Yearly Income Tax Brackets

In tax year 2020 for example a single person with taxable income up to 9 875 paid 10 percent while in 2021 that income bracket rises to 9 950.

Yearly income tax brackets. See 2020 tax brackets. Paying income tax is a duty of every indian citizen. The irs used to use the consumer price index cpi to calculate the past. Then the internal revenue service adjusts the income brackets each year usually in late october or early november based on inflation.

This is done to prevent what is called bracket creep when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation instead of any increase in real income. 2021 tax rates and income brackets use these. The federal income tax rates remain unchanged for the 2019 and 2020 tax years. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals.

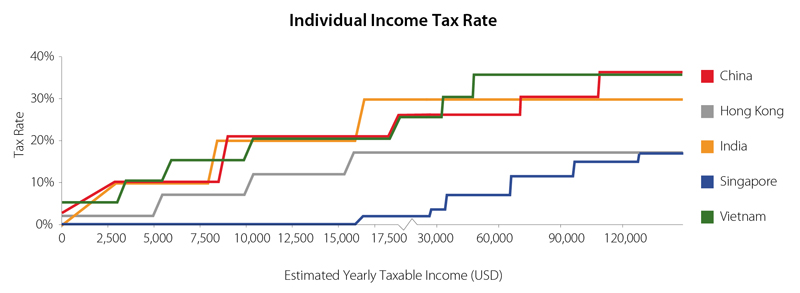

19c for each 1 over 18 200. There are seven federal tax brackets for the 2020 tax year. The highest earners pay 37 percent. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22.

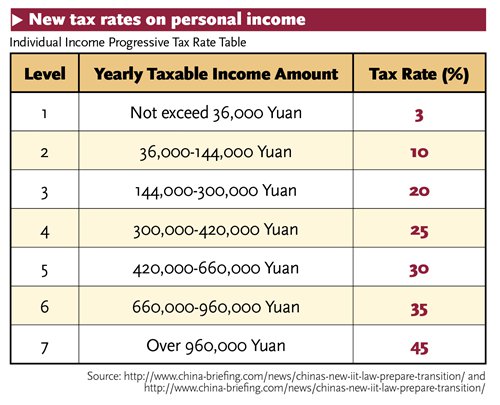

Income tax brackets in india for fy 2020 21 ay 2021 22 updated on november 15 2020 11028 views. Read on for more about the federal income tax brackets for tax year 2019 due july 15 2020 and tax year 2020 due april 15 2021. This is done to prevent what is called bracket creep when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation instead of any increase in real income. Here s a look at income tax rates and brackets over the years.

The irs used to use the consumer price index cpi to calculate the past. The tax code has seven income tax brackets with the lowest tax rate being 10 percent. The taxes we pay depend on two things. 10 12 22 24 32 35 and 37.

Under the income tax act 1961 the percentage of income payable as tax is based on the amount of income you ve earned during a year. On a yearly basis the irs adjusts more than 40 tax provisions for inflation. Congress sets the rates and a baseline income amount that falls into them when a tax law is created or changed. Australian income tax rates for 2020 21 residents income thresholds rate tax payable on this income.

These are the rates for taxes due. The income tax brackets and rates for australian residents for this financial year are listed below. Your bracket depends on your taxable income and filing status. On a yearly basis the irs adjusts more than 40 tax provisions for inflation.

See 2021 tax brackets. Standard deductions nearly doubled under the tax code overhaul that went. Similarly other brackets for income earned in 2021 have been adjusted upward as well.

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)