Income Tax Definition Australia

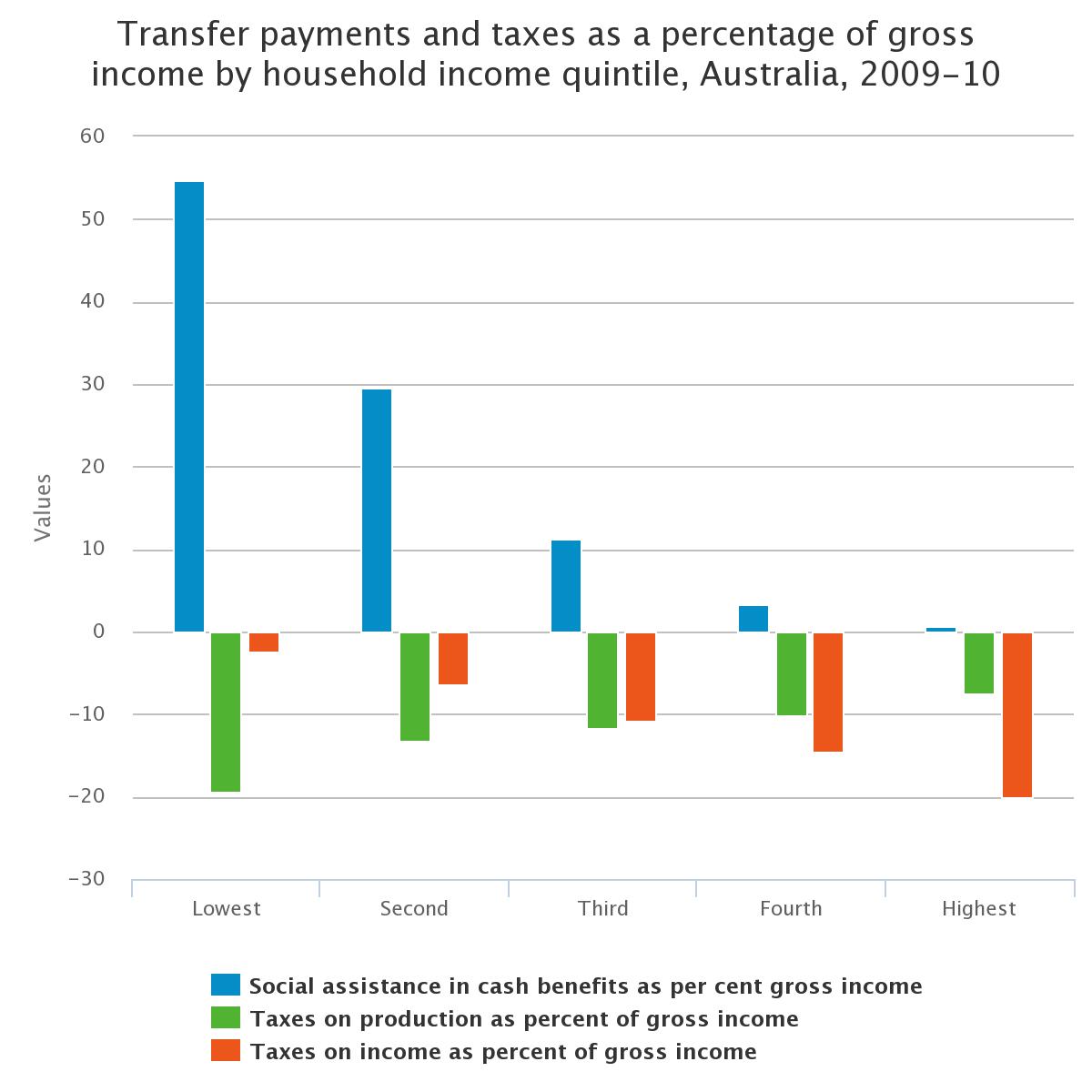

Personal earnings such as salary and wages business income and capital gains collectively these three sources of income tax account for 66 of federal government revenue and 57 of total revenue across the three tiers of.

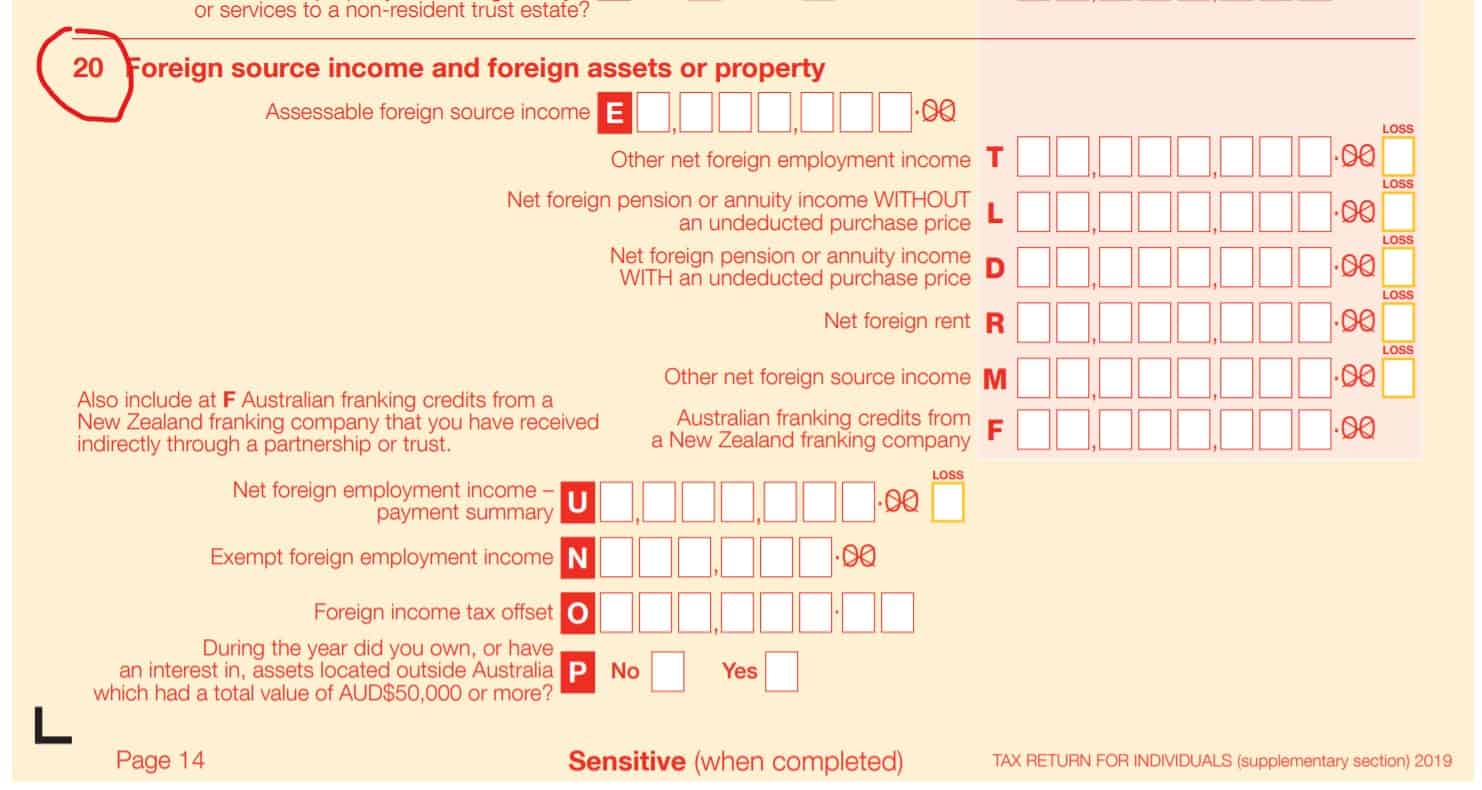

Income tax definition australia. In addition to the above rates a medicare levy is deducted at 2 0 percent of your taxable income. Tax returns are required to be filed by non residents who derive any australian sourced income other than franked dividends interest managed investment trust income or royalties and departing australia superannuation payments which are subject to a final withholding tax. Your gross pay that s your total salary before any deductions are made is split into 2 elements taxable income and non taxable income. State governments have not imposed income taxes since world war ii on individuals income tax is levied at progressive rates and at one of two rates for corporations the income of partnerships and trusts is not taxed directly but is taxed on its distribution to the partners or.

Australian resident means a person who is a resident of australia for the purposes of the income tax assessment act 1936. Australia maintains a relatively low tax burden in comparison with other. Income tax in australia is imposed by the federal government on the taxable income of individuals and corporations. Income tax is levied upon 3 sources of income for individual taxpayers.

Income tax on personal income is a progressive tax which means the more you earn the more tax you pay. The current tax free threshold as of the date of this post is 18 200 and the highest marginal rate for individuals is 45. Tax file number tfn you can register for tax online when you arrive in australia by following this link to get a tax file number. Total tax levied on 50 000 31 897.

If you have a low income you may pay a reduced levy or be. Taxable income in simple terms. Iit is important that you know and understand what taxable income is and what non taxable income is. Income taxes are the most significant form of taxation in australia and collected by the federal government through the australian taxation office australian gst revenue is collected by the federal government and then paid to the states under a distribution formula determined by the commonwealth grants commission.

Personal income tax in australia.