Income Tax Brackets 2020 Utah

View 2020 and 2021 irs income tax brackets for single married and head of household filings.

Income tax brackets 2020 utah. January 1 2008 december 31 2017. See the instruction booklets for those years. Utah has a flat income tax rate which applies to both single and joint filers. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

January 1 2018 current. The federal income tax in contrast to the utah income tax has multiple tax brackets with varied bracket width for single or joint filers. 2020 utah tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Before the official 2020 utah income tax rates are released provisional 2020 tax rates are based on utah s 2019 income tax brackets.

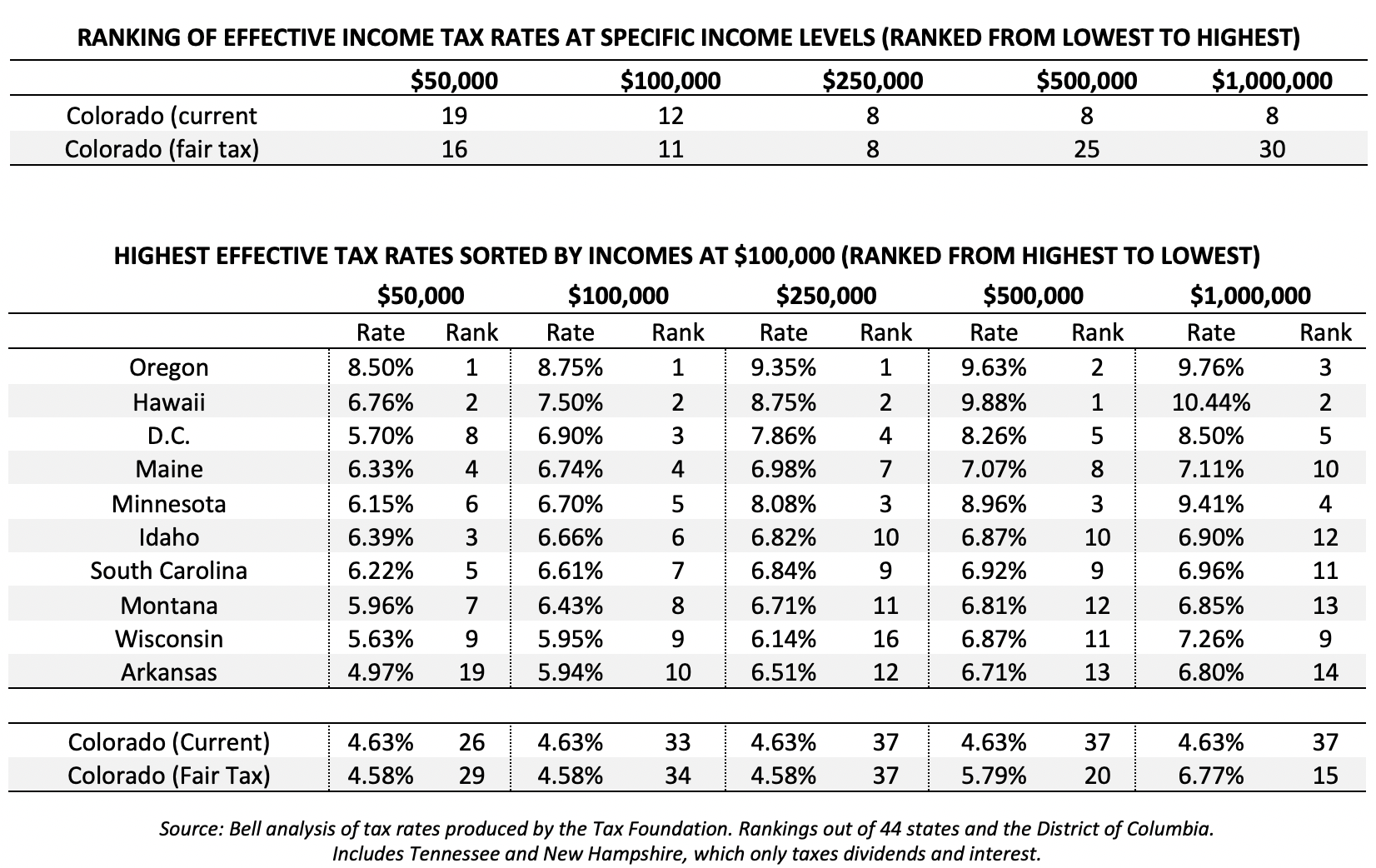

Utah tax forms are sourced from the utah income tax forms page and are updated on a yearly basis. How does utah rank. Each state s tax code is a multifaceted system with many moving parts and utah is no exception. The 2020 state personal income tax brackets are updated from the utah and tax foundation data.

There are both state and local sales tax rates in utah. The first step towards understanding utah s tax code is knowing the basics. That means the actual rates paid in utah range from 6 10 to 9 05. Please make sure.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518 400 and higher for single filers and 622 050 and higher for married couples. Local rates which are collected at the county and city level range from 1 25 to 4 20. Tax years prior to 2008. Utah s income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2006.

Below we have highlighted a number of tax rates ranks and measures detailing utah s income tax business tax sales tax and property tax systems. 2020 federal income tax brackets and rates in 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows table 1. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in april 2020. Official income tax website for the state of utah with information about filing and paying your utah income taxes and your income tax refund.