Income Statement Method Of Allowance For Doubtful Accounts

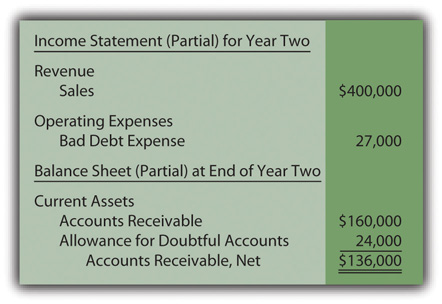

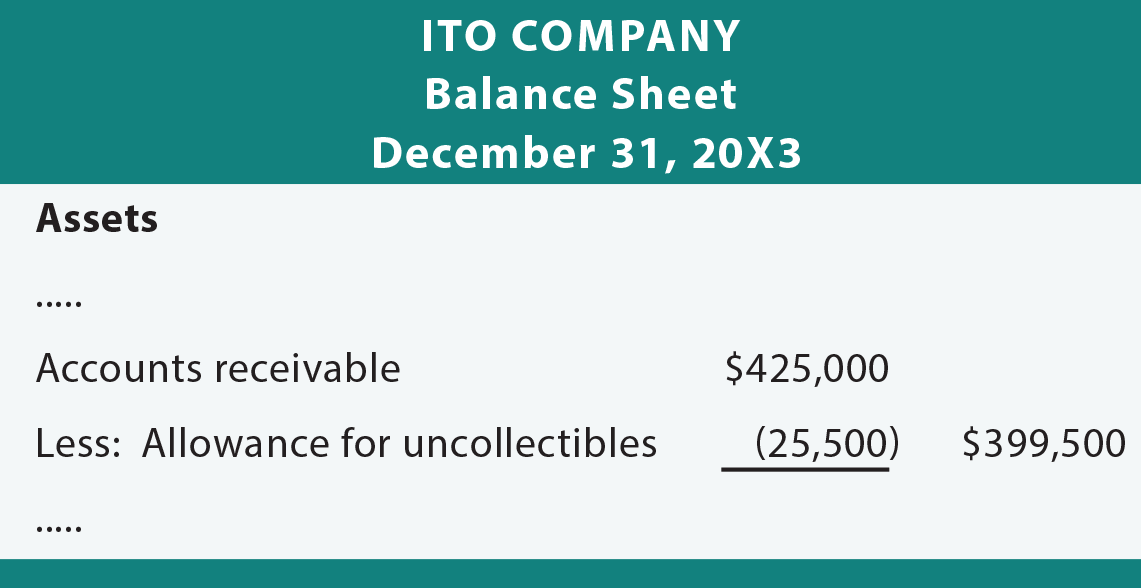

The income statement will report the bad debts expense closer to the time of the sale or service and the balance sheet will report a more realistic net.

Income statement method of allowance for doubtful accounts. If instead the allowance. Gonzalez company estimates that about 1 of net credit sales will become uncollectible. We do this by estimating how much will not be paid. Since the sales are made on credit there are chances that some customers might default.

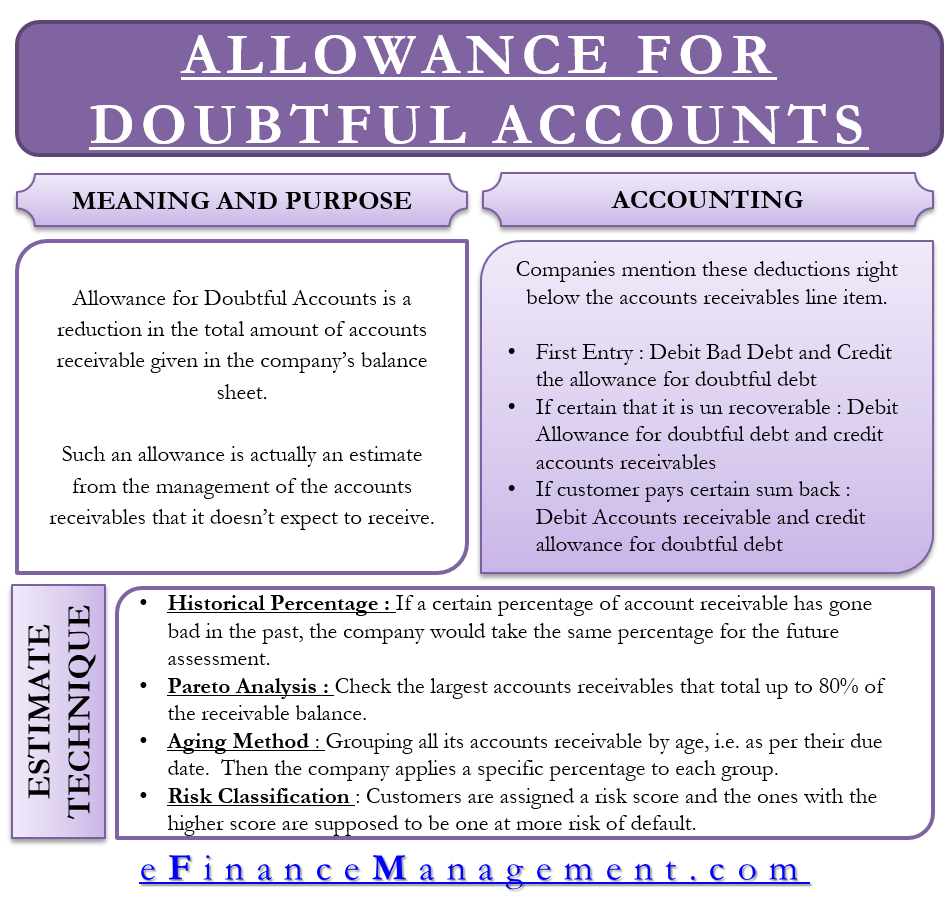

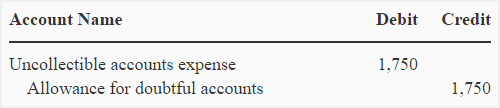

And the second and third journal entries will only affect the balance sheet where we will first deduct the amount of provision from the accounts receivables and if any amount is collected we will add that amount back. Two approaches are balance sheet and income statement approaches to measuring bad debts expense and allowance for doubtful accounts afda. Allowance method allowance method lo 5 7 26 illustration. The allowance method is preferred over the direct write off method because.

With both methods the bad debt expense needs to record in the income statement by a different time. A doubtful debt is an accounts receivable that is expected to be an uncollectible invoice where an accounts receivable is the amount owed to you against the sales you made or services you provided on credit. Any subsequent write offs of accounts receivable against the. Allowance for doubtful accounts on the balance sheet allowance for doubtful is the contra asset account with accounts.

Calculate allowance for doubtful accounts using sales method or income statement approach. The only impact that the allowance for doubtful accounts has on the income statement is the initial charge to bad debt expense when the allowance is initially funded. Above we assumed that the allowance for doubtful accounts began with a balance of zero. The first journal entry above would affect the income statement where we need to pass the entry of the bad debt and also for the allowance for doubtful debts account.

Cr allowance for doubtful accounts 17 000 これで 既に残っていた3 000ドル分のallowanceと今回計上したallowanceを足して20 000ドルとなります 1つめの percentage of sales methodはかけた結果の金額をそのまま計上していましたが aging methodの場合は最終目標値が計算結果となるという違いがあります. The debit to bad debts expense would report credit losses of 50 000 on the company s june income statement. Prepare adjusting entry to recognize uncollectible accounts expense and to update the allowance for doubtful accounts account at the end of the year 2015. Allowance for doubtful accounts afda and bad debts expense.