Variable Costing Income Statement Depreciation

It is accounted for when companies record the loss in value of their fixed assets through depreciation.

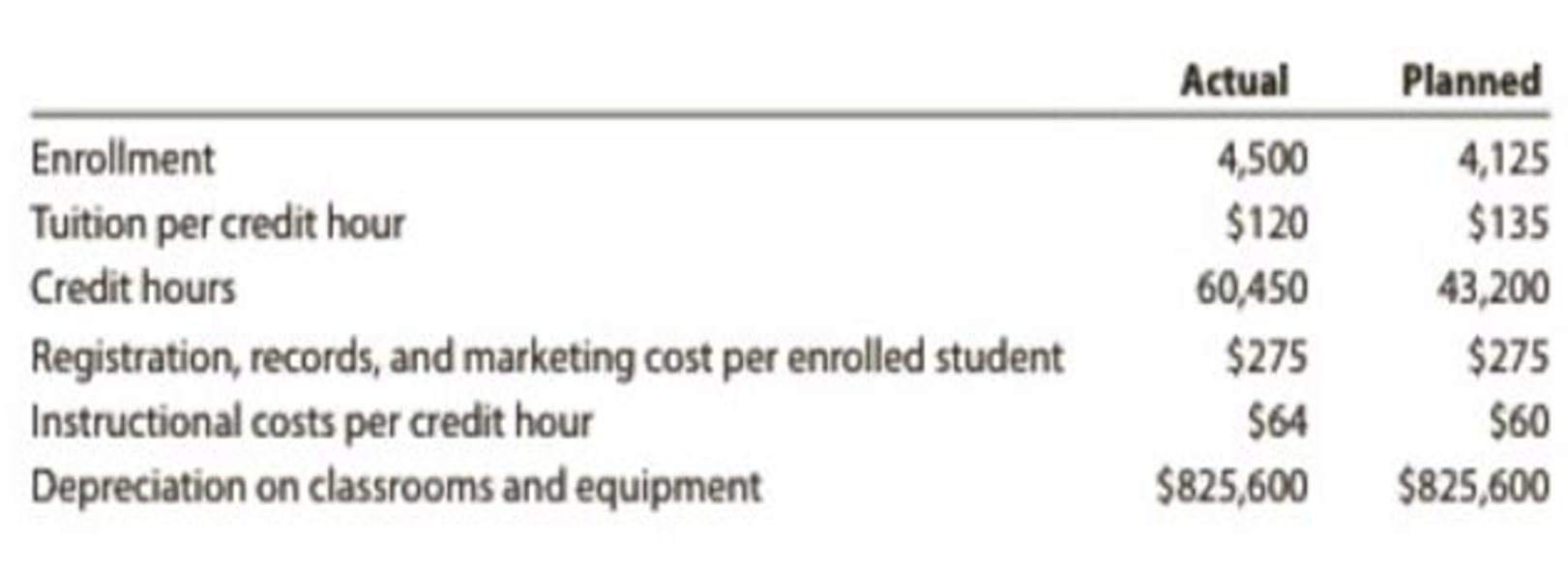

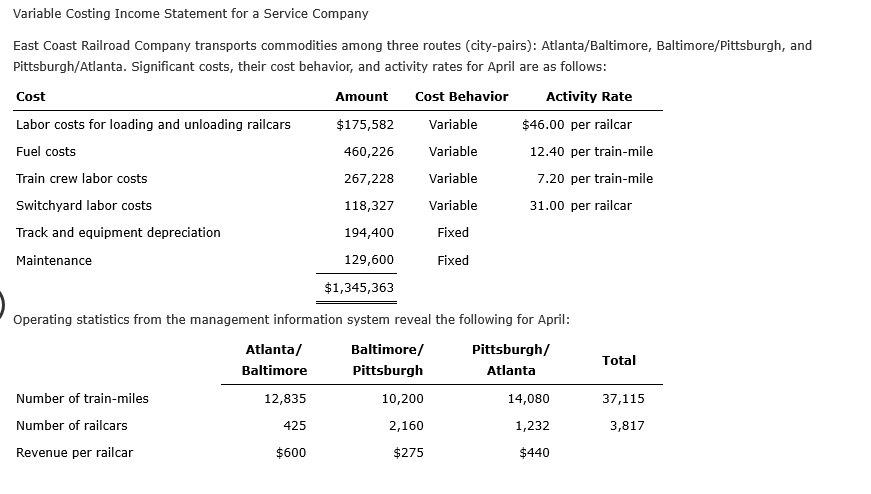

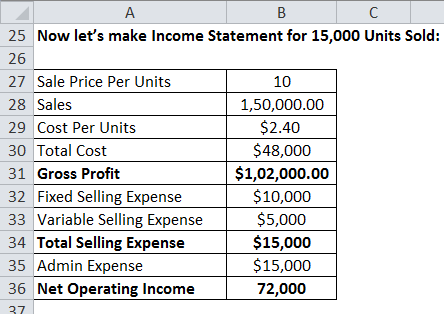

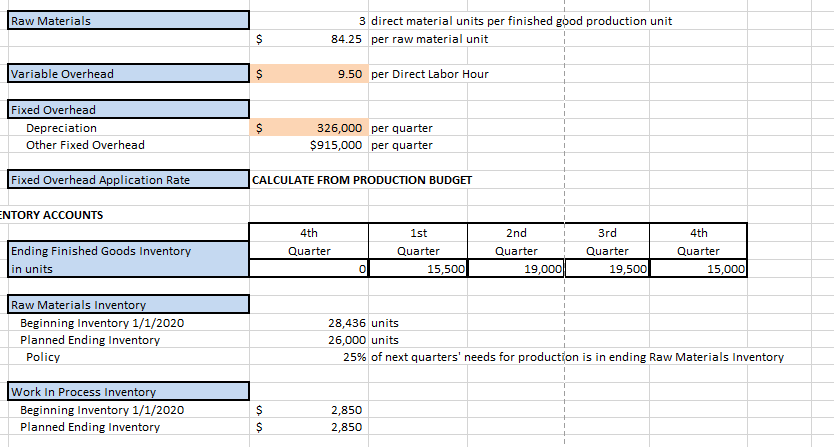

Variable costing income statement depreciation. From this all fixed expenses are then subtracted to arrive at the net profit or loss for the period. Prepare a contribution margin analysis report comparing planned with actual performance for the fall term. This expense is most common in firms with copious amounts of fixed assets. It is useful to create an income statement in the variable costing format when you want to determine that proportion of expenses that truly.

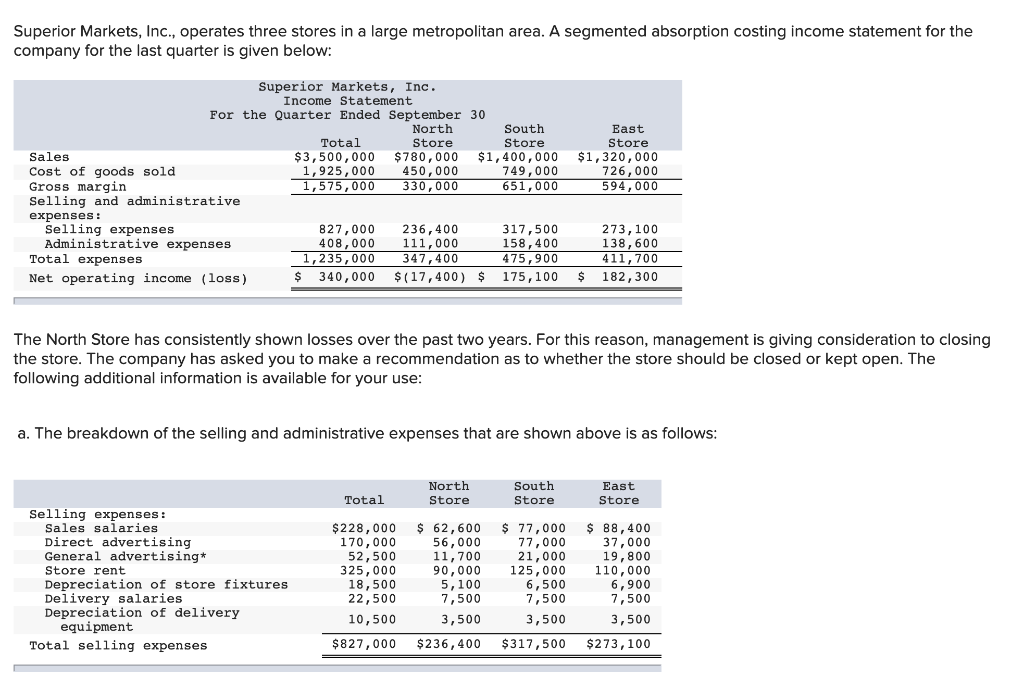

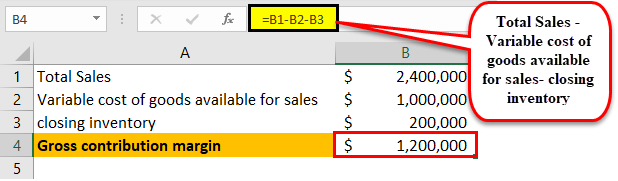

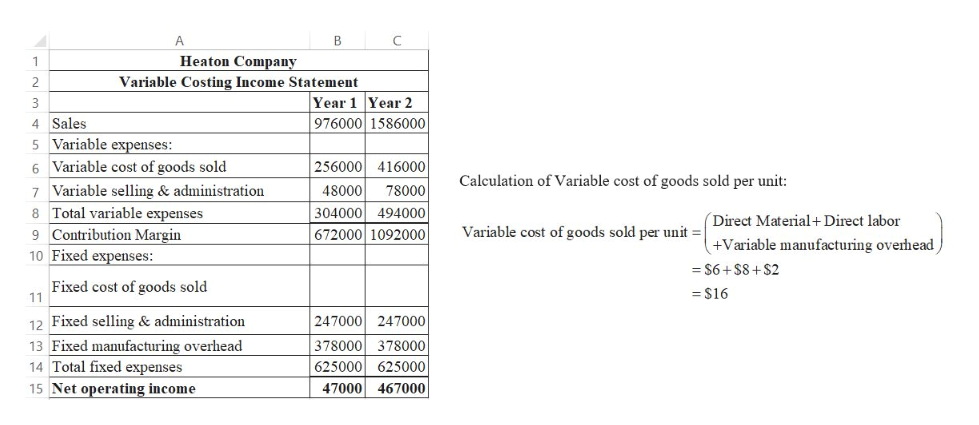

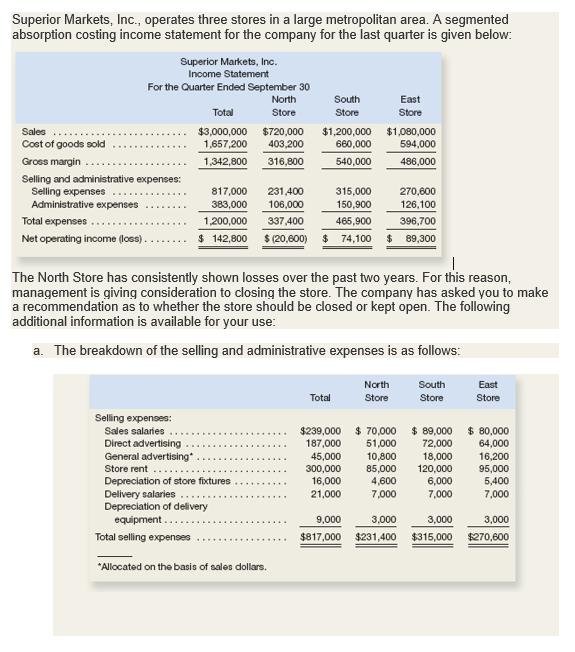

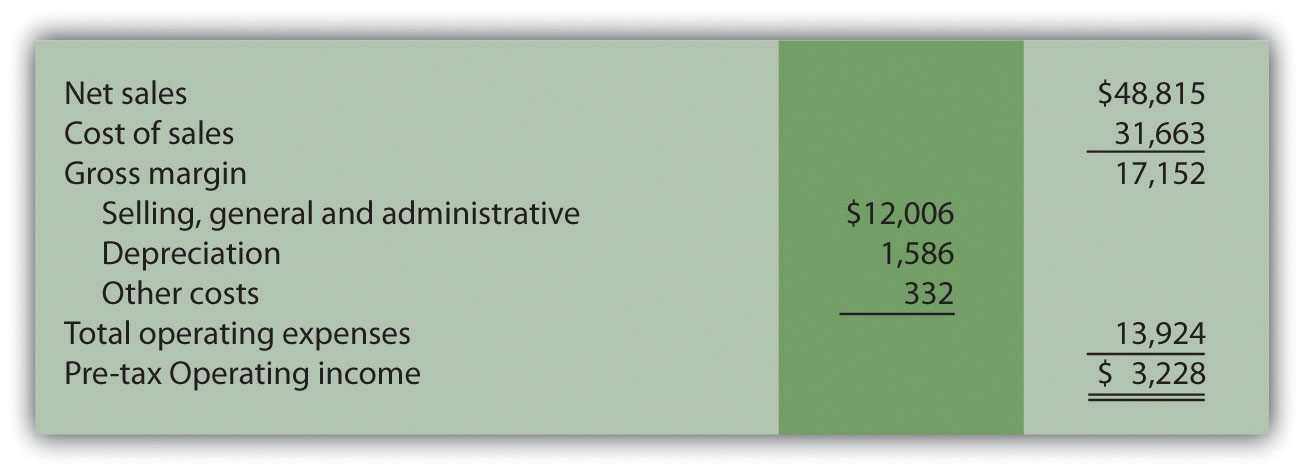

The income statement reports all the revenues costs of goods sold and expenses for a firm. Marginal cost statement offers an alternative layout to the traditional income statement prepared under absorption costing. Prepare a variable costing income statement showing the contribution margin and operating income for the fall term. The variable costing income statement is one where all variable expenses are subtracted from revenue which results in contribution margin.

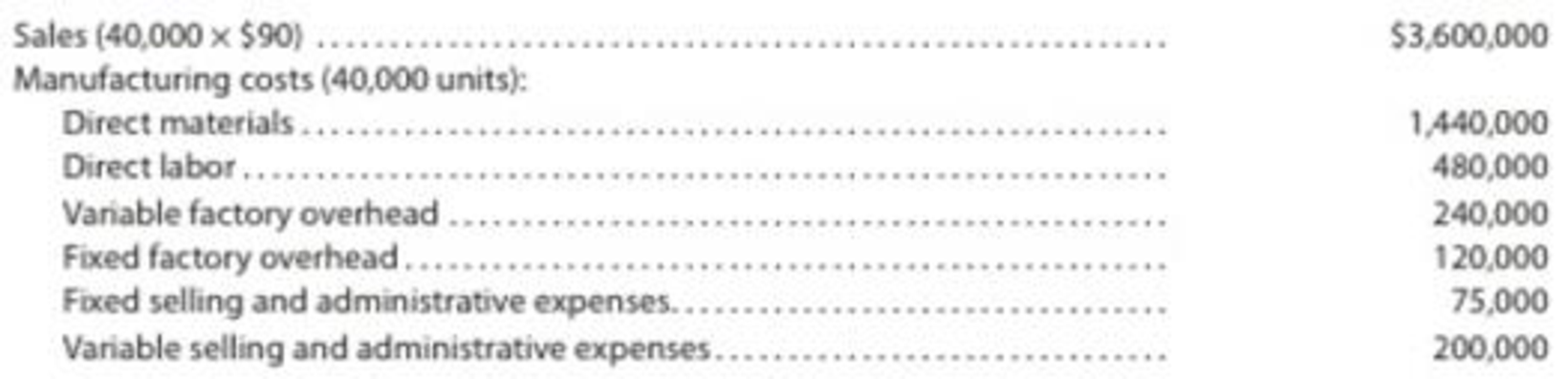

Depreciation is a fixed cost. Depreciation expense is an income statement item. Absorption costing statement assumes that fixed costs attach to products so all the production costs whether fixed or variable should become part of product cost. Absorption costing income statement of arora company for the first two years of operations is as follows.

Unlike other expenses depreciation expenses are listed on income statements as. Registration records and marketing costs vary by the number of enrolled students while instructional costs vary by the number of credit hours. Physical assets such as machines equipment or vehicles degrade over time and reduce in value incrementally. Prepare a variable costing income statement showing the contribution margin and income from operations for the fall term.

Income statement marginal costing. It is useful to determine the proportion of expenses that actually varies directly with revenues. One expense reported here relates to depreciation. 6 per unit sold the manufacturing cost per unit is as follows.

In the absence of these assets depreciation doesn t exist as an expense on a firm s income.

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)