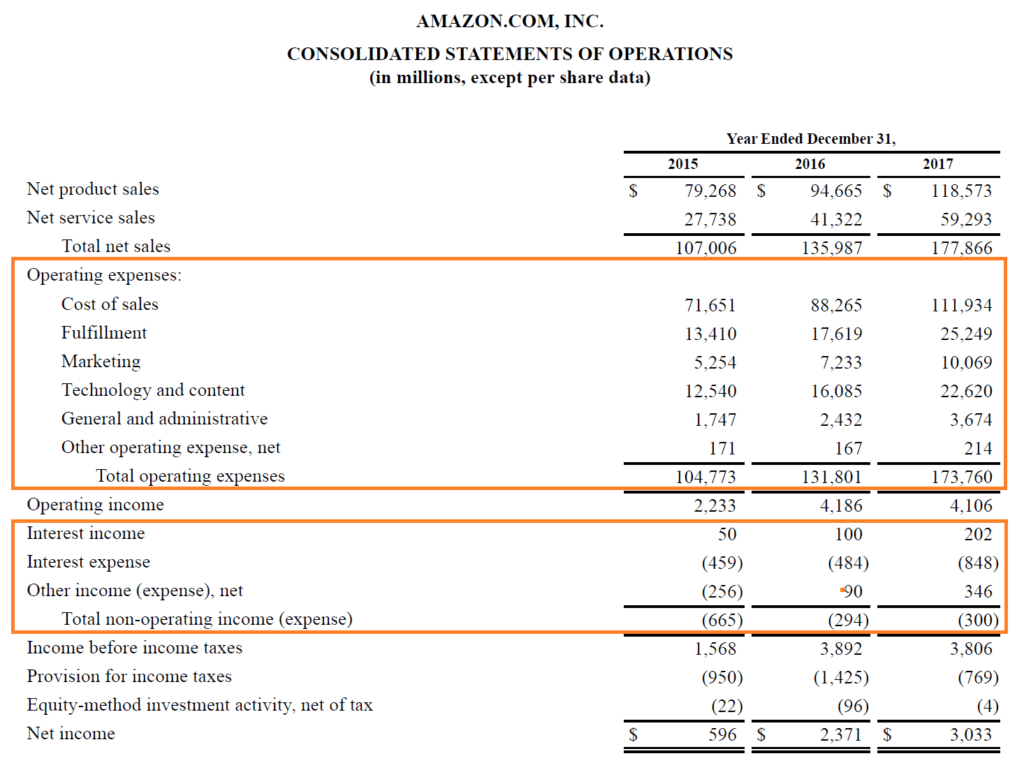

What Type Of Income Statement Items Are Marketing Expenses

The same process also applies to the way companies provide services.

What type of income statement items are marketing expenses. The key variations on the income statement are as follows. The cost to market products and services is an expense item and is lined up along with all other expense items in the income statement. Gross revenue is placed in the top section of an income statement. There are several types of income statement formats available which can be used to present this information in different ways.

Income includes operating income plus other incomes. Operating expenses of the business are those expenses incurred while performing the principal business activity and the list of such costs includes production expenses like direct material and labor cost rent expenses salary and wages paid to administrative staff depreciation expenses telephone expenses traveling expenses sales promotion expenses and other. List of operating expenses. Expenses include the cost of goods sold operating expenses and other expenses.

An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. While the balance sheet constitutes a financial snapshot at a given point in time such as december 31 the income statement summarizes a financial movie of operational results over a period of time such as for the year ending december 31. There may be a great number of expenses depending on the type of organization some examples include. When preparing the income statement you must place certain expenses on certain lines which keeps it organized and allows you calculate the correct numbers.

However there are several generic line items that are commonly seen in any income statement. Cost of goods sold after sales revenue has been listed on the income statement for the accounting period you list the cost of goods sold or cost of sales. 2 wages and salaries repairs and maintenance rent and rates heating and lighting telephone insurance etc. Due to the accrual principle in accounting expenses are recognized when they are incurred not necessarily when they are paid for.

The most common income statement items include. 1 cost of the goods sold during the ordinary course of business. Expenses are positioned below gross revenue and are treated as deductions from gross profit. Marketing expenses are important items that top leadership heeds especially when it comes to preparing the corporate income statement and aligning.

Such incomes and expenses. In the single step income statement all data are divided into two groups. Businesses spend a lot of money to research a product s attributes design the item and sell it.