On A Traditional Income Statement Cost Of Goods Sold Reports The

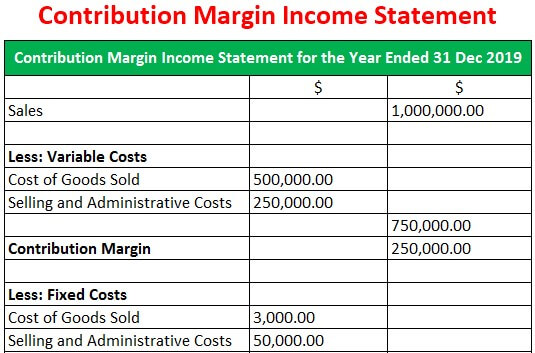

The contribution margin.

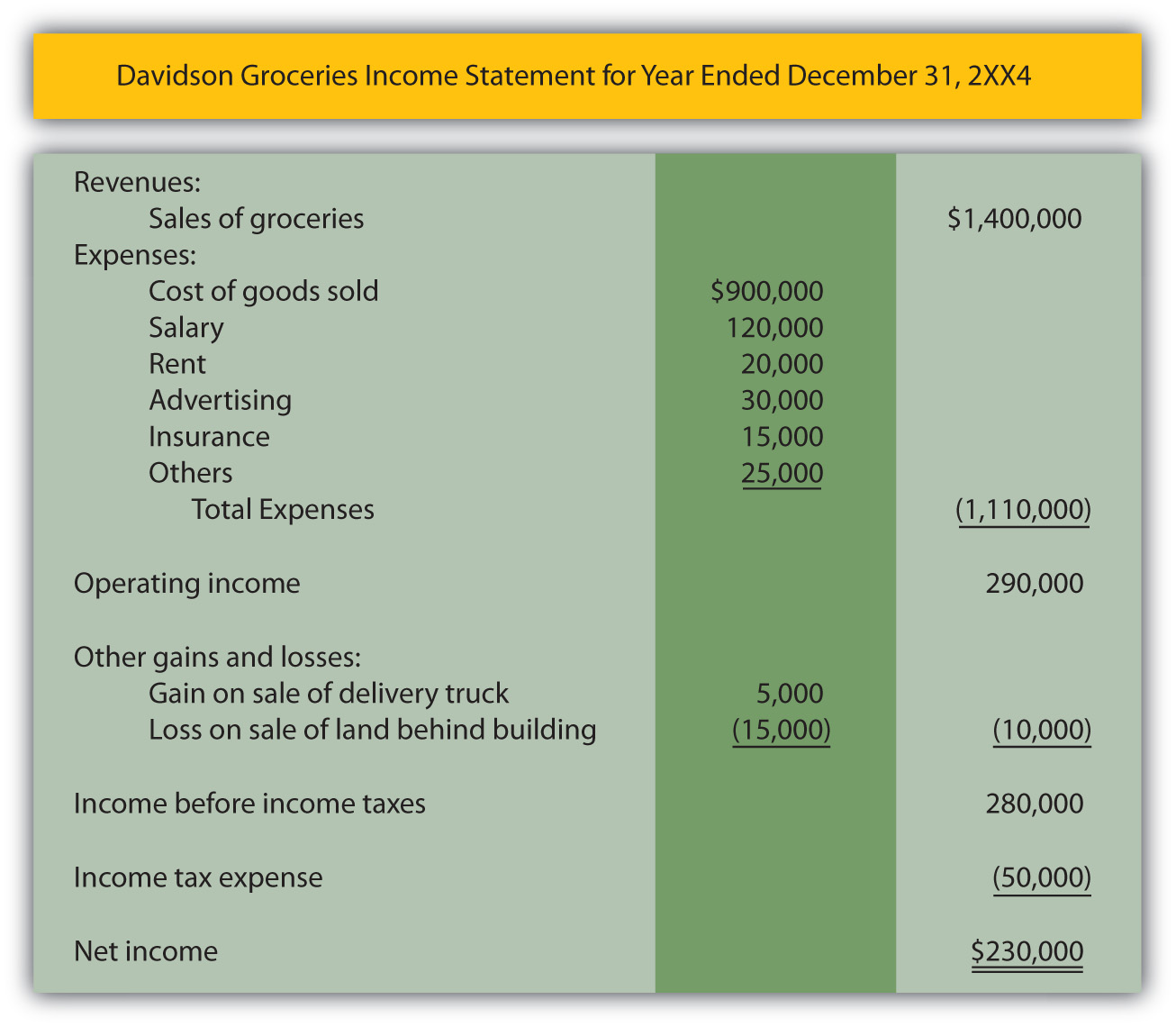

On a traditional income statement cost of goods sold reports the. Cogs do not comprise any overhead expenses such as rent security charges communication charges etc. A traditional income statement employs absorption costing to arrive at a profit or loss figure. It reports the annual turnover first the amount of which is extracted from the sales ledger. Using the cost per unit that we calculated previously we can calculate the cost of goods sold by multiplying the cost per unit by the number of units sold.

Example of calculating the cost of goods sold for the traditional income statement. Be careful not to confuse the terms total manufacturing cost and cost of goods manufactured with each other or with the cost of goods sold. Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits. Gross profit in turn is a measure of how efficient a company is at managing its operations.

It is treated as a current asset on the financial statements and also makes a part of cost of goods sold. Inventory on income statement. Cost of goods sold 48 80 x 8 000. This profit is before the company s administrative costs are added.

The formula to calculate profit is revenue cost and similar is the format of income statement. Cost of goods sold cost per unit x number of units sold. Cost of goods sold is deducted from revenue to determine a company s gross profit. Cost of goods sold report the cost of goods sold report or cogs is important because it along with the contribution margin gives a snapshot of profitability.

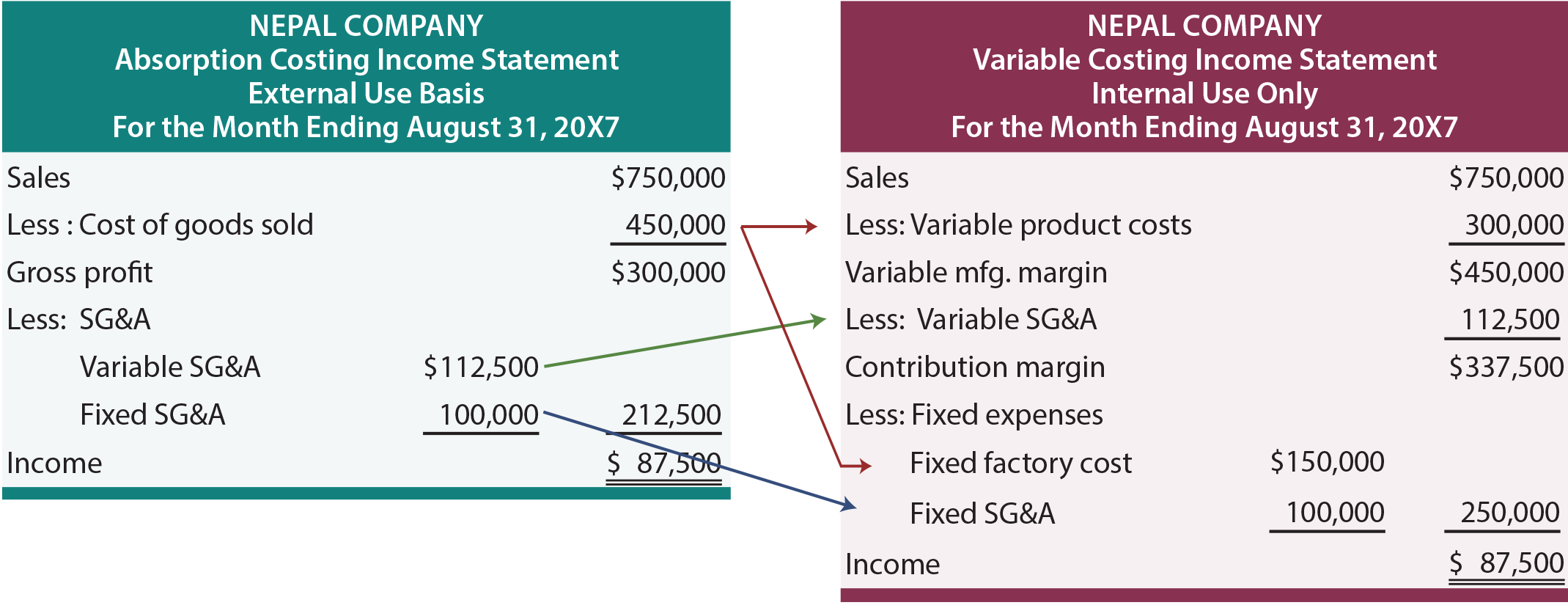

The statement of cost of goods manufactured supports the cost of goods sold figure on the income statement. Cogs figure is reported on the face of a firm s income statement cogs figures are presented under the head expenses as the costs related. Revenue block usually a one line aggregation of gross sales and a variety of sales discounts and allowances. A traditional income statement uses absorption or full costing where both variable and fixed manufacturing costs are included when calculating the cost of goods sold.

Cost of goods sold block includes the cost of direct materials direct labor and.