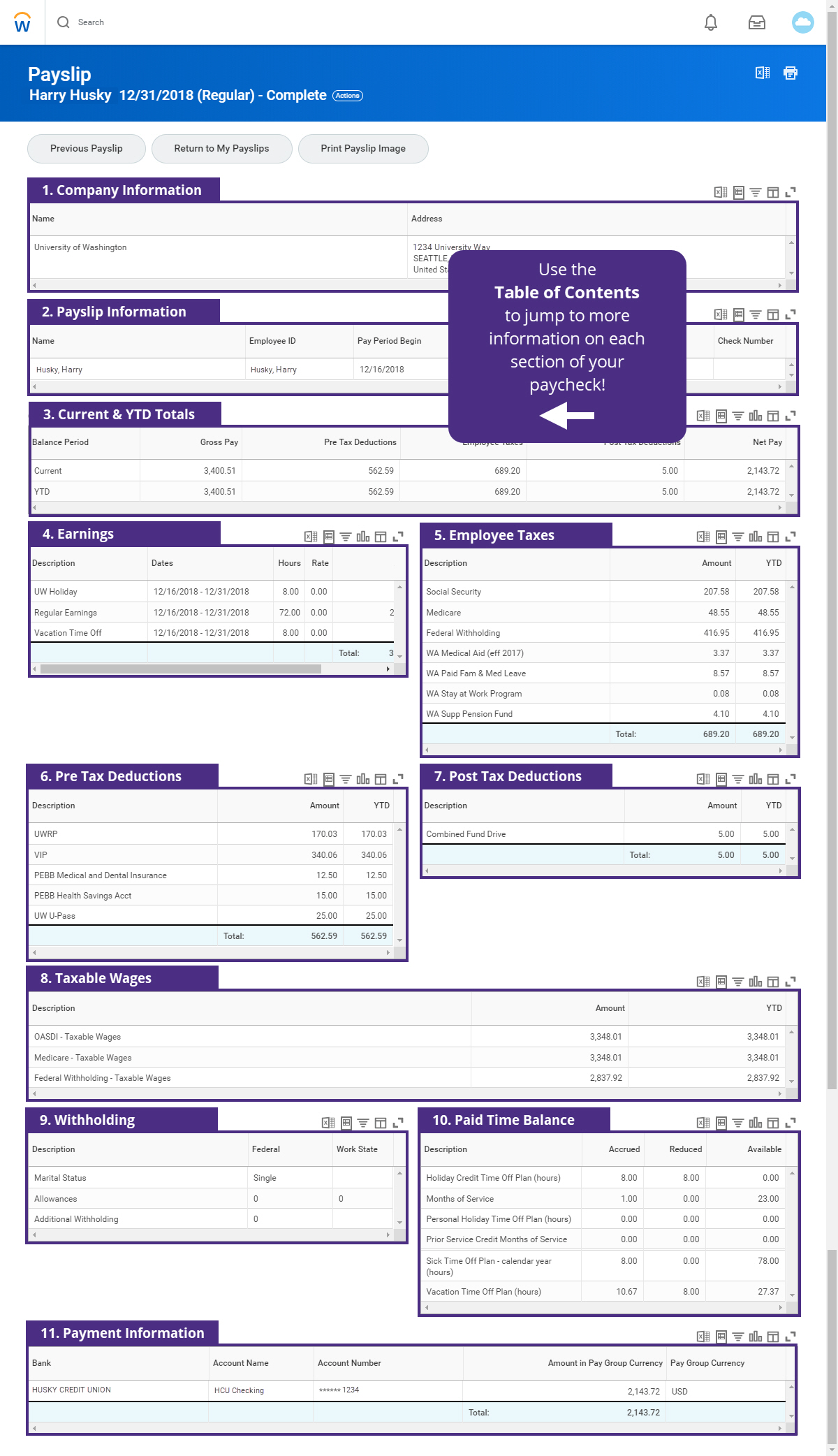

Annual income qualified unit report. Annual housing report report provides information on single family loan purchases by the enterprises by race or ethnicity gender census tract median income fixed rate vs. Families living in home funded rental housing or receiving rental assistance must be low income at or below 80 of area median income. Show 10 more archives. However this posting does not discuss the specific u s.

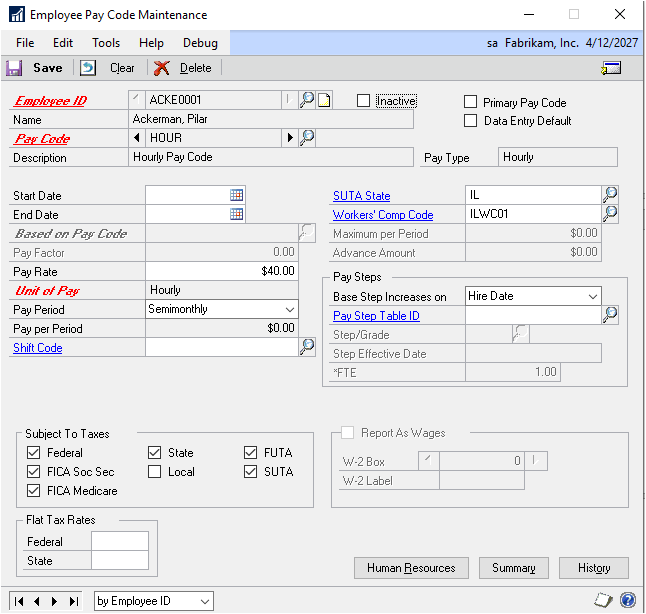

The net investment income tax is applied to the lesser of the net investment income or the magi amount in excess of the predetermined limit. For example a single tax filer with annual gross. In general a qbu is any separate and. On the last day of the one year period that begins on the date owner properly submits a written request to the dhcd asking the dhcd to assist in procuring a ʺqualified contract ʺ as defined in section 42 h 6 f for the acquisition of the low income portion of the.

Plicable income limitation the unit may continue to be counted as a low income unit as long as two things happen. This posting discusses what a qbu is. Attachment a section 8 definition of annual income 24 cfr part 5 subpart f section 5 609 5 609 annual income. Dollar denominated transactions for a qbu or a non qbu.

Tax rules on how to report non u s. Or foreign status of the owner of the income such as tax exempt municipal bond interest and. A annual income means all amounts monetary or not which. Adjustable rate loan to value ratio and credit score.

Audit reports on government agencies with incomplete set of books and or some subsidiaries are in the form of management letters. The annual audit report files are password protected and presented in ms word ms excel pdf. Management letter ml is an audit report on the results of audit of the regional branch office field operating unit. Fixed determinable annual or periodical fdap income is all income except.

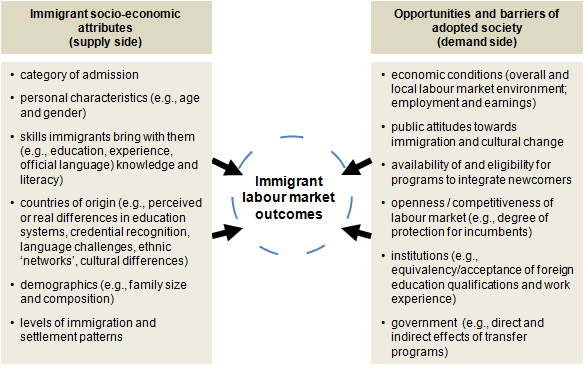

1 using the regulations at 24 c. 1 the unit continues to be rent restricted and 2 the next available unit of comparable or smaller size in the same building is oc cupied by a qualified low income household. Tax rules qualified business units qbus are important for purposes of calculating certain transactions denominated in currencies other than the u s. Gains derived from the sale of real or personal property including market discount and option premiums but not including original issue discount items of income excluded from gross income without regard to the u s.

1 go to or on behalf of the family head or spouse even if temporarily absent or to any other. However with income targeting 90 of families must be at or below 60 of area median income. Most recent annual report.

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)