Income Tax Rates Sweden

This article only looks at the total local tax rates which are set to increase next year.

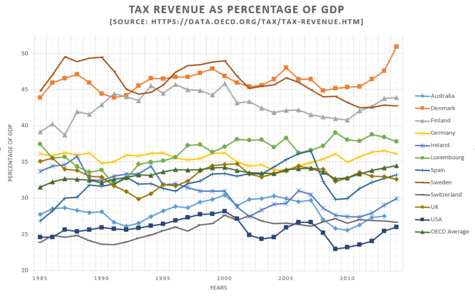

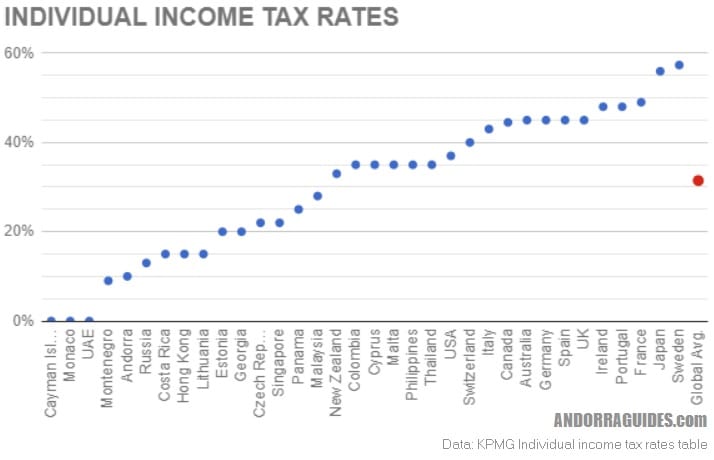

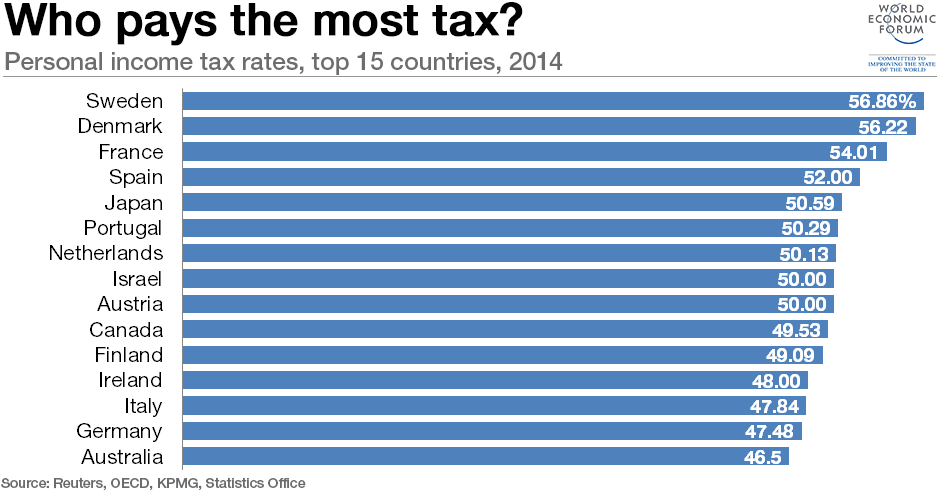

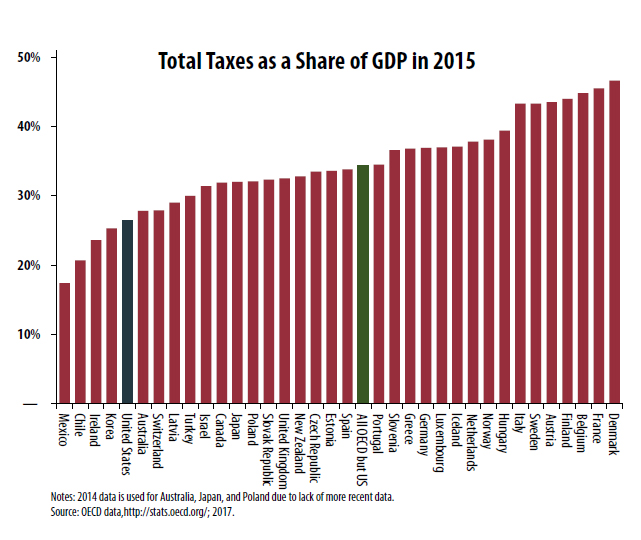

Income tax rates sweden. People in sweden see the value and benefit of the taxes they pay and therefore there is much more belief in paying taxes and dealing with the higher tax rates. 0 from 0 kronor to 20 008 kronor. The personal income tax rate in sweden stands at 57 20 percent. Tax in sweden is high and sweden has the 2nd highest tax rate in europe but like denmark the feeling for tax here is not as hated as other places in europe like the uk.

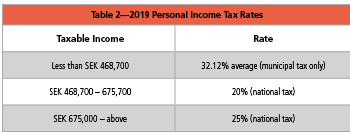

Tax rates 2020 persons with unlimited tax liability. Capital income is generally taxed at a flat rate of 30. Non residents working in sweden for a non swedish employer without a pe in sweden are not taxed in sweden provided that the individual does not spend more than 183 days in sweden in a 12 month period. Sweden has a bracketed income tax system with three income tax brackets ranging from a low of 0 00 for those earning under kr372 100 to a high of 25 00 for those earning more then kr532 700 a year.

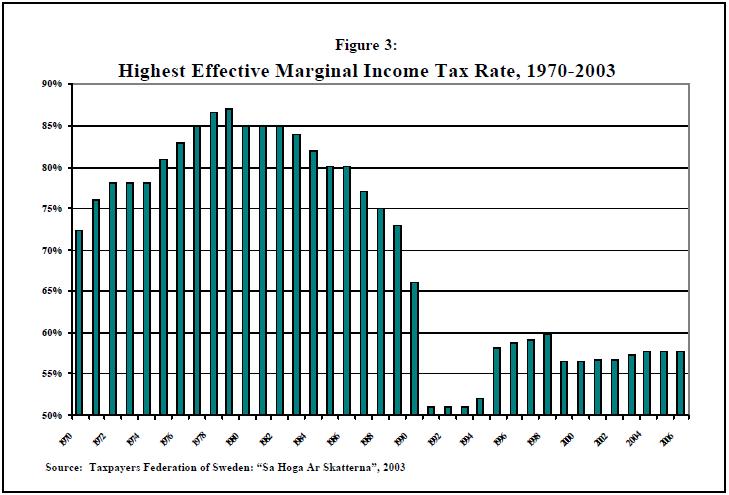

How does the sweden tax code rank. You can deduct a basic allowance of between sek 13 700 and sek 35 900 on taxable earned income employment and business activity if you have had unlimited tax liability for the whole year. This page provides sweden personal income tax rate actual values historical data forecast chart statistics economic calendar and news. According to the oecd single swedish workers making over 867 000 sek around 98 000 at prevailing exchange rates face a 70 percent overall marginal tax rate on all labor.

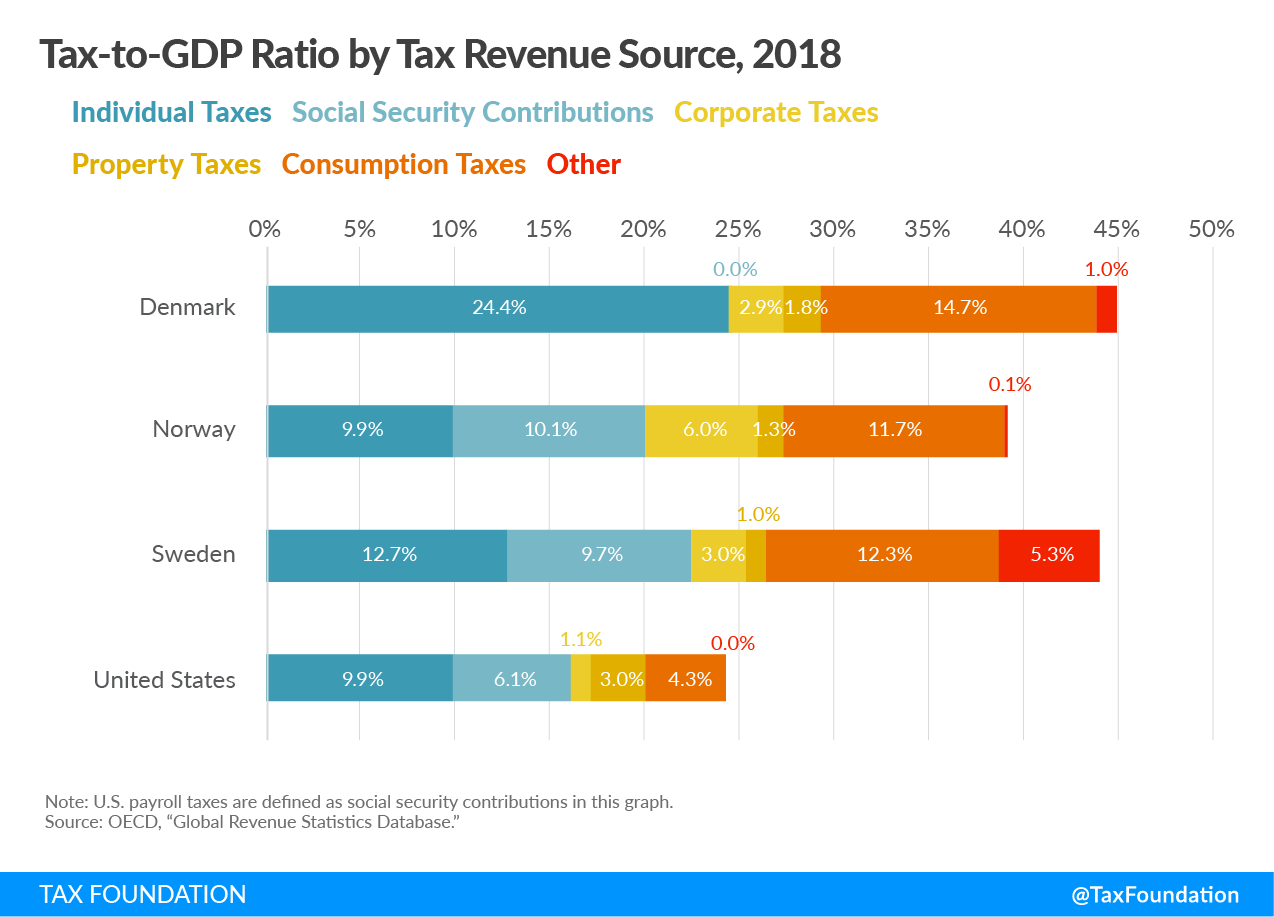

Sweden has a 70 percent marginal tax rate and it kicks in not at 10 million like aoc proposes but at around 98 000. Below we have highlighted a number of tax rates ranks and measures detailing the income tax business tax consumption tax property tax and international tax systems. 11 county and 20 municipality tax which is the swedish average. If you are over 65 years of age you will instead get an basic allowande of between sek 24 100 and sek 99 100.

From 468 700 kronor to 675 700 kronor. How does the sweden income tax compare to the rest of the world. Personal income tax rate in sweden averaged 56 60 percent from 1995 until 2020 reaching an all time high of 61 40 percent in 1996 and a record low of 51 50 percent in 2000. 57 32 average municipality income tax 25 state income tax 25 standard rate 12 or 6 reduced rate taxation in sweden switzerland.

From 20 008 kronor to 468 700 kronor. The first step towards understanding the sweden tax code is knowing the basics. 0 11 5 federal 37 2 canton 0 15 municipal 7 7 standard rate 3 8 or 2 5 reduced rates taxation in switzerland syria. Sweden has a progressive income tax the general rates for 2018 are as follows based on yearly incomes.