Income Tax Definition Canada

All except quebec use the federal definition of taxable income.

Income tax definition canada. Agreement to share income etc so as to reduce or postpone tax otherwise payable 103 1 where the members of a partnership have agreed to share in a specified proportion any income or loss of the partnership from any source or from sources in a particular place as the case may be or any other amount in respect of any activity of the partnership. Income taxes in canada constitute the majority of the annual revenues of the government of canada and of the governments of the provinces of canada in the fiscal year ending 31 march 2018 the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Federal laws of canada.

All provinces and territories compute income tax using tax on income systems i e. Business or professional income calculate business or professional income get industry codes and report various income types. Taxes have been called the building block of civilization. Income tax is used to fund public services pay government.

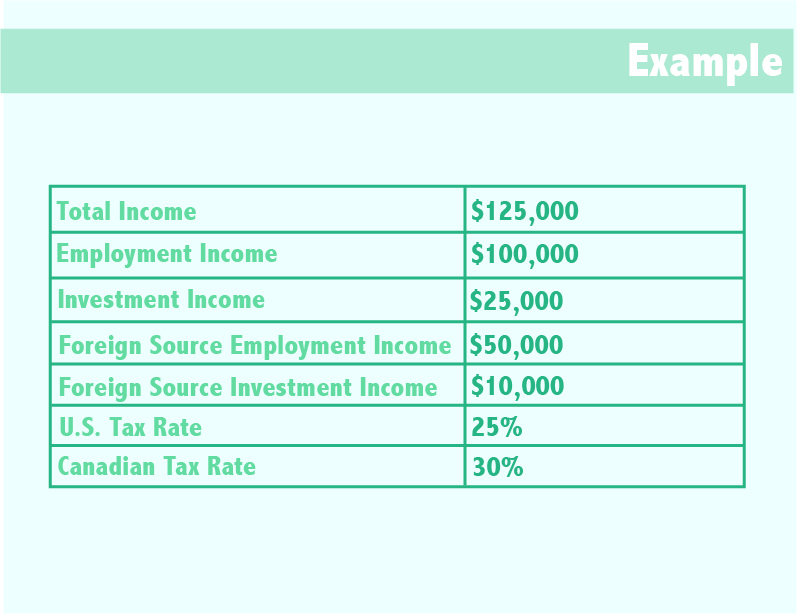

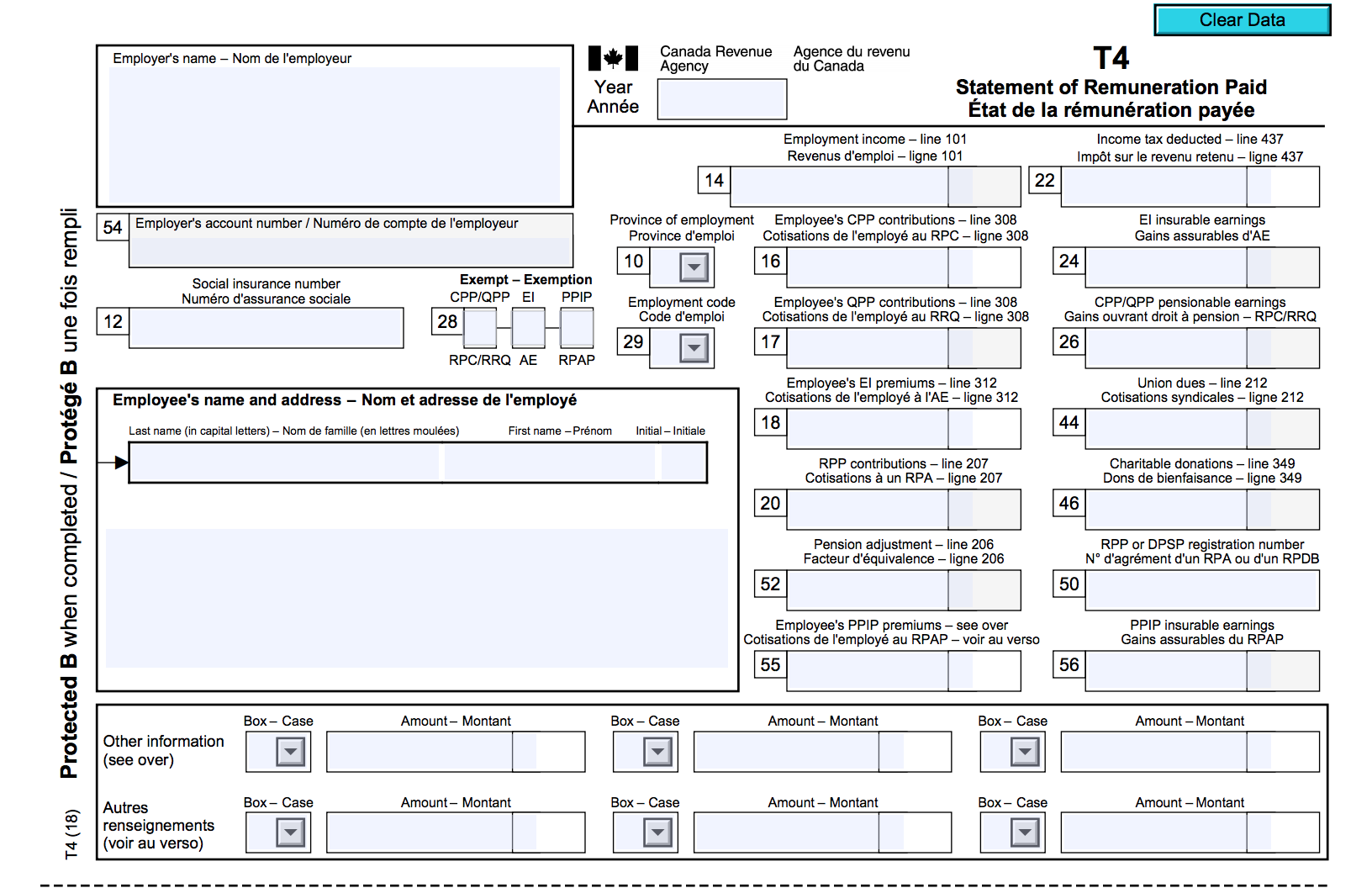

The following table shows the top 2020 provincial territorial tax rates and surtaxes. The canadian company has the legal responsibility under the act and the income tax regulations of canada to withhold canadian income tax from the gross fees and to report the gross fees and related canadian withholding tax on a t4 statement of remuneration paid the canadian equivalent of a us w 2 or a uk p60 statement. File income tax get the income tax and benefit package and check the status of your tax refund. They set their own rates brackets and credits.

A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and other sources determined in accordance with the internal revenue code or state law. You will find the provincial or territorial tax rates on form 428 for the respective province or territory all except quebec.