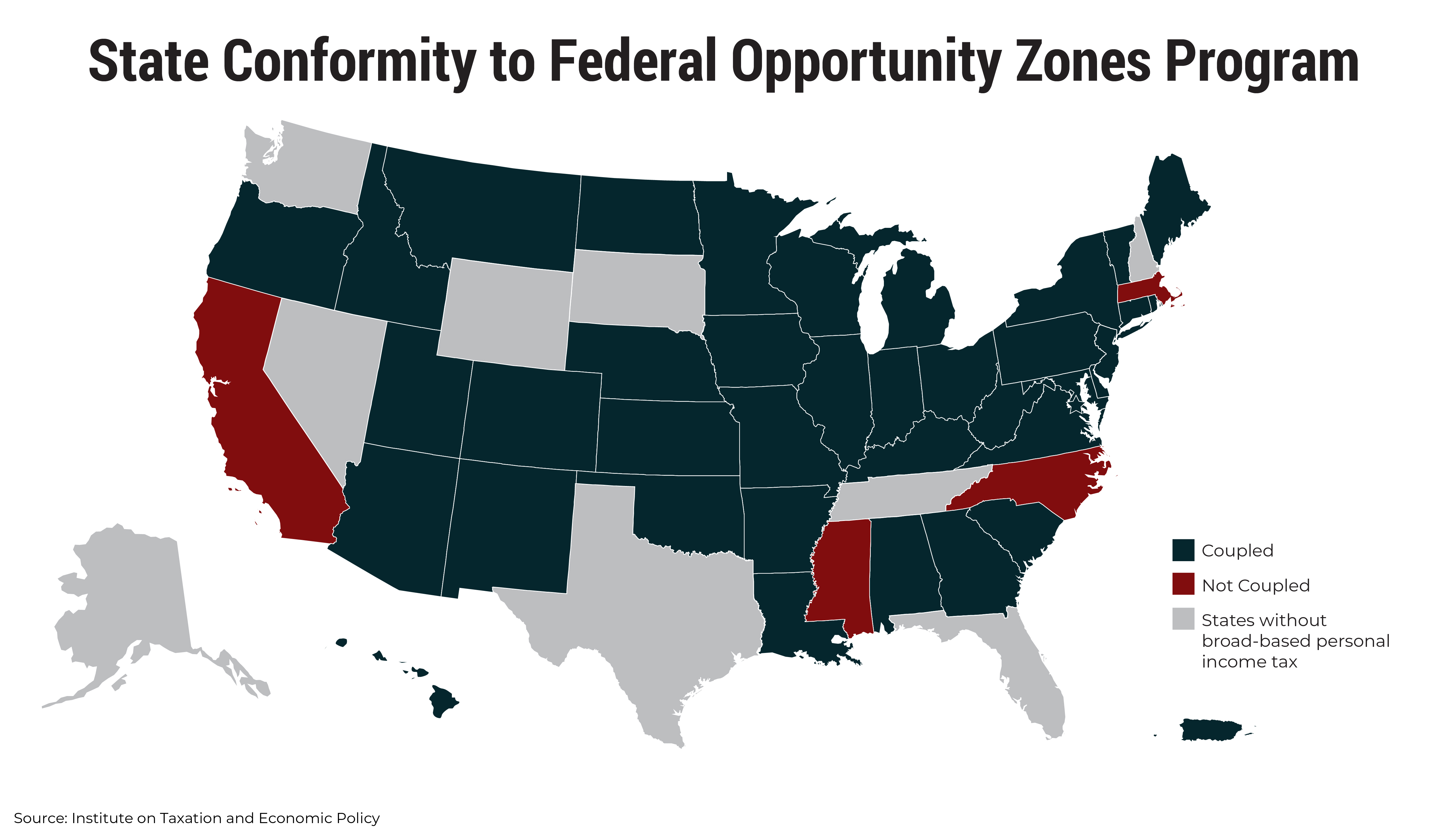

Income Tax Zone Code

Tax exempt income regularly granted by the belgian employer includes meal vouchers representation allowances and daily expense allowances.

Income tax zone code. If your usual place of residence was in a zone for less than 183 days in the income year you may still be able to claim the tax offset. Change your tax code if it s wrong. Skip to main content tell us whether you accept cookies we use cookies to. Income deemed to be received.

If you live in a zone for less than 183 days in 2019 20 you may still be able to claim a tax offset if you meet each of the following three conditions. Apportionment of income between spouses governed by portuguese civil code. 183 days or more during the period 1 july 2018 30 june 2020 including at least one day in this financial year and you did not claim a zone tax offset in your 2018 19 tax return. Income tax is a tax on a person s income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the tax code of 1997 tax code as.

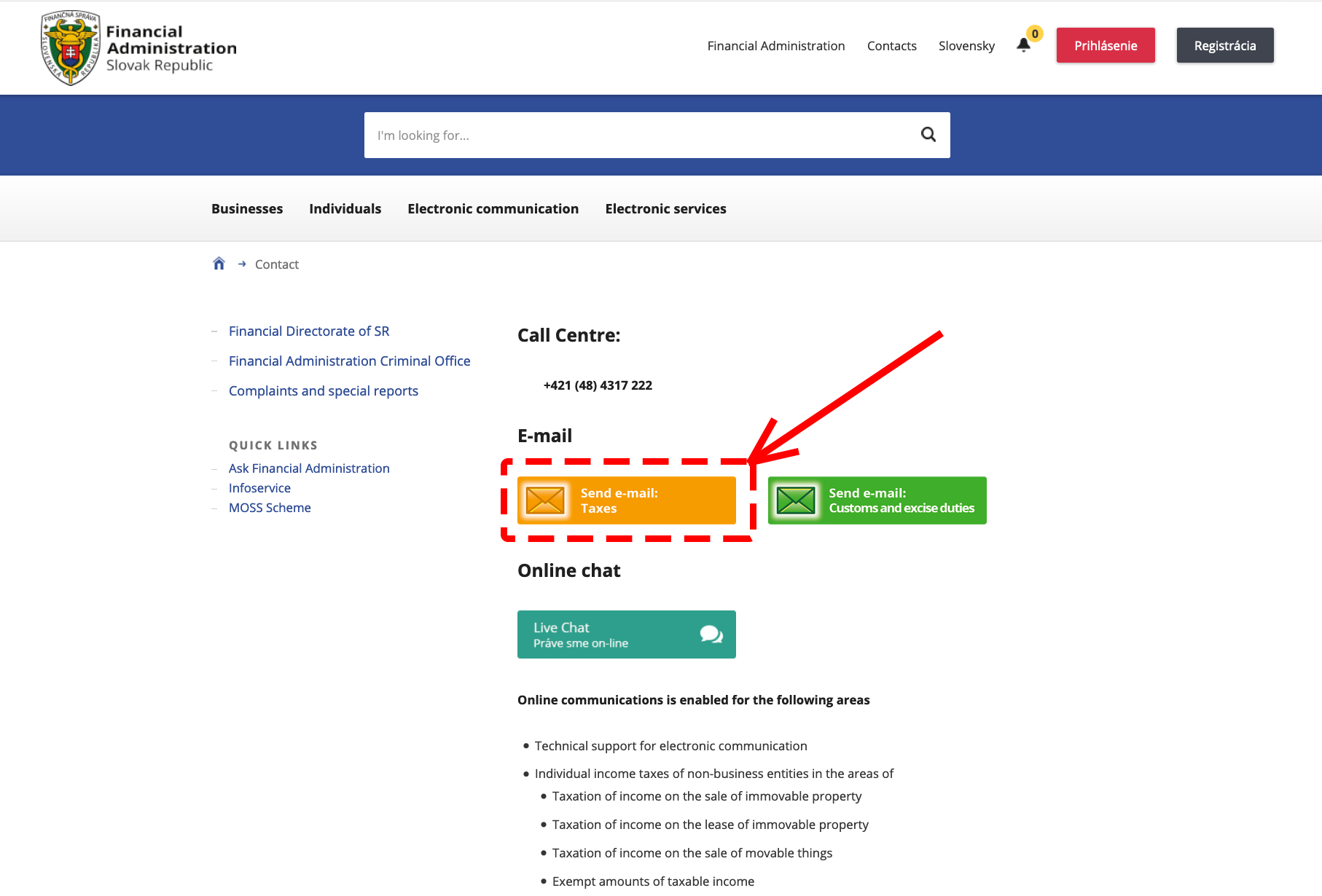

Please refer also to the section of tax exempt income under the belgian. There is quite a. Tax info by zip code by paul neiffer on tue 09 15 2020 08 19 the irs each year provides certain income tax data based upon zip codes. Income tax conventions interpretation act income tax folios all related laws and regulations publications 5000 g general income tax and benefit guide t4012 corporation income tax guide p105 students and income tax.

A minimum corporate income tax of two percent 2 of gross income as prescribed under section 27 e of this code shall be imposed under the same. They recently released the data for 2018. Scope of total income. Check your income tax personal allowance and tax code for the current tax year.

:max_bytes(150000):strip_icc()/156416606-5bfc2b8b46e0fb00517bdff7.jpg)