While The Income Statement Shows Two Classes Namely

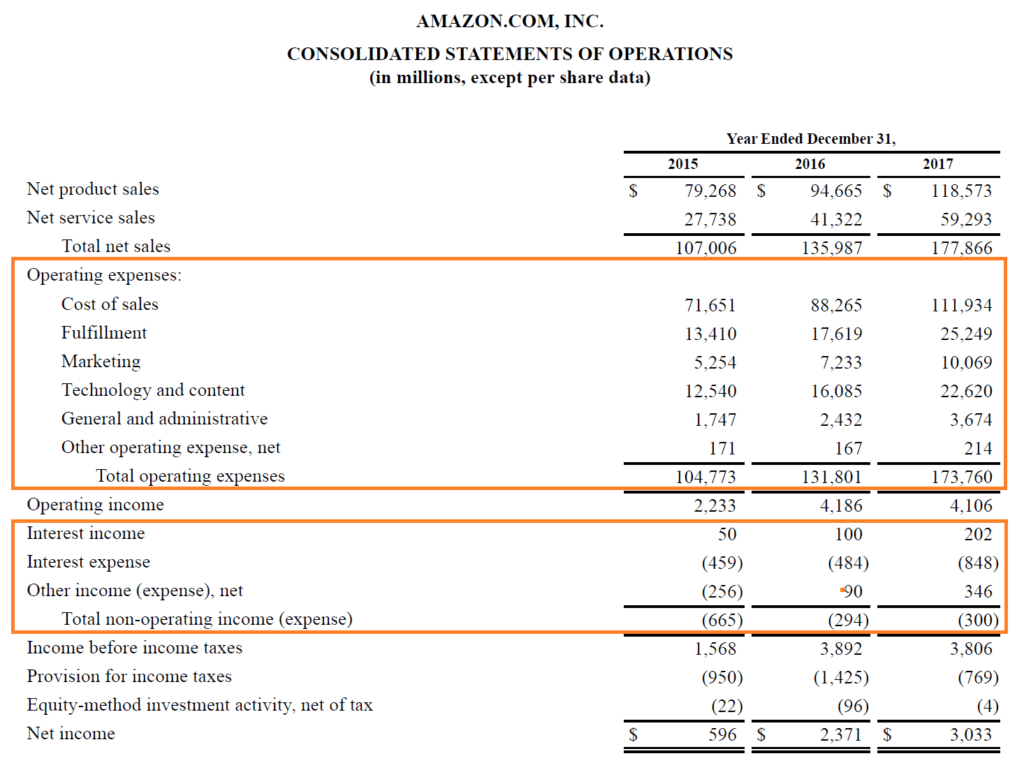

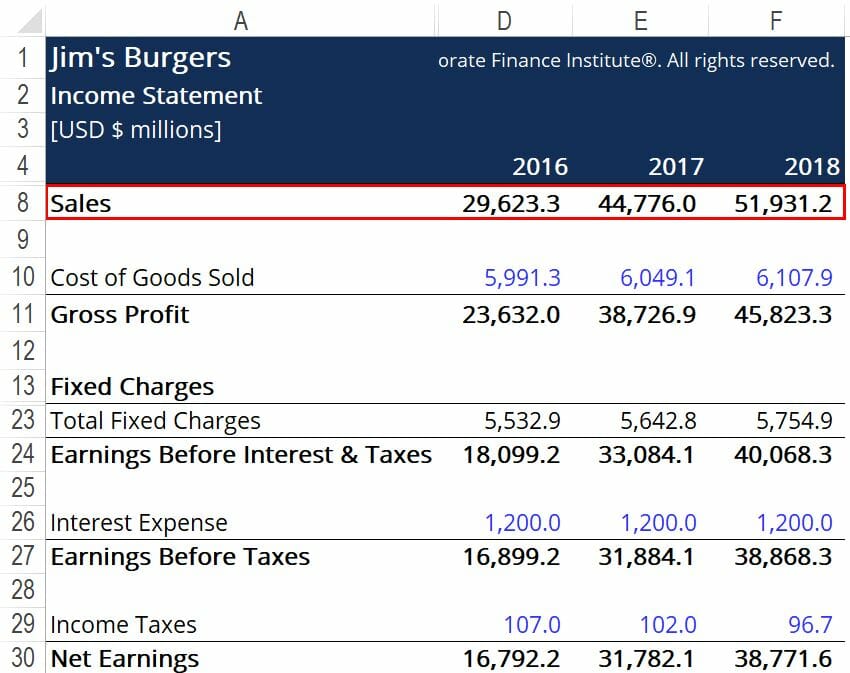

A profit and loss statement p l or income statement income statement the income statement is one of a company s core financial statements that shows their profit and loss over a period of time.

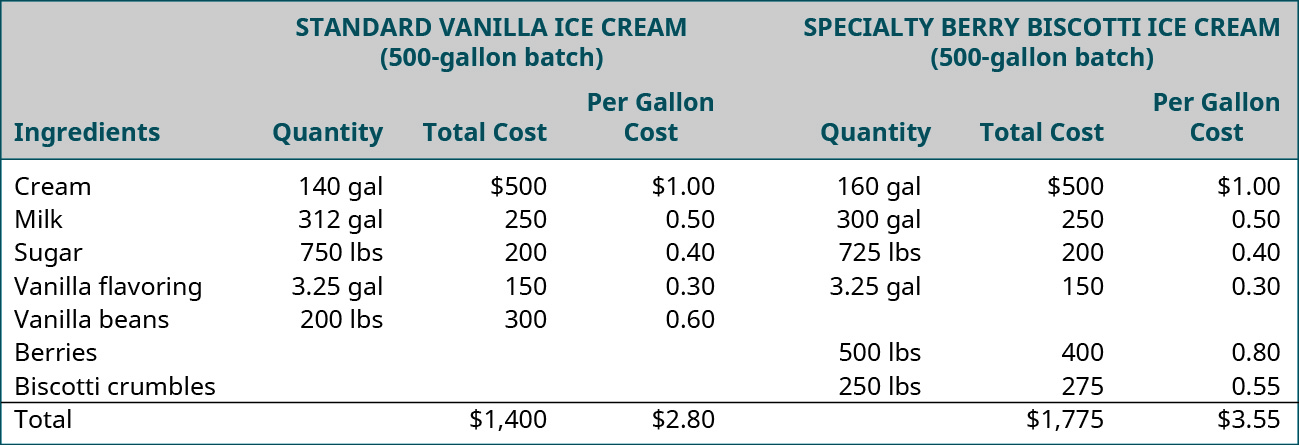

While the income statement shows two classes namely. Placement on income statement. Give any two contents of business plan. There are two income statement formats that are generally prepared. This format is less useful of external users because they can t calculate many efficiency and profitability ratios with this limited data.

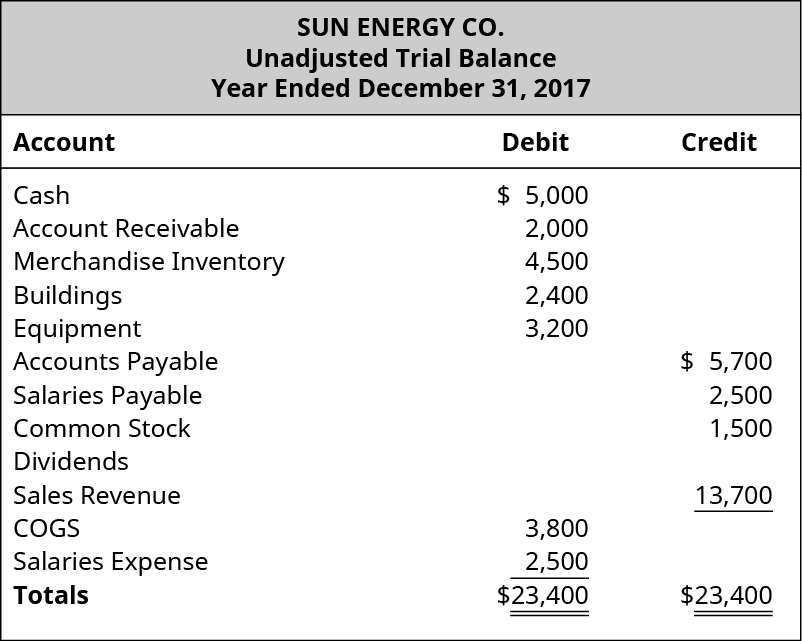

Who can write the business plan. Ncert solutions for class 12 entrepreneurship chapter 2 entrepreneurial planning textbook questions solved a very short answer type questions question 1. The income statement must report the interest incurred regardless of the date the interest is paid. While becoming familiar with the statement of cash flow and statement of owner s equity is also valuable the balance sheet and income statement.

For investors considering whether to purchase stock in a company two essential types of financial statements to analyze are the balance sheet and the income statement. Is a retailer s interest expense an operating expense or a non operating expense. Income statement and balance sheet overview. The income statement basically shows the amount the corporation earned expenses that were paid and the amount of earnings remaining after expenses.

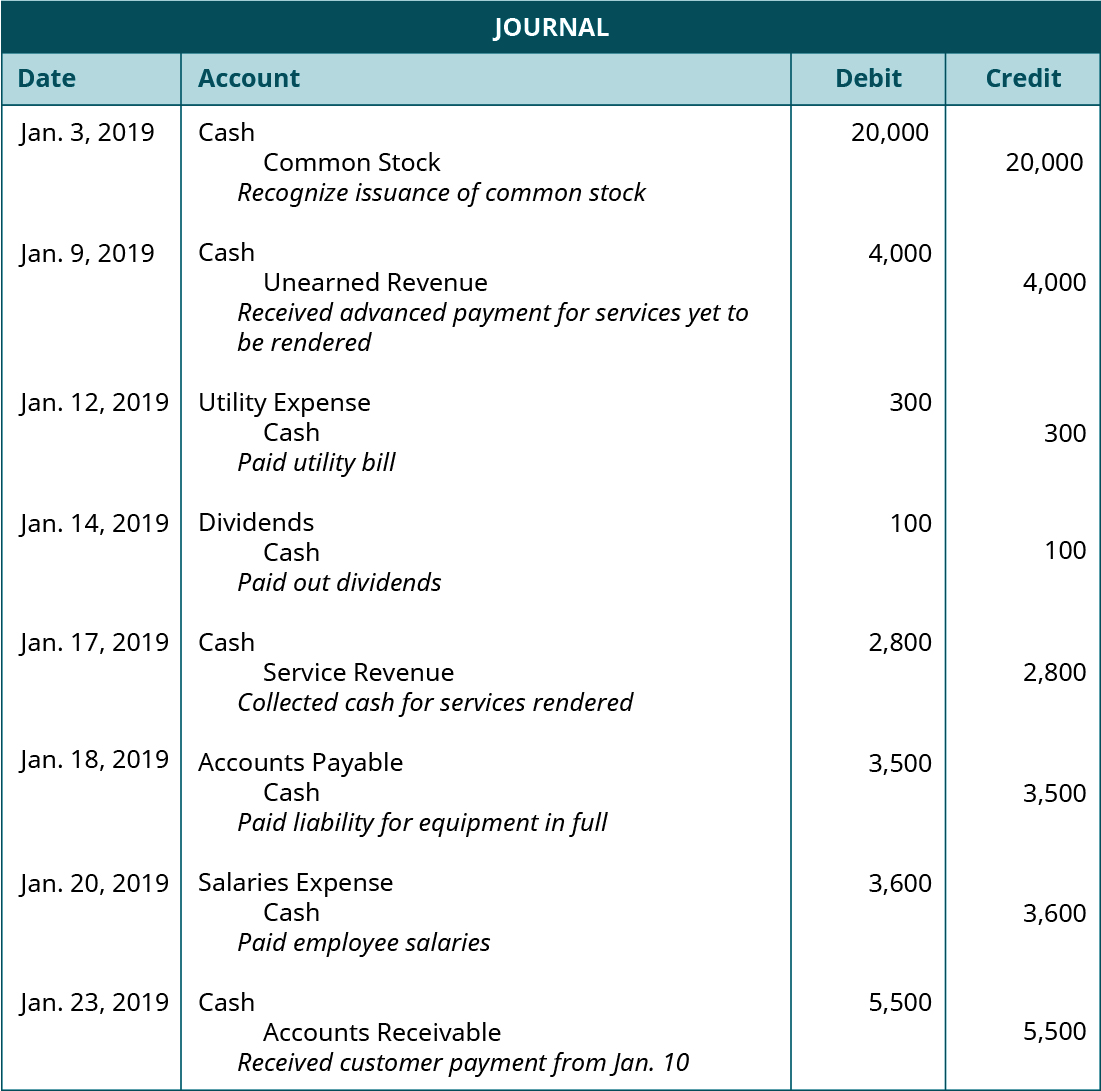

The income statement totals the debits and credits to determine net income before taxes the income statement can be run at any time during the fiscal year to show a company s profitability. A company using the accrual method of accounting performed services on account in august. Any person s who wish to start a business venture can write the business plan. Therefore the net earnings would be reflected on this statement.

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement. The income statement or profit and loss report is the easiest to understand it lists only the income and expense accounts and their balances. Show in separate section after continuing operations but before extraordinary items. In financial accounting a cash flow statement also known as statement of cash flows or funds flow statement is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents and breaks the analysis down to operating investing and financing activities.

Show net of tax. General introduction and business venture. Food distributor that sells wholesale to supermarket chains and through fast food restaurants decides to discontinue the division that sells to one of the two classes of customers.

:max_bytes(150000):strip_icc()/Screenshot2019-08-21at10.58.51AM-049e1ab335434a16ab7ddc69664758a7.png)

/dotdash_Final_DuPont_Analysis_Aug_2020-01-254eeb707b3e4ebc9527e054caa914a2.jpg)