Income Tax Definition Gcse

The basic rate the higher rate and the additional rate.

Income tax definition gcse. For example if you earn pounds900 more than the allowance you only pay tax on the pounds900. Vat currently 20 on relevant spending excise duties on fuel and alcohol car tax betting tax and the tv licence. The level of income a taxpayer has after paying income tax. Added to the prices of goods and the taxpayers pay the tax as they purchase the goods.

Income tax is progressive. Income tax is a certain percentage of your income that you have to pay regularly to the. Income tax a tax on the value of income earned by workers. Any income over this amount is taxed.

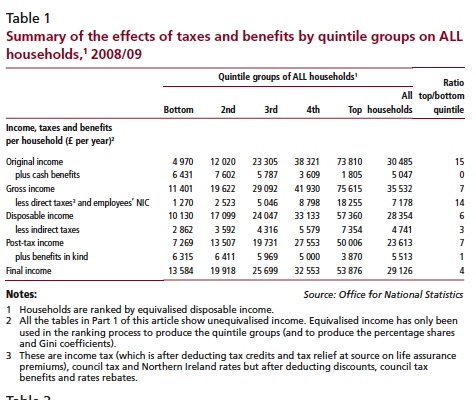

Taxes are enforced on. Government income is greater than its expenditure for that year. Taxation on income and wealth income tax corporation tax inheritance tax capital gains tax. Paid directly from incomes.

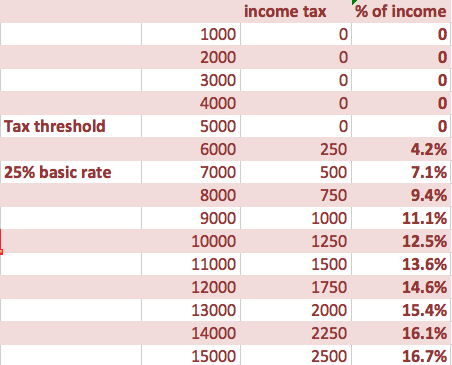

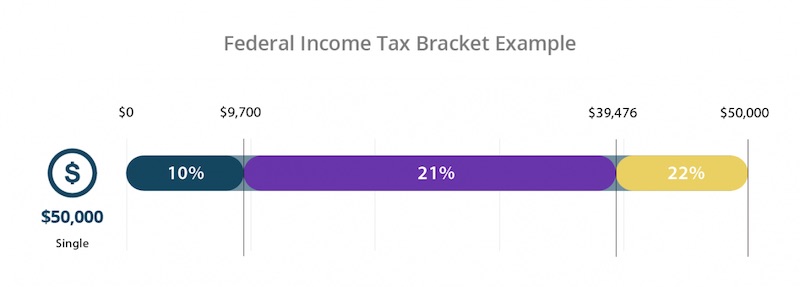

This means that the marginal rate of tax rises at certain boundaries of taxable income. Any change by the government in tax rates or public sector spending. Tax is a financial contribution made to the government. A tax on an imported product.

Indirect taxes are levied on spending by consumers on goods and services. Model showing the flow of money factors of production goods services in the economy. Income tax on earned income is charged at three rates. It is involuntary and is enforced.

Wages salaries interest rent profit tax. Circular flow of income. It may be in the form of a reduction such as income tax which is subtracted from your earnings or deducted from the. All taxpayers pay the same percentage.

Income tax for 2018 19. A tax on the value of sales. This includes sole traders who have to pay income tax on their net earnings. Taxation is a fee levied by a government on a product income or activity.

The tax rate is usually given as a percentage. Part of the value of a person s assets to the government distribution of taxes proportional tax.