Income Tax Rates Texas

Texas state income tax rate for 2020 is 0 because texas does not collect a personal income tax.

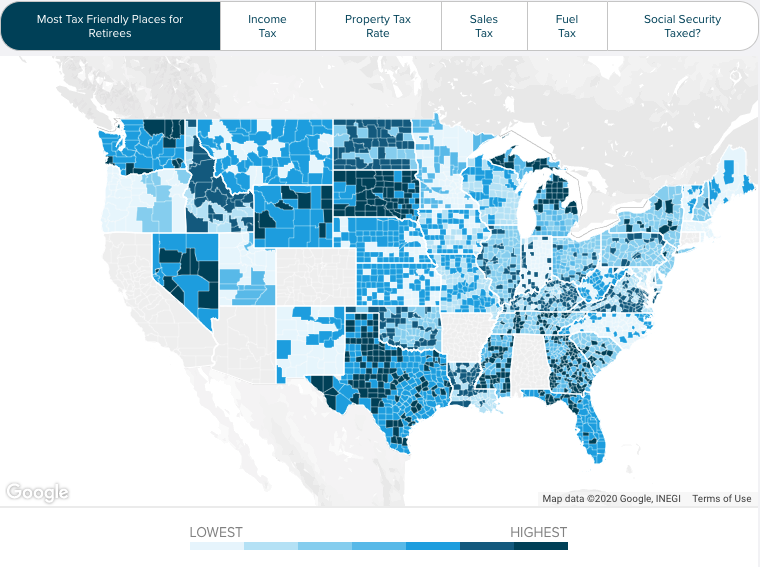

Income tax rates texas. The texas corporate income tax is the business equivalent of the texas personal income tax and is based on a bracketed tax system. If you make 52 000 a year living in the region of texas usa you will be taxed 8 693 that means that your net pay will be 43 307 per year or 3 609 per month. Texas has no individual income tax but it does levy a franchise tax of 475 on some wholesalers and retail businesses as of 2020. The rate increases to 95 for other non exempt businesses.

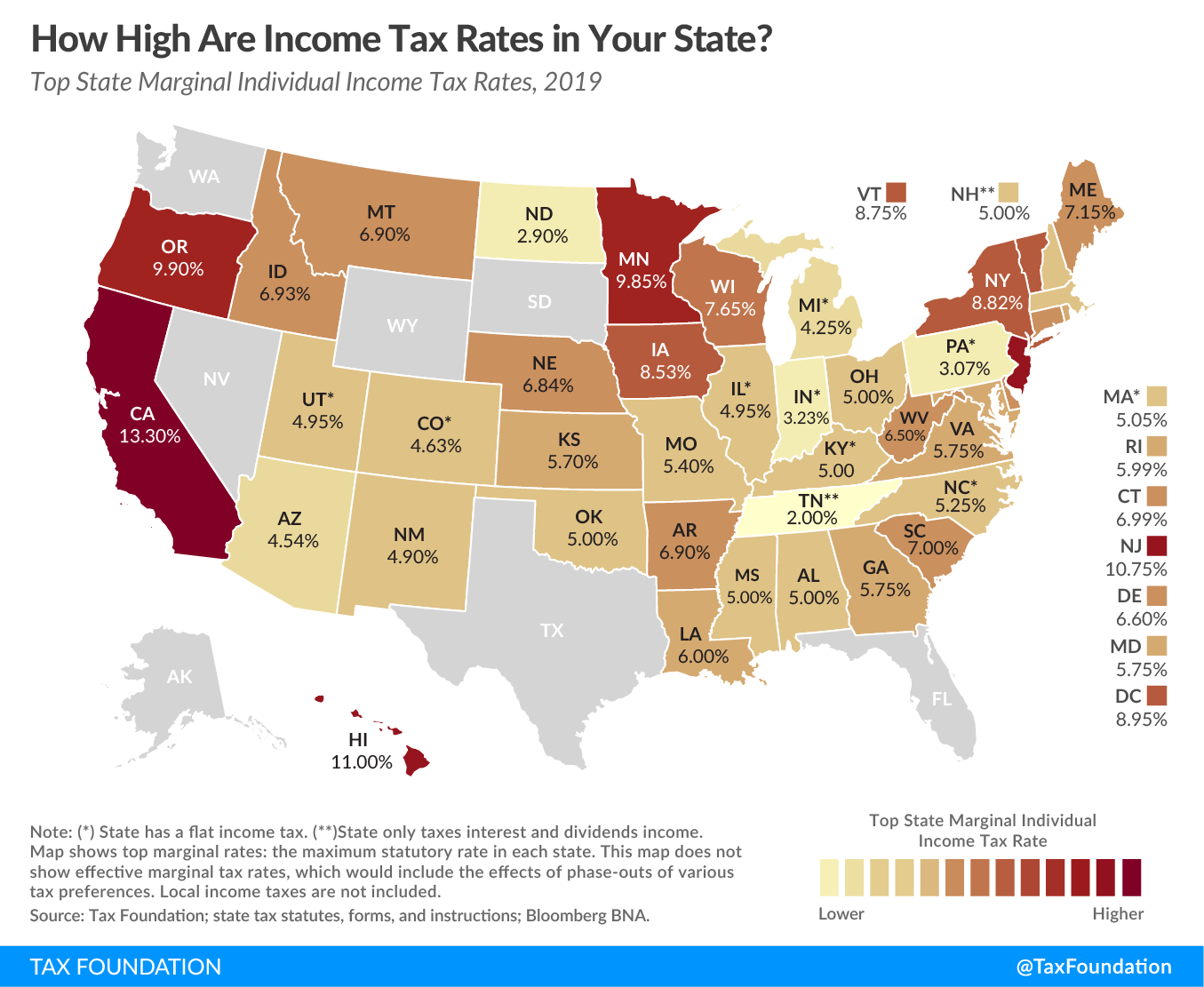

The federal income tax rates remain unchanged for the 2019 and 2020 tax years. Texas has no state level income taxes although the federal income tax still applies to income earned by texas residents. While texas s statewide sales tax rate is a relatively moderate 6 25 total sales taxes including county and city taxes of up to 8 25 are levied and in most major cities this limit is reached. Your average tax rate is 16 72 and your marginal tax rate is 26 30 this marginal tax rate means that your immediate additional income will be taxed at this rate.

Texas income tax rate and tax brackets shown in the table below are based on income earned between january 1 2020 through december 31 2020. Your average tax rate is 17 24 and your marginal tax rate is 29 65 this marginal tax rate means that your immediate additional income will be taxed at this rate. The income brackets though are adjusted slightly for inflation. Read on for more about the federal income tax brackets for tax year 2019 due july 15 2020 and tax year 2020 due april 15 2021.

10 12 22 24 32 35 and 37. Both texas tax brackets and the associated tax rates have not been changed since at least 2001. The texas franchise tax. The texas income tax has one tax bracket with a maximum marginal income tax of 0 00 as of 2020.

There are only seven states nationwide that din t collect a state income tax however when a state has no income tax it generally makes up for lost tax revenue with higher. Similar to the personal income tax businesses must file a yearly tax return and are allowed deductions such as wages paid cost of goods sold and other qualifying business expenses. Dallas houston and san antonio all have combined state and local sales tax rates of 8 25 for example. The texas state income tax rates in the table reflect almost a worst case scenario for a us taxpayer because those that are married and have dependents can typically take advantage of other deductions which would effectively make the federal income tax you pay less than what you see in the table.

Outlook for the 2019 texas income tax rate is to remain unchanged at 0.