Us Income Federal Tax Rates

Being in a tax bracket doesn t mean you pay that federal income.

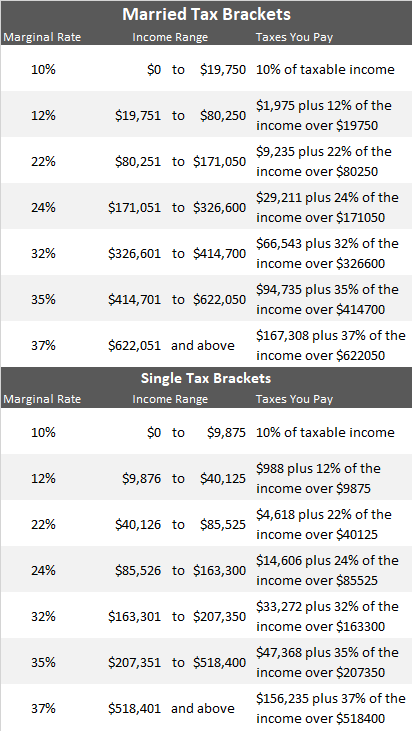

Us income federal tax rates. Read on for more about the federal income tax brackets for tax year 2019 due july 15 2020 and tax year 2020 due april 15 2021. 2020 individual income tax brackets. The highest earners pay 37 percent. The tax code has seven income tax brackets with the lowest tax rate being 10 percent.

If you are looking for 2019 tax rates you can find them here. Standard deductions nearly doubled under the tax code overhaul that went. 10 12 22 24 32 35 and 37. The federal income tax rates remain unchanged for the 2019 and 2020 tax years.

10 12 22 24 32 35 and 37.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)