Income Tax Mathematical Definition

Bravedog s gross income is 220 000 and its net income is 120 000.

Income tax mathematical definition. Income tax definition is a tax on the net income of an individual or a business. Income after tax and expenses. The tax on 400 in taxable income is. The taxpayer must have an established checking or savings account to qualify for direct deposit.

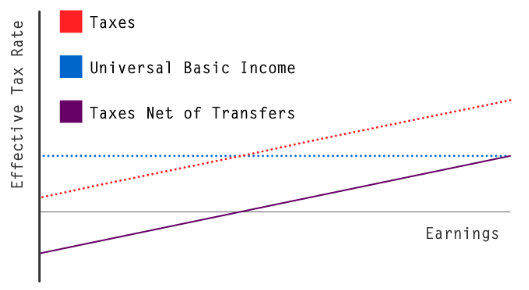

An income tax is a tax imposed on individuals or entities taxpayers that varies with respective income or profits taxable income. Direct deposit is a fast simple safe secure way to get a tax refund. In this case the tax is 2 of the taxable income. It is the tax levied directly on personal income.

What was the total cost of the battery in dollars and cents. Tax money that the government collects based on income sales and other activities. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Taxation rates may vary by type or characteristics of the taxpayer.

Income tax is used to fund public services pay government. Play this game to review applied math. Barrett bought a new battery for his car. The other 400 incurs a tax of 4.

Test your knowledge and learn some interesting things along the way. The resulting revenue is usually one of the chief sources of cash for a government entity. For 900 in taxable income we need to take into account two tax rates. The first 500 of taxable income incurs a tax of 2.

The battery cost 72. Marketing and other costs and tax are 100 000. Alex earned 300 but had to pay 42 of that to the government as tax. O income tax o compound interest o rate o aer depreciation after completing booklet.

Bravedog inc sells 400 000 of dog biscuits spending 180 000 making them. Total sales minus all expenses including tax. The tax imposed on a person or entity under the orbit of income tax law is called income tax. Income tax is a typical example of a direct tax.

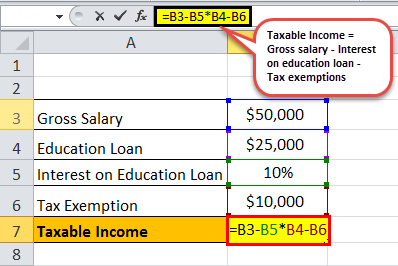

Practice answering exam paper questions questions s highlight the topics you need to go over. Since batteries are a taxable item he had to pay a sales tax of 7 5. This is because 400 of taxable income falls in the first 500 of taxable income. Income tax generally is computed as the product of a tax rate times taxable income.

T 400 0 02 400 8.