Which Of The Following Income Statement Items Is Considered To Be Permanent

Write down or write offs of receivables.

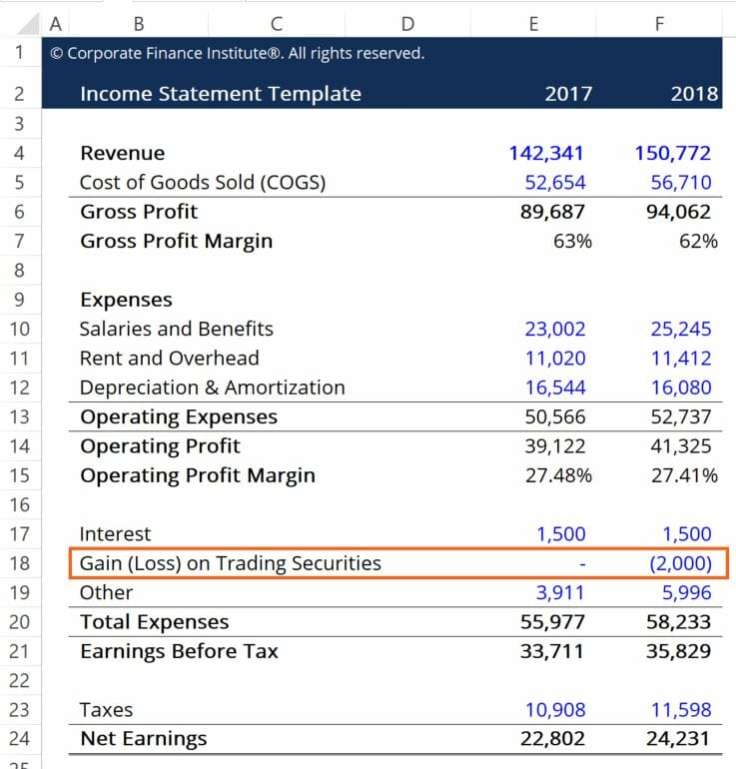

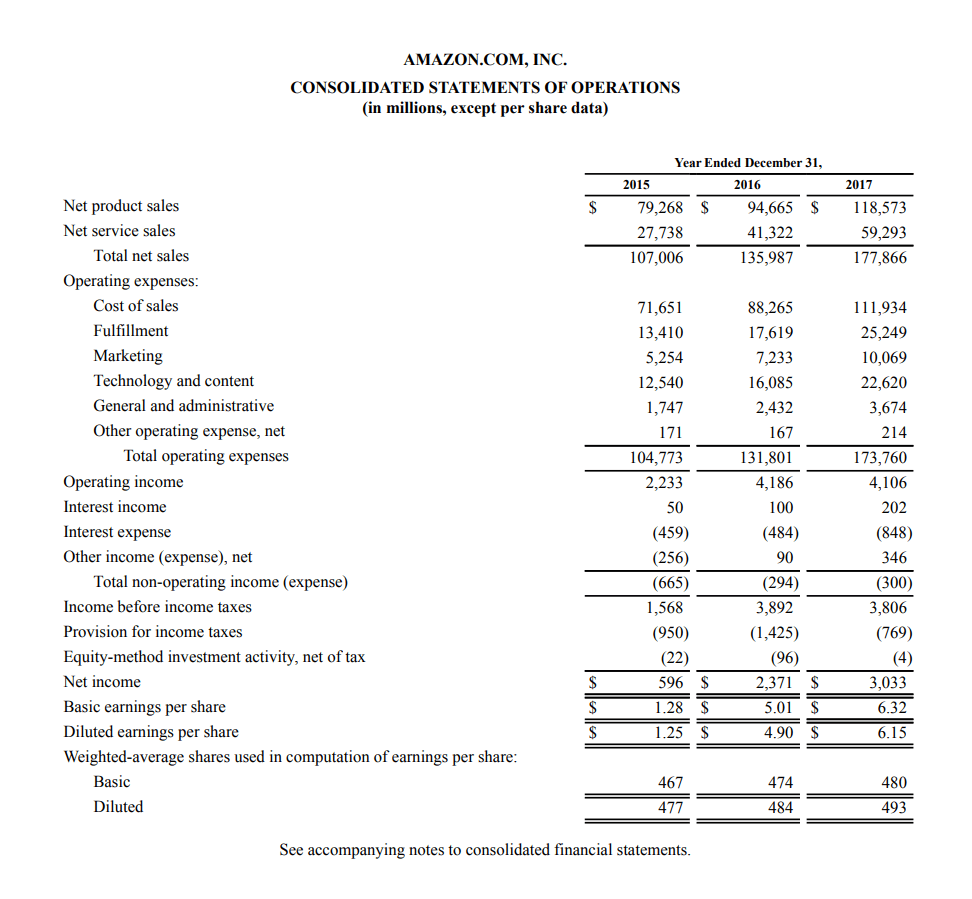

Which of the following income statement items is considered to be permanent. Cost of goods sold of 35 025 000. 3 3 1 income statement items. Given the following price and dividend information calculate the geometric average return. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time.

Operating expenses of 10 115 000. Which of the following income statement items is considered to be transitory. Which of the following income statement items is considered to be permanent. Which of the following items for a financial services company is least likely to be considered an operating item on the income statement.

Which of the following income statement items is considered to be transitor. Effects of a strike. And interest expense of 750 000. An income statement or profit and loss account also referred to as a profit and loss statement p l statement of profit or loss revenue statement statement of financial performance earnings statement statement of earnings operating statement or statement of operations is one of the financial statements of a company and shows the company s revenues and expenses during a particular period.

Gains on disposal of equipment b. The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting. Which of the following is considered to be a characteristic of the usefulne. Enter percentages as decimals and round to 4 decimals year price a new investment opportunity for you is an annuity that pays 3 450 at the beginning of each year for 3 years.

Income tax of 1 744 000. At the end of the year the company is still holding the business segment for disposal which is expected early in the following year. A promotional costs for a new product b sales revenue from the general public c interest expense on short term loans d income from discontinued operations. What is the amount of the firm s income before tax.

Which of the following is considered to be a limitation of income statement. While the balance sheet constitutes a financial snapshot at a given point in time such as december 31 the income statement summarizes a financial movie of operational results over a period of time such as for the year ending december 31. 6 your firm has the following income statement items. Morton company has the following transactions in the current year.

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)